Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Beta Engineering Ltd has a Plant under construction that is being financed with $ 10 million of debt, 8 million of which is a construction

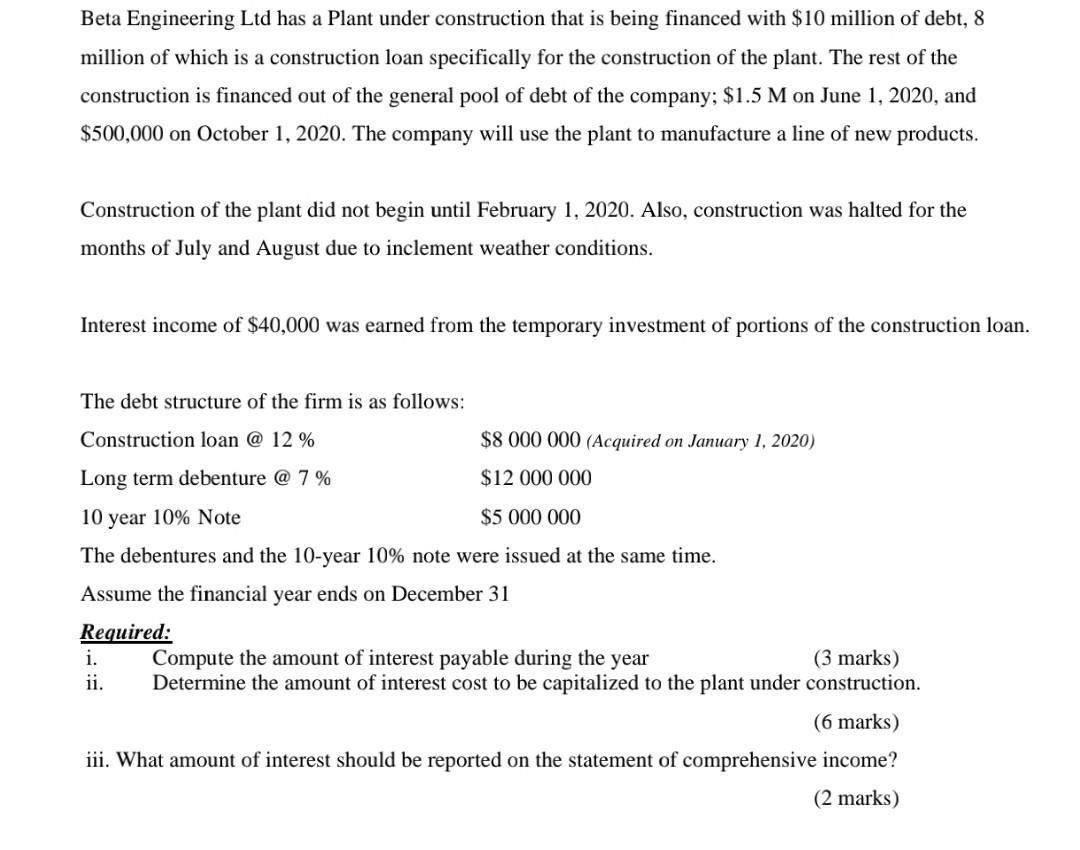

Beta Engineering Ltd has a Plant under construction that is being financed with $ 10 million of debt, 8 million of which is a construction loan specifically for the construction of the plant. The rest of the construction is financed out of the general pool of debt of the company; $1.5 M on June 1, 2020, and $500,000 on October 1, 2020. The company will use the plant to manufacture a line of new products. Construction of the plant did not begin until February 1, 2020. Also, construction was halted for the months of July and August due to inclement weather conditions. Interest income of $40,000 was earned from the temporary investment of portions of the construction loan. The debt structure of the firm is as follows: Construction loan @ 12% $8 000 000 (Acquired on January 1, 2020) $12 000 000 Long term debenture @ 7 % 10 year 10% Note $5 000 000 The debentures and the 10-year 10% note were issued at the same time. Assume the financial year ends on December 31 Required: i. Compute the amount of interest payable during the year (3 marks) ii. Determine the amount of interest cost to be capitalized to the plant under construction. (6 marks) iii. What amount of interest should be reported on the statement of comprehensive income? (2 marks) Beta Engineering Ltd has a Plant under construction that is being financed with $ 10 million of debt, 8 million of which is a construction loan specifically for the construction of the plant. The rest of the construction is financed out of the general pool of debt of the company; $1.5 M on June 1, 2020, and $500,000 on October 1, 2020. The company will use the plant to manufacture a line of new products. Construction of the plant did not begin until February 1, 2020. Also, construction was halted for the months of July and August due to inclement weather conditions. Interest income of $40,000 was earned from the temporary investment of portions of the construction loan. The debt structure of the firm is as follows: Construction loan @ 12% $8 000 000 (Acquired on January 1, 2020) $12 000 000 Long term debenture @ 7 % 10 year 10% Note $5 000 000 The debentures and the 10-year 10% note were issued at the same time. Assume the financial year ends on December 31 Required: i. Compute the amount of interest payable during the year (3 marks) ii. Determine the amount of interest cost to be capitalized to the plant under construction. (6 marks) iii. What amount of interest should be reported on the statement of comprehensive income? (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started