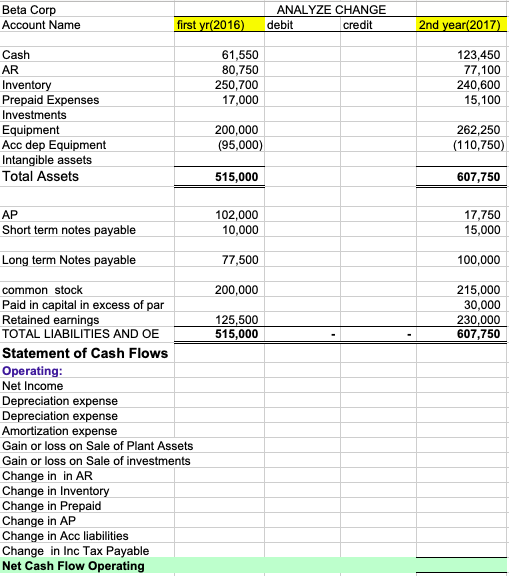

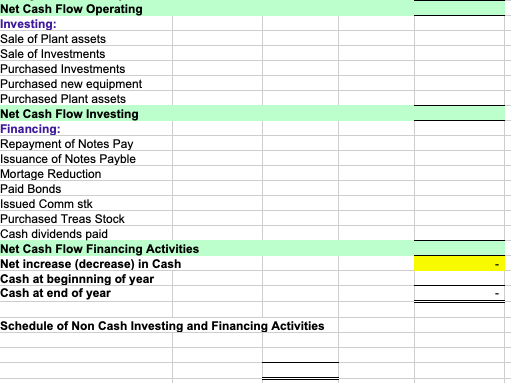

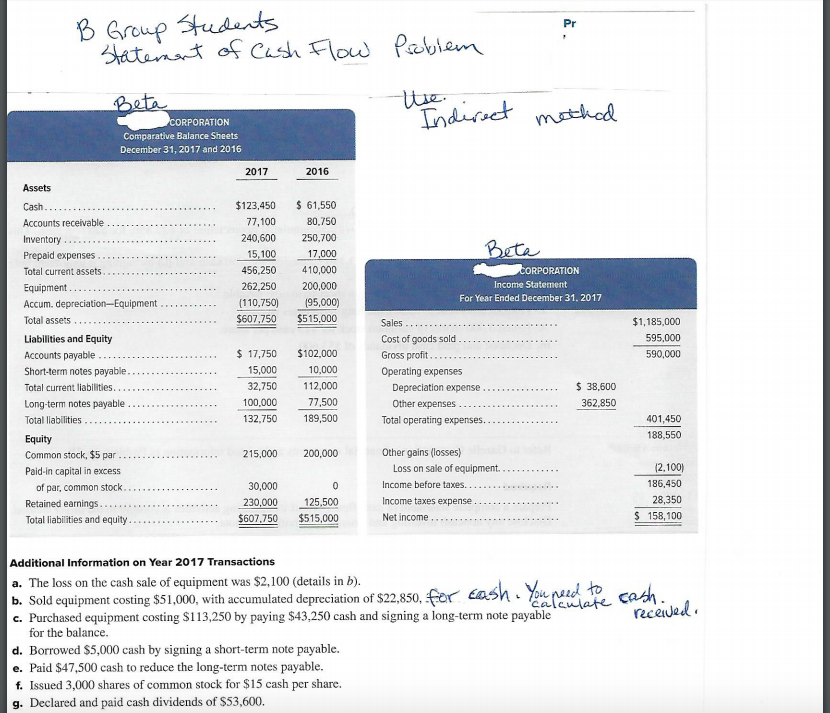

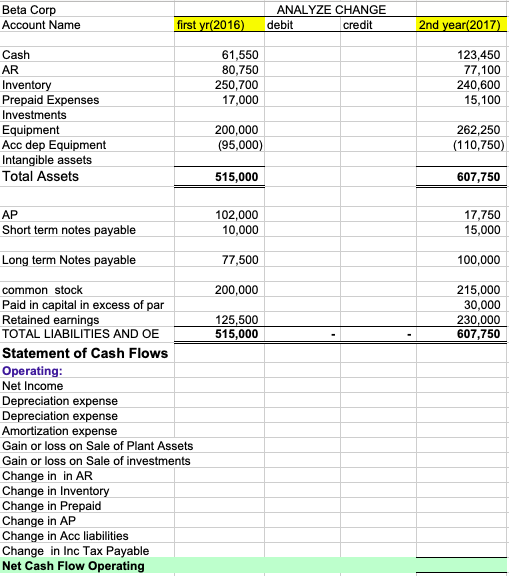

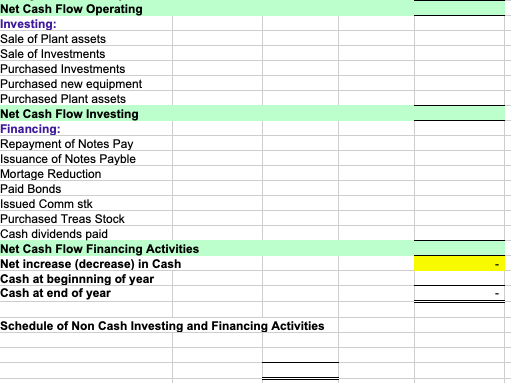

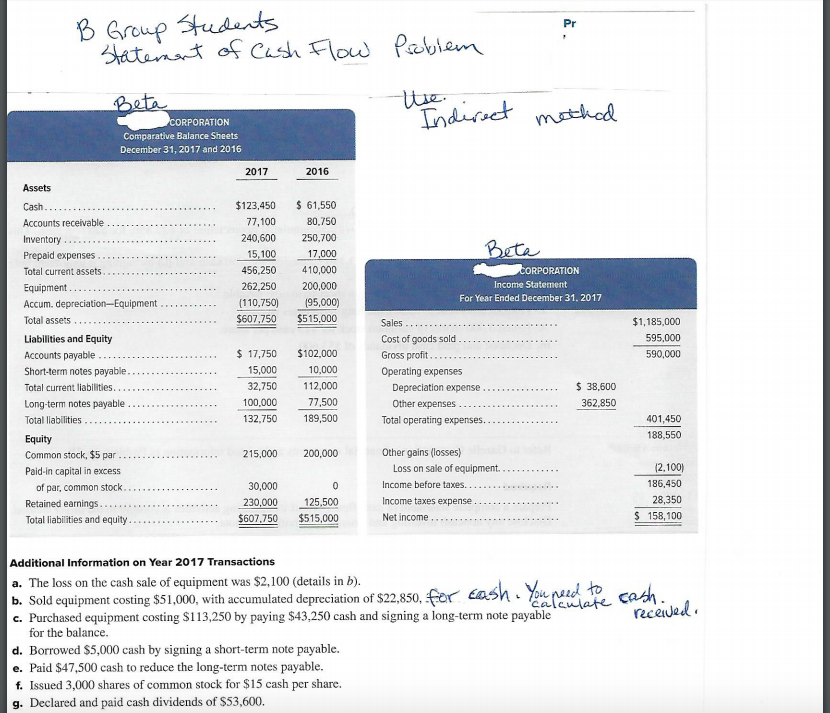

Beta Corp Account Name first yr(2016) ANALYZE CHANGE debit credit 2nd year(2017) 61,550 80,750 250,700 17,000 123,450 77,100 240,600 15,100 Cash AR Inventory Prepaid Expenses Investments Equipment Acc dep Equipment Intangible assets Total Assets 200,000 (95,000) 262,250 (110,750) 515,000 607,750 AP Short term notes payable 102,000 10,000 17,750 15,000 Long term Notes payable 77,500 100,000 200,000 215,000 30,000 230,000 607,750 125,500 515,000 common stock Paid in capital in excess of par Retained earnings TOTAL LIABILITIES AND OE Statement of Cash Flows Operating: Net Income Depreciation expense Depreciation expense Amortization expense Gain or loss on Sale of Plant Assets Gain or loss on Sale of investments Change in in AR Change in Inventory Change in Prepaid Change in AP Change in Acc liabilities Change in Inc Tax Payable Net Cash Flow Operating Net Cash Flow Operating Investing: Sale of Plant assets Sale of Investments Purchased Investments Purchased new equipment Purchased Plant assets Net Cash Flow Investing Financing: Repayment of Notes Pay Issuance of Notes Payble Mortage Reduction Paid Bonds Issued Comm stk Purchased Treas Stock Cash dividends paid Net Cash Flow Financing Activities Net increase (decrease) in Cash Cash at beginning of year Cash at end of year Schedule of Non Cash Investing and Financing Activities Pr B Group Students staterment of Cash Flow Probiem itse. Beta CORPORATION Comparative Balance Sheets December 31, 2017 and 2016 Indirect method 2017 2016 Beta Assets Cash.. Accounts receivable Inventory Prepaid expenses Total current assets. Equipment. Accum. depreciation-Equipment Total assets Liabilities and Equity Accounts payable Short-term notes payable. Total current liabilities... Long-term notes payable Total liabilities .. $123,450 77,100 240,600 15,100 456,250 262,250 [110.750) $607,750 $ 61,550 80.750 250,700 17,000 410,000 200,000 195,000) $515,000 CORPORATION Income Statement For Year Ended December 31, 2017 $1,185,000 595,000 590,000 $ 17,750 15,000 32,750 100.000 132.750 $102,000 10,000 112,000 77,500 189,500 Sales .. Cost of goods sold Gross profit... Operating expenses Depreciation expense Other expenses Total operating expenses. $ 38,600 362,850 401,450 188,550 215,000 200,000 Equity Common stock, $5 par Paid-in capital in excess of par, common stock Retained earnings Total liabilities and equity 30,000 230,000 $607.750 0 125,500 $515,000 Other gains (losses Loss on sale of equipment. Income before taxes. Income taxes expense Net income 12.100) 186,450 28,350 $ 158,100 cash. receivedlo Additional Information on Year 2017 Transactions a. The loss on the cash sale of equipment was $2,100 (details in b). b. Sold equipment costing $51,000, with accumulated depreciation of $22,850, for cash. You need to calculate c. Purchased equipment costing $113,250 by paying $43,250 cash and signing a long-term note payable for the balance. d. Borrowed $5,000 cash by signing a short-term note payable. e. Paid $47,500 cash to reduce the long-term notes payable. f. Issued 3,000 shares of common stock for $15 cash per share. g. Declared and paid cash dividends of $53,600