Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Betsy has Type 2 diabetes and high blood pressure. She visits the doctor often to keep her diabetes and blood pressure controlled. The doctor regularly

Betsy has Type 2 diabetes and high blood pressure. She visits the doctor often to keep her diabetes and blood pressure controlled. The doctor regularly checks her blood levels and prescribes level 1 prescriptions to help Betsy control her diabetes and blood pressure.

- Betsy is considered a controlled diabetic; she uses her insurance plan frequently.

- Compare the plans provided and determine the best plan for Betsy. Remember to consider deductibles and general costs for the services she would be using.

- For several years, Betsy was really taking care of herself. However, after suffering a broken leg and being more inactive, Betsy has gained weight and has not been diligent about controlling her diabetes. Betsy has found that she is requiring emergency department services and urgent care more often.

- If Betsy was considering changing her insurance plan, which plan should she consider? Why?

- How does the plan she should consider in this scenario compare to the plan choice from the first question?

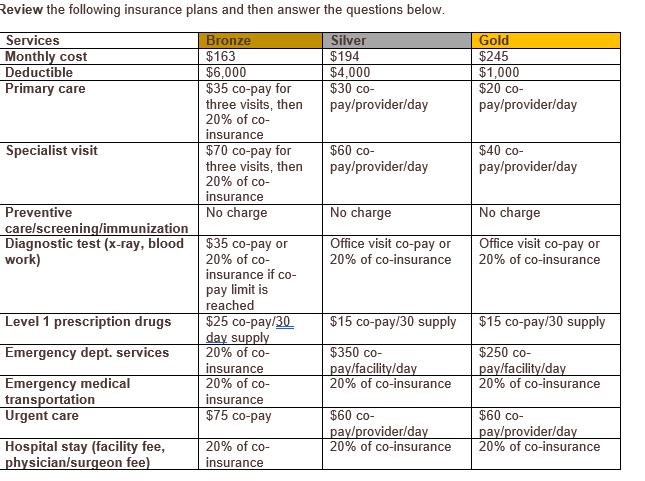

Review the following insurance plans and then answer the questions below. Services Bronze Monthly cost $163 Deductible $6,000 Primary care Specialist visit Preventive care/screening/immunization Diagnostic test (x-ray, blood work) Level 1 prescription drugs Emergency dept. services Emergency medical transportation Urgent care Hospital stay (facility fee, physician/surgeon fee) $35 co-pay for three visits, then 20% of co- insurance $70 co-pay for three visits, then 20% of co- insurance No charge $35 co-pay or 20% of co- insurance if co- pay limit is reached $25 co-pay/30 day supply 20% of co- insurance 20% of co- insurance $75 co-pay 20% of co- insurance Silver $194 $4,000 $30 co- pay/provider/day $60 co- pay/provider/day No charge Office visit co-pay or 20% of co-insurance $15 co-pay/30 supply $350 co- pay/facility/day 20% of co-insurance $60 co- pay/provider/day 20% of co-insurance Gold $245 $1,000 $20 co- pay/provider/day $40 co- pay/provider/day No charge Office visit co-pay or 20% of co-insurance $15 co-pay/30 supply $250 co- pay/facility/day 20% of co-insurance $60 co- pay/provider/day 20% of co-insurance

Step by Step Solution

★★★★★

3.60 Rating (182 Votes )

There are 3 Steps involved in it

Step: 1

If Betsy was considering changing her insurance plan which plan should she consider Why Betsy shoul...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started