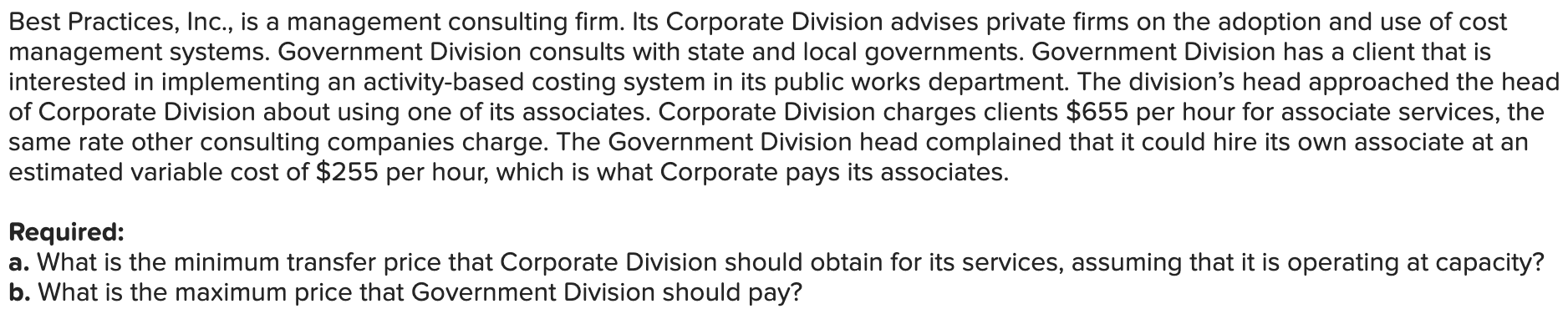

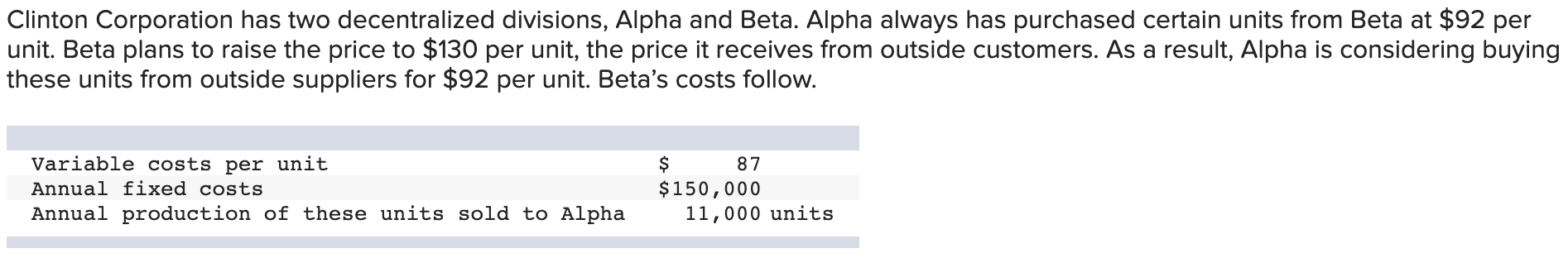

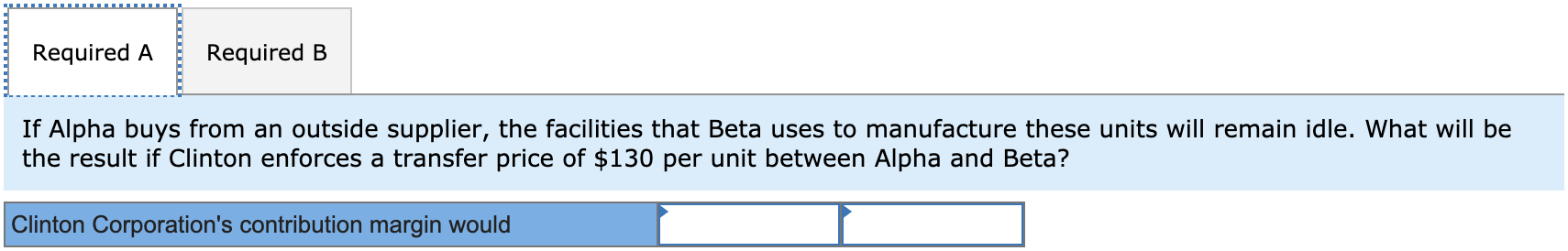

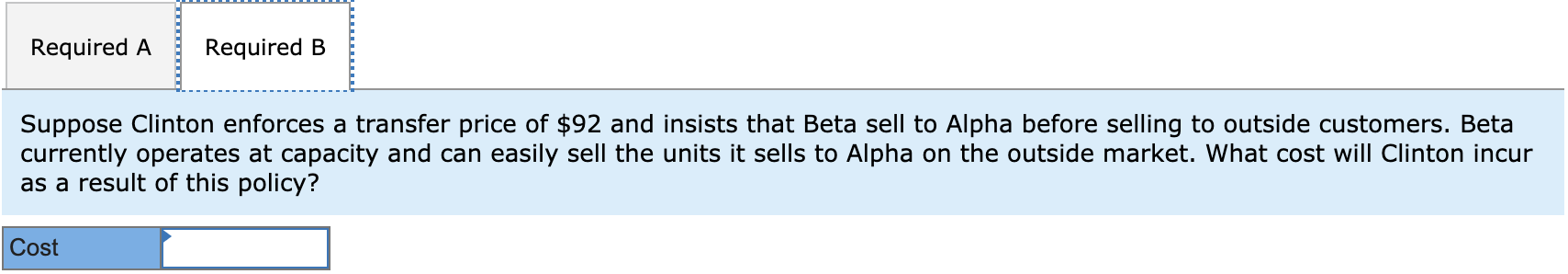

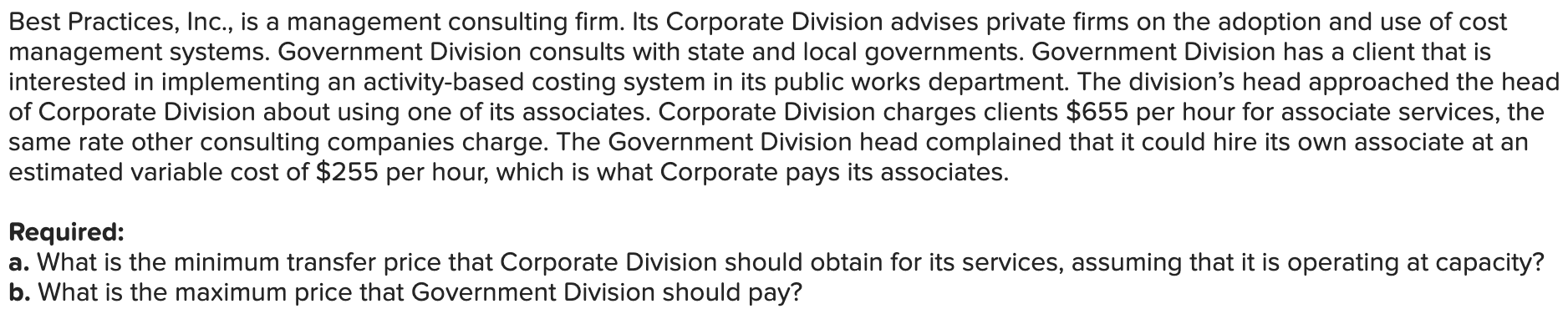

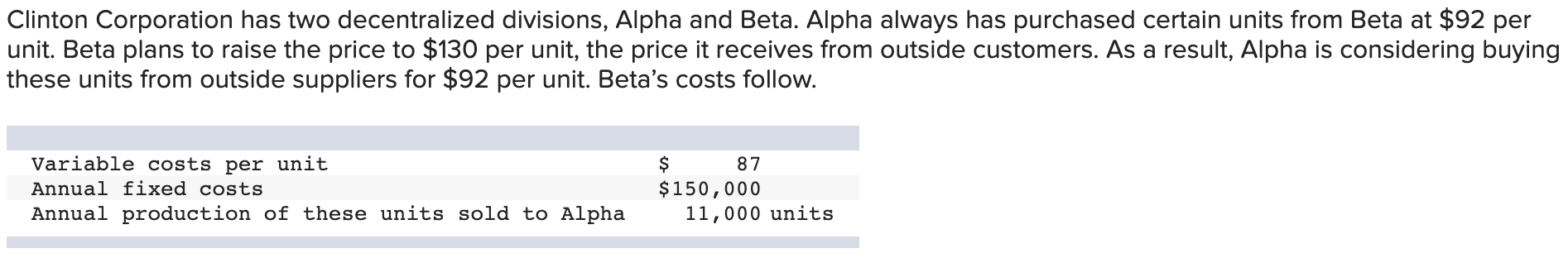

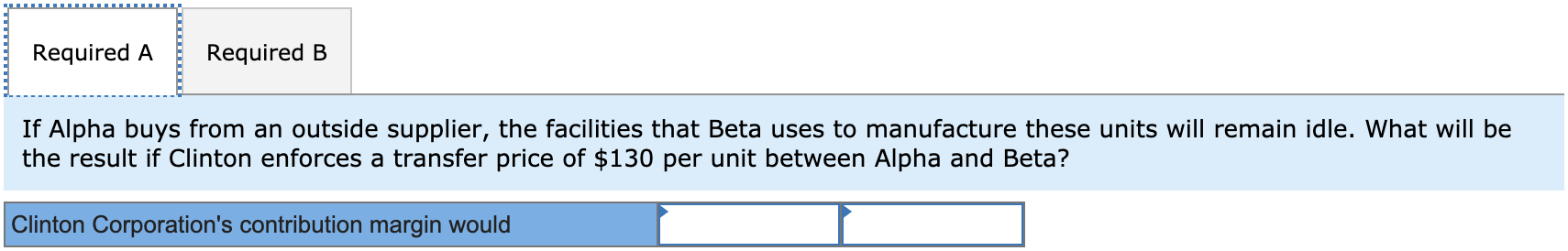

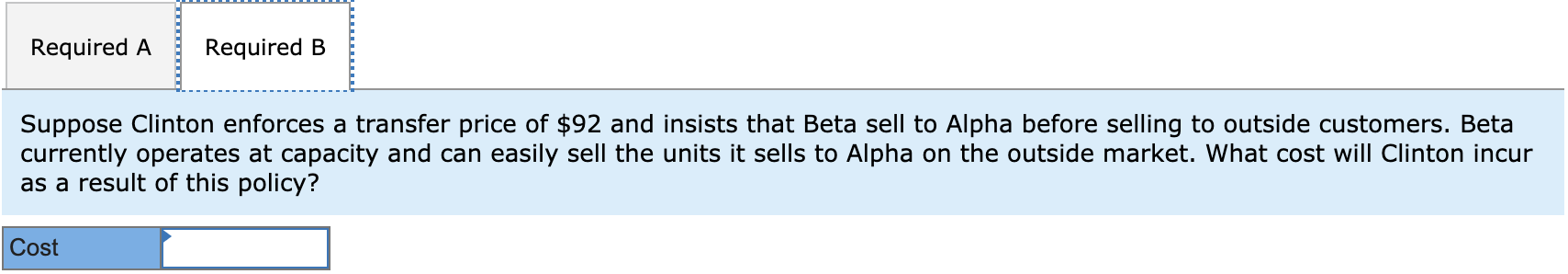

Best Practices, Inc., is a management consulting firm. Its Corporate Division advises private firms on the adoption and use of cost management systems. Government Division consults with state and local governments. Government Division has a client that is interested in implementing an activity-based costing system in its public works department. The division's head approached the head of Corporate Division about using one of its associates. Corporate Division charges clients $655 per hour for associate services, the same rate other consulting companies charge. The Government Division head complained that it could hire its own associate at an estimated variable cost of $255 per hour, which is what Corporate pays its associates. Required: a. What is the minimum transfer price that Corporate Division should obtain for its services, assuming that it is operating at capacity? b. What is the maximum price that Government Division should pay? Clinton Corporation has two decentralized divisions, Alpha and Beta. Alpha always has purchased certain units from Beta at $92 per unit. Beta plans to raise the price to $130 per unit, the price it receives from outside customers. As a result, Alpha is considering buying these units from outside suppliers for $92 per unit. Beta's costs follow. Variable costs per unit Annual fixed costs Annual production of these units sold to Alpha $ 87 $150,000 11,000 units Required A Required B If Alpha buys from an outside supplier, the facilities that Beta uses to manufacture these units will remain idle. What will be the result if Clinton enforces a transfer price of $130 per unit between Alpha and Beta? Clinton Corporation's contribution margin would Required A Required B ----- Suppose Clinton enforces a transfer price of $92 and insists that Beta sell to Alpha before selling to outside customers. Beta currently operates at capacity and can easily sell the units it sells to Alpha on the outside market. What cost will Clinton incur as a result of this policy? Cost