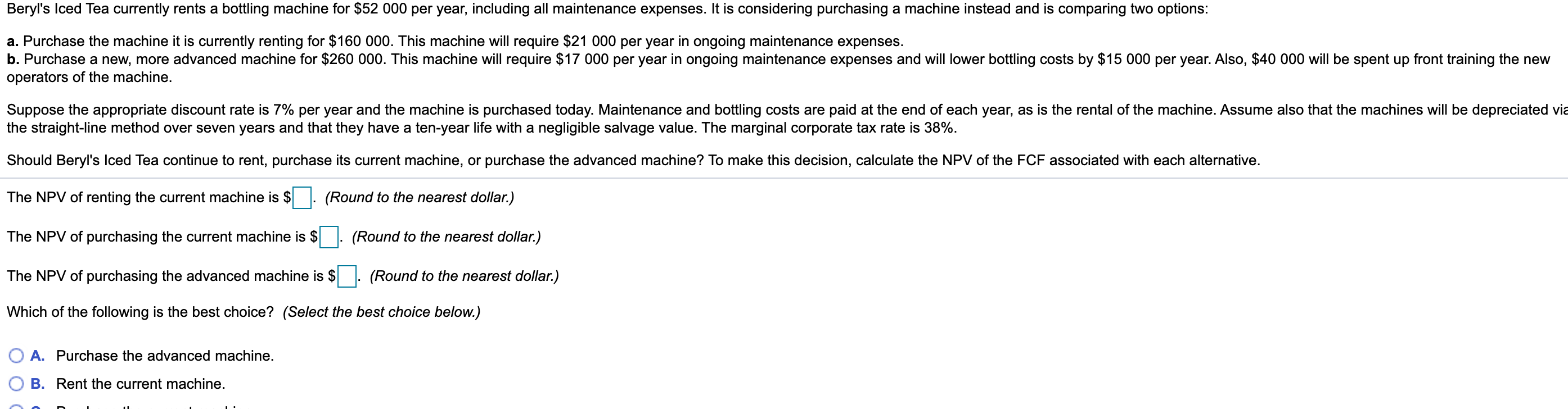

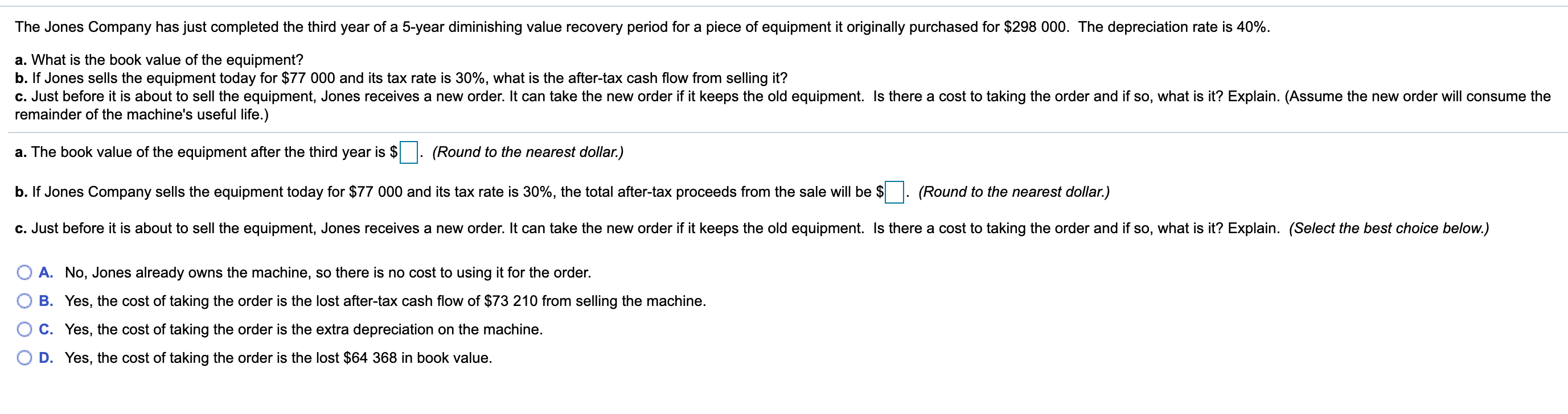

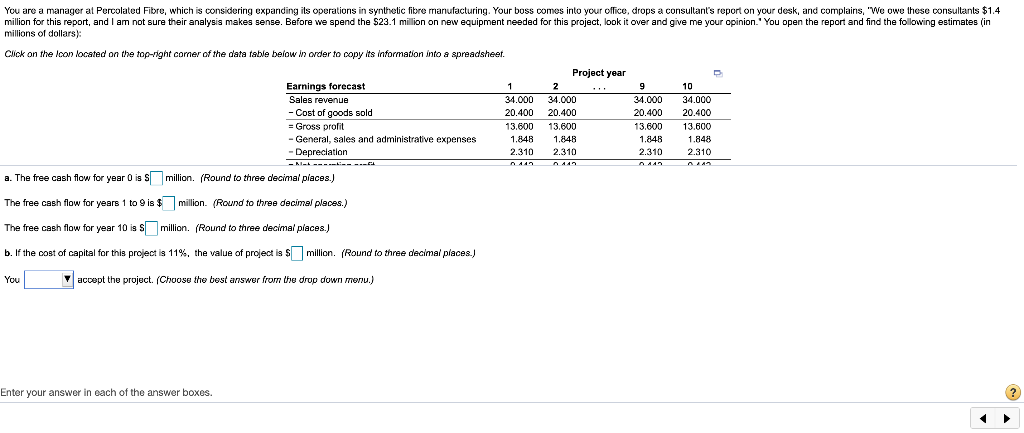

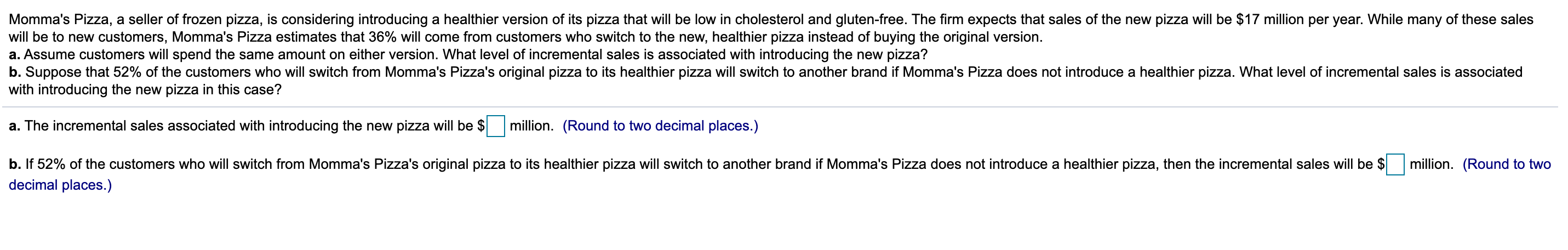

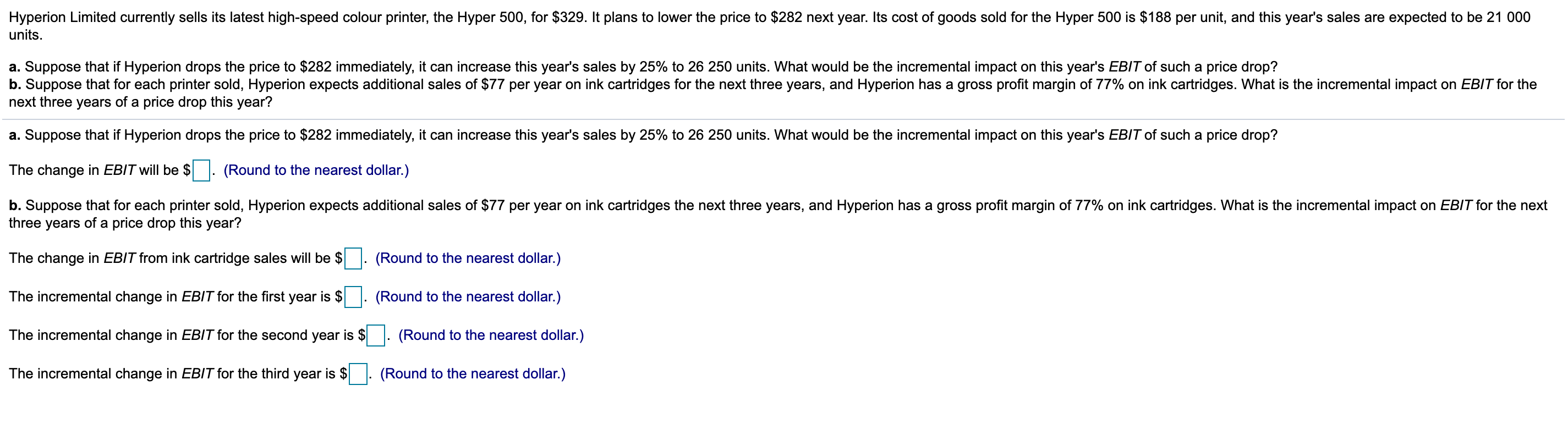

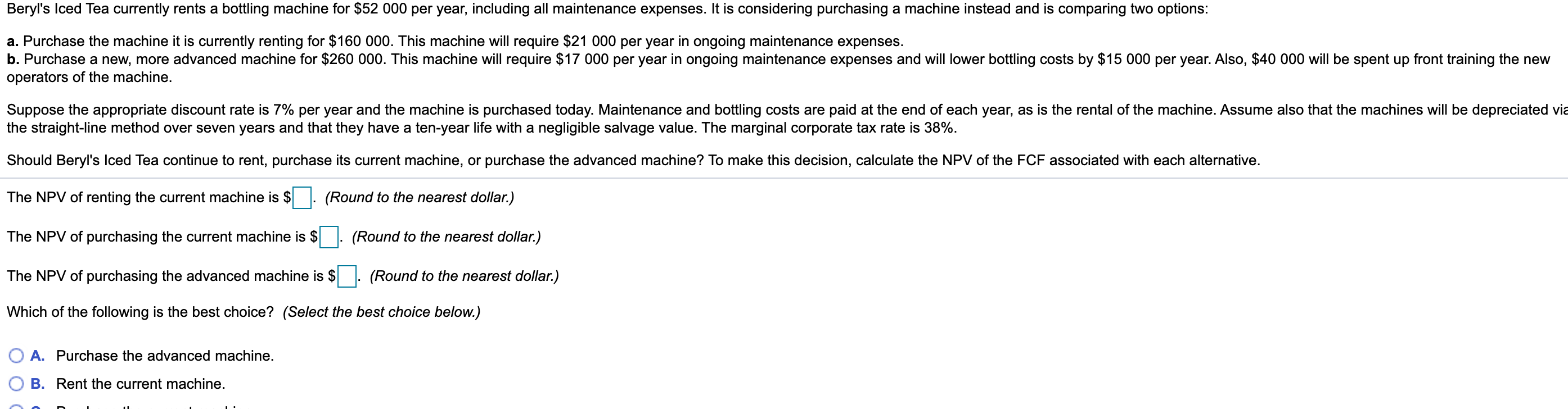

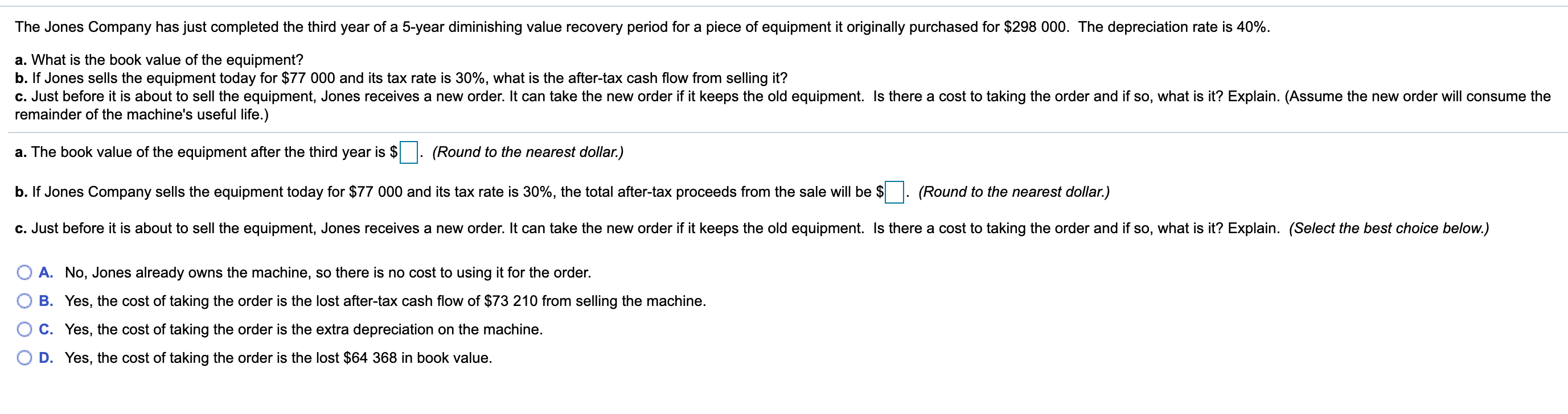

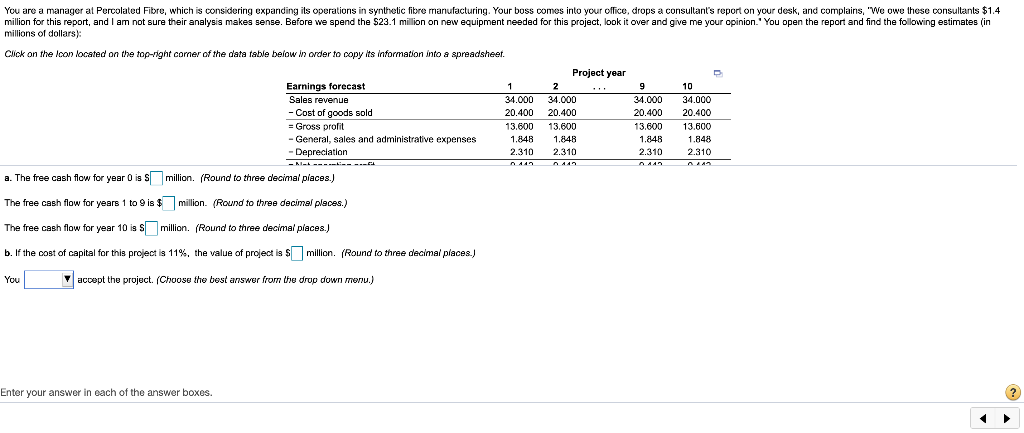

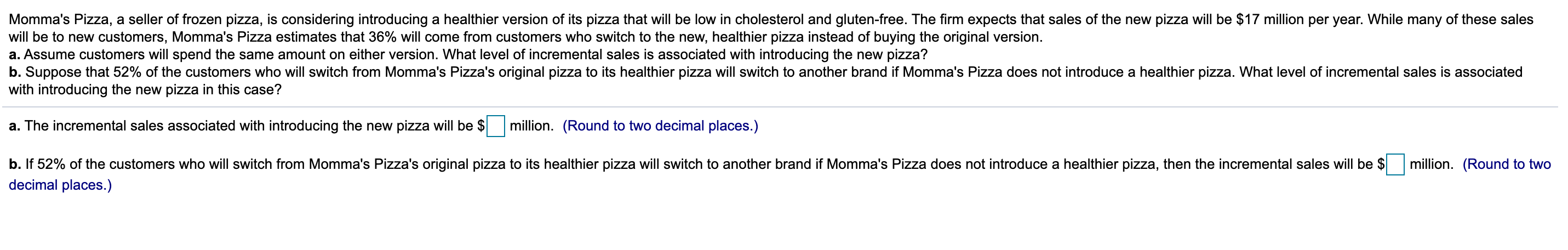

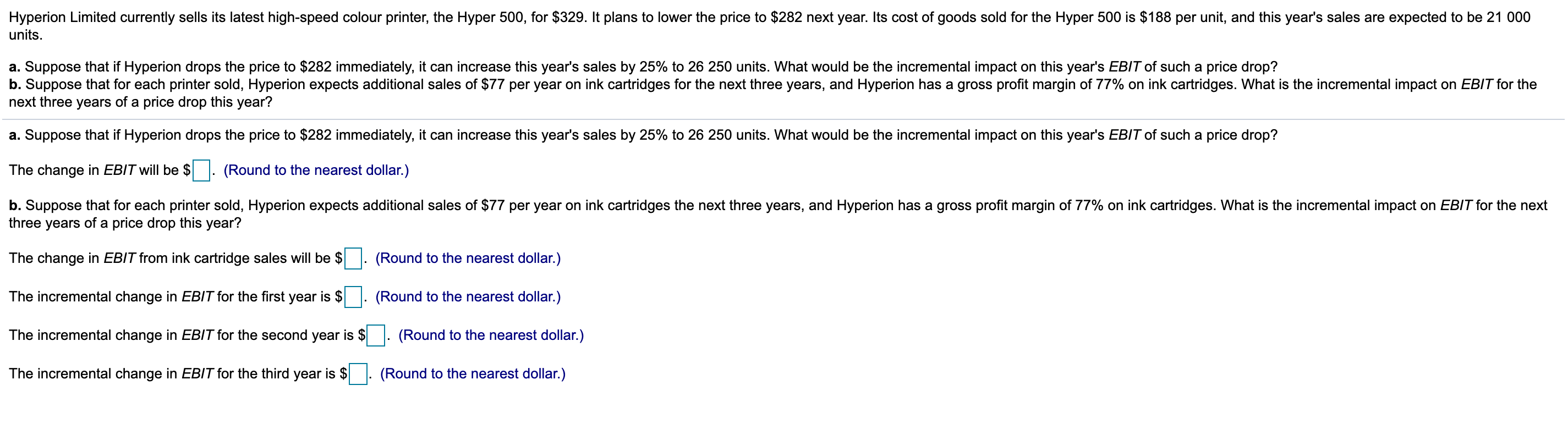

Beryl's Iced Tea currently rents a bottling machine for $52 000 per year, including all maintenance expenses. It is considering purchasing a machine instead and is comparing two options: a. Purchase the machine it is currently renting for $160 000. This machine will require $21 000 per year in ongoing maintenance expenses. b. Purchase a new, more advanced machine for $260 000. This machine will require $17 000 per year in ongoing maintenance expenses and will lower bottling costs by $15 000 per year. Also, $40 000 will be spent up front training the new operators of the machine. Suppose the appropriate discount rate is 7% per year and the machine is purchased today. Maintenance and bottling costs are paid at the end of each year, as is the rental of the machine. Assume also that the machines will be depreciated via the straight-line method over seven years and that they have a ten-year life with a negligible salvage value. The marginal corporate tax rate is 38%. Should Beryl's Iced Tea continue to rent, purchase its current machine, or purchase the advanced machine? To make this decision, calculate the NPV of the FCF associated with each alternative. The NPV of renting the current machine is $ (Round to the nearest dollar.) The NPV of purchasing the current machine is $ (Round to the nearest dollar.) The NPV of purchasing the advanced machine is $ - (Round to the nearest dollar.) Which of the following is the best choice? (Select the best choice below.) A. Purchase the advanced machine. B. Rent the current machine. The Jones Company has just completed the third year of a 5-year diminishing value recovery period for a piece of equipment it originally purchased for $298 000. The depreciation rate is 40%. a. What is the book value of the equipment? b. If Jones sells the equipment today for $77 000 and its tax rate is 30%, what is the after-tax cash flow from selling it? c. Just before it is about to sell the equipment, Jones receives a new order. It can take the new order if it keeps the old equipment. Is there a cost to taking the order and if so, what is it? Explain. (Assume the new order will consume the remainder of the machine's useful life.) a. The book value of the equipment after the third year is $. (Round to the nearest dollar.) b. If Jones Company sells the equipment today for $77 000 and its tax rate is 30%, the total after-tax proceeds from the sale will be $ (Round to the nearest dollar.) c. Just before it is about to sell the equipment, Jones receives a new order. It can take the new order if it keeps the old equipment. Is there a cost to taking the order and if so, what is it? Explain. (Select the best choice below.) A. No, Jones already owns the machine, so there is no cost to using it for the order. B. Yes, the cost of taking the order is the lost after-tax cash flow of $73 210 from selling the machine. C. Yes, the cost of taking the order is the extra depreciation on the machine. D. Yes, the cost of taking the order is the lost $64 368 in book value. You are a manager at Percolated Fibre, which is considering expanding is operations in synthetic fibre manufacturing. Your boss comes into your office, drops a consultant's report on your desk, and complains, 'We owe these consultants $1.4 million for this report, and I am not sure their analysis makes sense. Before we spend the $23.1 million on new equipment needed for this project, look it over and give me your opinion.' You open the report and find the following estimates (in millions of dollars): Click on the loon located on the top-right comer of the data table below in order to copy its Information into a spreadsheet. Project year Earnings forecast 2 9 10 Sales revenue 34.000 34.000 34.000 34.000 - Cost of goods sold 20.400 20.400 20.400 20.400 = Gross profit 13,600 13.600 13.600 13.600 - General, sales and administrative expenses 1.848 1.848 1.848 1.848 - Depreciation 2.310 2.310 2.310 2.310 1 a. The free cash flow for year is million. (Round to three decimal places.) The free cash flow for years 1 to 9 is $ million (Round to three decimal places.) . .) The free cash flow for year 10 is S million. (Round to three decimal places.) b. If the cost of capital for this project is 11%, the value of project is million. (Round to three decimal places.) You accept the project. (Choose the best answer from the drop down menu.) Enter your answer in each of the answer boxes. ? Momma's Pizza, a seller of frozen pizza, is considering introducing a healthier version of its pizza that will be low in cholesterol and gluten-free. The firm expects that sales of the new pizza will be $17 million per year. While many of these sales will be to new customers, Momma's Pizza estimates that 36% will come from customers who switch to the new, healthier pizza instead of buying the original version. a. Assume customers will spend the same amount on either version. What level of incremental sales is associated with introducing the new pizza? b. Suppose that 52% of the customers who will switch from Momma's Pizza's original pizza to its healthier pizza will switch to another brand if Momma's Pizza does not introduce a healthier pizza. What level of incremental sales is associated with introducing the new pizza in this case? a. The incremental sales associated with introducing the new pizza will be $ million. (Round to two decimal places.) b. If 52% of the customers who will switch from Momma's Pizza's original pizza to its healthier pizza will switch to another brand if Momma's Pizza does not introduce a healthier pizza, then the incremental sales will be $ decimal places.) million. (Round to two Hyperion Limited currently sells its latest high-speed colour printer, the Hyper 500, for $329. It plans to lower the price to $282 next year. Its cost of goods sold for the Hyper 500 is $188 per unit, and this year's sales are expected to be 21 000 units. a. Suppose that if Hyperion drops the price to $282 immediately, it can increase this year's sales by 25% to 26 250 units. What would be the incremental impact on this year's EBIT of such a price drop? b. Suppose that for each printer sold, Hyperion expects additional sales of $77 per year on ink cartridges for the next three years, and Hyperion has a gross profit margin of 77% on ink cartridges. What is the incremental impact on EBIT for the next three years of a price drop this year? a. Suppose that if Hyperion drops the price to $282 immediately, it can increase this year's sales by 25% to 26 250 units. What would be the incremental impact on this year's EBIT of such a price drop? The change in EBIT will be $ . (Round to the nearest dollar.) b. Suppose that for each printer sold, Hyperion expects additional sales of $77 per year on ink cartridges the next three years, and Hyperion has a gross profit margin of 77% on ink cartridges. What is the incremental impact on EBIT for the next three years of a price drop this year? The change in EBIT from ink cartridge sales will be $ (Round to the nearest dollar.) The incremental change in EBIT for the first year is $ (Round to the nearest dollar.) The incremental change in EBIT for the second year is $ (Round to the nearest dollar.) The incremental change in EBIT for the third year is $ (Round to the nearest dollar.)