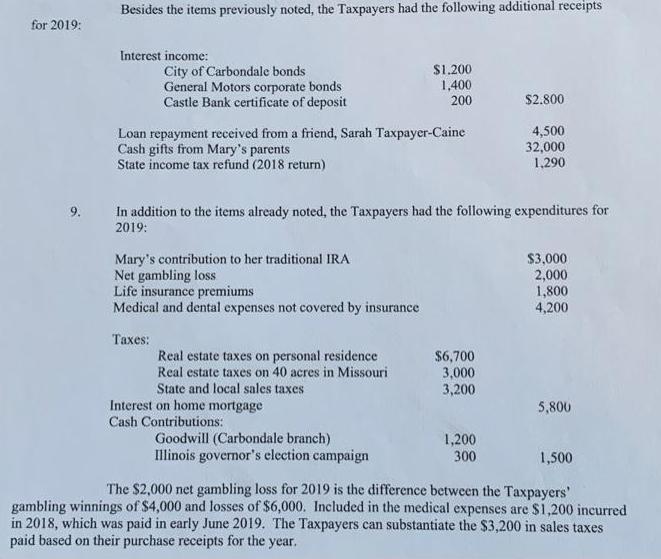

Besides the items previously noted, the Taxpayers had the following additional receipts Interest income: City of Carbondale bonds $1.200 1,400 General Motors corporate bonds

Besides the items previously noted, the Taxpayers had the following additional receipts Interest income: City of Carbondale bonds $1.200 1,400 General Motors corporate bonds Castle Bank certificate of deposit 200 $2.800 Loan repayment received from a friend, Sarah Taxpayer-Caine 4,500 Cash gifts from Mary's parents 32,000 State income tax refund (2018 return) 1,290 In addition to the items already noted, the Taxpayers had the following expenditures for 2019: $3,000 Mary's contribution to her traditional IRA Net gambling loss 2,000 Life insurance premiums 1,800 Medical and dental expenses not covered by insurance 4,200 Taxes: $6,700 Real estate taxes on personal residence Real estate taxes on 40 acres in Missouri State and local sales taxes 3,000 3,200 Interest on home mortgage Cash Contributions: 5,800 Goodwill (Carbondale branch) Illinois governor's election campaign 1,200 300 1,500 The $2,000 net gambling loss for 2019 is the difference between the Taxpayers' gambling winnings of $4,000 and losses of $6,000. Included in the medical expenses are $1,200 incurred in 2018, which was paid in early June 2019. The Taxpayers can substantiate the $3,200 in sales taxes paid based on their purchase receipts for the year. for 2019:

Step by Step Solution

3.32 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

kindly go through the q...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started