Question

Besla Energy Corporation is a power generator manufacturer that exports their products to more than 70 countries. They design and build their gas and diesel

Besla Energy Corporation is a power generator manufacturer that exports their products to more than 70 countries. They design and build their gas and diesel generators at accredited manufacturing facility in the United States. The company has always taken care of environment concerns, with industry-leading soundproofing and emission control that meets all standards.

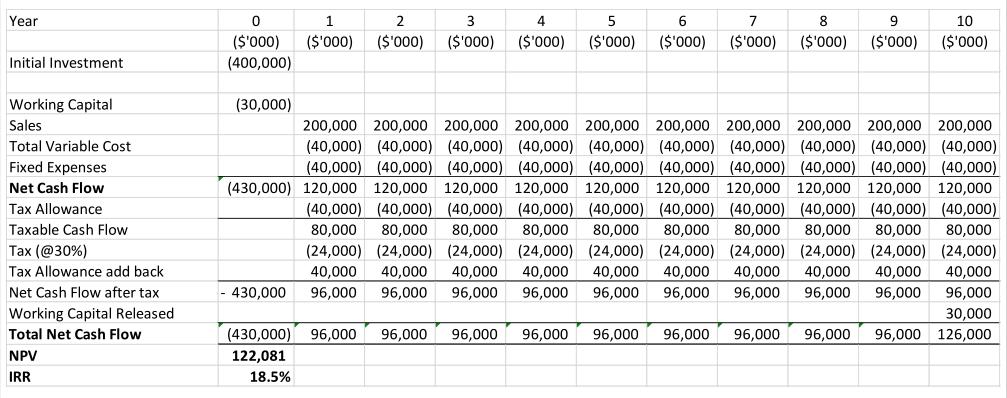

Due to the growth potential of sustainable energy, Besla Energy is considering restructuring part of their facility for the production of industrial solar panels. The project feasibility committee has collated forecasted investments and financing cash flows and other information for this project. An appraisal has been performed with the following result.

Required:

Required:

a) Critically analyse the investment proposal and provide recommendation by using the NPV and IRR result. Your discussion should include analysis of how the forecasted inputs to the appraisal could potentially impact the result.

b) Suggest another investment proposal technique that Besla Energy may use to evaluate this project, and critically discuss the applicability, benefits and limitations of this technique in the form of a literature review (no calculation required)

c) Provide an explanation on the different sources of funding available to the company, and their advantages and disadvantages and make recommendations as to how these funding sources are appropriate to the planned investment project.

Year Initial Investment Working Capital Sales Total Variable Cost Fixed Expenses Net Cash Flow Tax Allowance Taxable Cash Flow Tax (@30%) Tax Allowance add back. Net Cash Flow after tax Working Capital Released Total Net Cash Flow NPV IRR 1 0 ($'000) ($'000) (400,000) (30,000) 2 3 4 5 6 ($'000) ($'000) ($'000) ($'000) ($'000) (430,000) 96,000 122,081 18.5% 200,000 200,000 200,000 200,000 200,000 200,000 200,000 200,000 200,000 200,000 (40,000) (40,000) (40,000) (40,000) (40,000) (40,000) (40,000) (40,000) (40,000) (40,000) (40,000) (40,000) (40,000) (40,000) (40,000) (40,000) (40,000) (40,000) (40,000) (40,000) (430,000) 120,000 120,000 120,000 120,000 120,000 120,000 120,000 120,000 120,000 120,000 (40,000) (40,000) (40,000) (40,000) (40,000) (40,000) (40,000) (40,000) (40,000) (40,000) 80,000 80,000 80,000 80,000 80,000 80,000 80,000 80,000 80,000 80,000 (24,000) (24,000) (24,000) (24,000) (24,000) (24,000) (24,000) (24,000) (24,000) (24,000) 40,000 40,000 40,000 40,000 40,000 40,000 40,000 40,000 40,000 40,000 96,000 96,000 96,000 96,000 96,000 430,000 96,000 96,000 96,000 96,000 96,000 7 8 9 ($'000) ($'000) ($'000) 96,000 96,000 96,000 10 ($'000) 96,000 30,000 96,000 96,000 96,000 96,000 126,000

Step by Step Solution

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Answers a Critically analyse the investment proposal and provide recommendation by using the NPV and IRR result Your discussion should include analysis of how the forecasted inputs to the appraisal co...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started