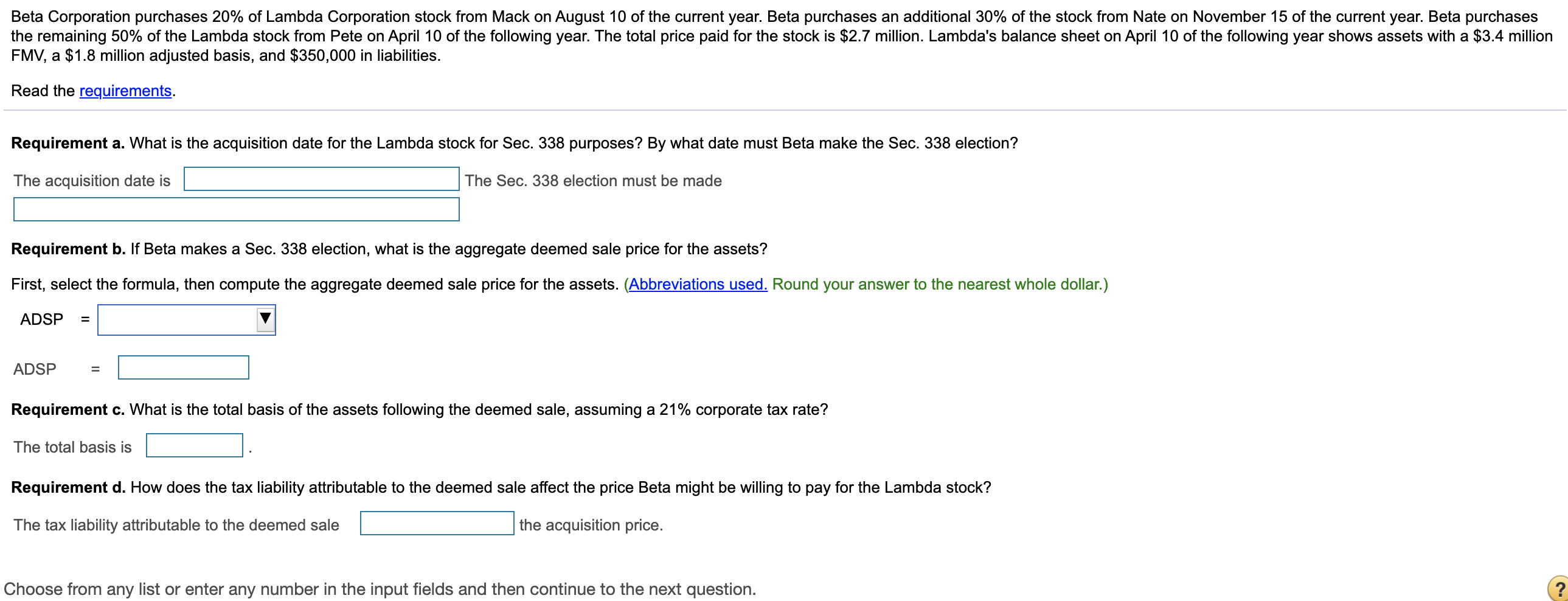

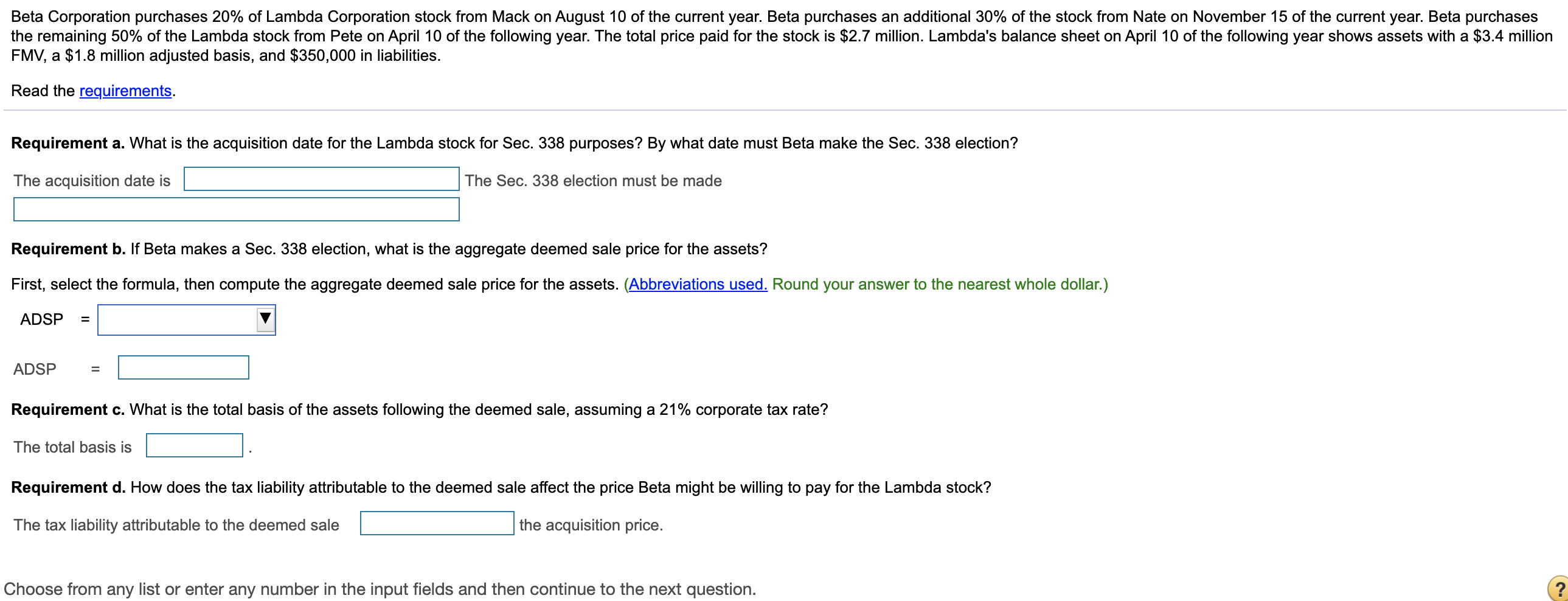

Beta Corporation purchases 20% of Lambda Corporation stock from Mack on August 10 of the current year. Beta purchases an additional 30% of the stock from Nate on November 15 of the current year. Beta purchases the remaining 50% of the Lambda stock from Pete on April 10 of the following year. The total price paid for the stock is $2.7 million. Lambda's balance sheet on April 10 of the following year shows assets with a $3.4 million FMV, a $1.8 million adjusted basis, and $350,000 in liabilities. Read the requirements. Requirement a. What is the acquisition date for the Lambda stock for Sec. 338 purposes? By what date must Beta make the Sec. 338 election? The acquisition date is The Sec. 338 election must be made Requirement b. If Beta makes a Sec. 338 election, what is the aggregate deemed sale price for the assets? First, select the formula, then compute the aggregate deemed sale price for the assets. (Abbreviations used. Round your answer to the nearest whole dollar.) ADSP ADSP Requirement c. What is the total basis of the assets following the deemed sale, assuming a 21% corporate tax rate? The total basis is Requirement d. How does the tax liability attributable to the deemed sale affect the price Beta might be willing to pay for the Lambda stock? The tax liability attributable to the deemed sale the acquisition price. Choose from any list or enter any number in the input fields and then continue to the next question. ? Requirement e. What happens to Lambda's tax attributes following the deemed sale? The tax attributes if Acquiring makes a Sec. 338 election because a. What is the acquisition date for the Lambda stock for Sec. 338 purposes? By what date must Beta make the Sec. 338 election? b. If Beta makes a Sec. 338 election, what is the aggregate deemed sale price for the assets? C. What is the total basis of the assets following the deemed sale, assuming a 21% corporate tax rate? d. How does the tax liability attributable to the deemed sale affect the price Beta might be willing to pay for the Lambda stock? e. What happens to Lambda's tax attributes following the deemed sale? Beta Corporation purchases 20% of Lambda Corporation stock from Mack on August 10 of the current year. Beta purchases an additional 30% of the stock from Nate on November 15 of the current year. Beta purchases the remaining 50% of the Lambda stock from Pete on April 10 of the following year. The total price paid for the stock is $2.7 million. Lambda's balance sheet on April 10 of the following year shows assets with a $3.4 million FMV, a $1.8 million adjusted basis, and $350,000 in liabilities. Read the requirements. Requirement a. What is the acquisition date for the Lambda stock for Sec. 338 purposes? By what date must Beta make the Sec. 338 election? The acquisition date is The Sec. 338 election must be made Requirement b. If Beta makes a Sec. 338 election, what is the aggregate deemed sale price for the assets? First, select the formula, then compute the aggregate deemed sale price for the assets. (Abbreviations used. Round your answer to the nearest whole dollar.) ADSP ADSP Requirement c. What is the total basis of the assets following the deemed sale, assuming a 21% corporate tax rate? The total basis is Requirement d. How does the tax liability attributable to the deemed sale affect the price Beta might be willing to pay for the Lambda stock? The tax liability attributable to the deemed sale the acquisition price. Choose from any list or enter any number in the input fields and then continue to the next question. ? Requirement e. What happens to Lambda's tax attributes following the deemed sale? The tax attributes if Acquiring makes a Sec. 338 election because a. What is the acquisition date for the Lambda stock for Sec. 338 purposes? By what date must Beta make the Sec. 338 election? b. If Beta makes a Sec. 338 election, what is the aggregate deemed sale price for the assets? C. What is the total basis of the assets following the deemed sale, assuming a 21% corporate tax rate? d. How does the tax liability attributable to the deemed sale affect the price Beta might be willing to pay for the Lambda stock? e. What happens to Lambda's tax attributes following the deemed sale