Question

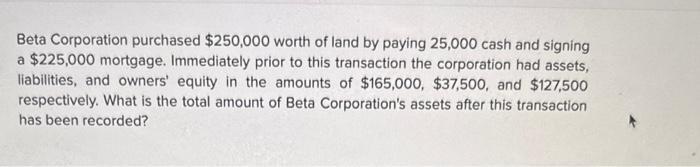

Beta Corporation purchased $250,000 worth of land by paying 25,000 cash and signing a $225,000 mortgage. Immediately prior to this transaction the corporation had

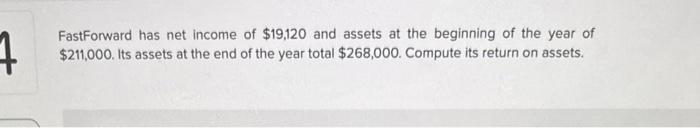

Beta Corporation purchased $250,000 worth of land by paying 25,000 cash and signing a $225,000 mortgage. Immediately prior to this transaction the corporation had assets, liabilities, and owners' equity in the amounts of $165,000, $37,500, and $127,500 respectively. What is the total amount of Beta Corporation's assets after this transaction has been recorded? 7 FastForward has net income of $19,120 and assets at the beginning of the year of $211,000. Its assets at the end of the year total $268,000. Compute its return on assets.

Step by Step Solution

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

After purchasing the land Beta Corporations assets would increase by the value of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamental Accounting Principles

Authors: John J. Wild, Ken W. Shaw, Barbara Chiappetta

20th Edition

1259157148, 78110874, 9780077616212, 978-1259157141, 77616219, 978-0078110870

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App