Best Value Hardware (BVH), Inc., a public company, is preparing their balance sheet, and income statement for the calendar year-ended December 31, 2016 based

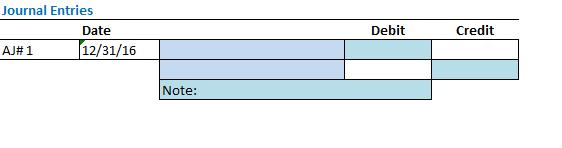

Best Value Hardware (BVH), Inc., a public company, is preparing their balance sheet, and income statement for the calendar year-ended December 31, 2016 based on U.S. GAAP and also based on IFRS. BVH's accountant has already recorded most of the entries at year end on the trial balance but needs your assistance in accounting for the following transactions and preparing the appropriate adjusting journal entries. Read through the following information, then using the provided Excel template, complete the missing information. For this project, you will first complete the calculations, journal entries, and adjusting entries. This information will then be reflected in the financial statements. You will use these financial statements to compare the financial information generated under IFRS and under GAAP. Part 1: Contingencies (Due at the end of unit 1) . Loss Contingency 12/31/16 Best Value Hardware is being sued by an employee who slipped on spilled milk and broke his back. BVH's lawyers expect to lose the lawsuit and estimate the loss to be between $250,000 and $500,000 with no one outcome being assessed as more likely than the other. Gain Contingency o 12/31/16 Best Value Hardware had a delivery truck drive through the side of one of their stores causing major damages. The delivery truck is owned by an independent party and Best Value Hardware is suing the trucking company for the $2,000,000 in damages. BVH's lawyers are virtually certain they will win the lawsuit and receive the full amount of damages. O Journal Entries AJ# 1 Date 12/31/16 Note: Debit Credit Best Value Hardware (BVH), Inc., a public company, is preparing their balance sheet, and income statement for the calendar year-ended December 31, 2016 based on U.S. GAAP and also based on IFRS. BVH's accountant has already recorded most of the entries at year end on the trial balance but needs your assistance in accounting for the following transactions and preparing the appropriate adjusting journal entries. Read through the following information, then using the provided Excel template, complete the missing information. For this project, you will first complete the calculations, journal entries, and adjusting entries. This information will then be reflected in the financial statements. You will use these financial statements to compare the financial information generated under IFRS and under GAAP. Part 1: Contingencies (Due at the end of unit 1) . Loss Contingency 12/31/16 Best Value Hardware is being sued by an employee who slipped on spilled milk and broke his back. BVH's lawyers expect to lose the lawsuit and estimate the loss to be between $250,000 and $500,000 with no one outcome being assessed as more likely than the other. Gain Contingency o 12/31/16 Best Value Hardware had a delivery truck drive through the side of one of their stores causing major damages. The delivery truck is owned by an independent party and Best Value Hardware is suing the trucking company for the $2,000,000 in damages. BVH's lawyers are virtually certain they will win the lawsuit and receive the full amount of damages. O Journal Entries AJ# 1 Date 12/31/16 Note: Debit Credit

Step by Step Solution

3.34 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Solution Part 1 Contingencies Loss Contingency GAAP Under GAAP a loss contingency is recognized if it is probable that the loss will be incurred and t...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started