Answered step by step

Verified Expert Solution

Question

1 Approved Answer

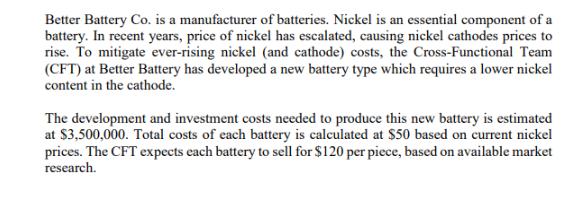

Better Battery Co. is a manufacturer of batteries. Nickel is an essential component of a battery. In recent years, price of nickel has escalated,

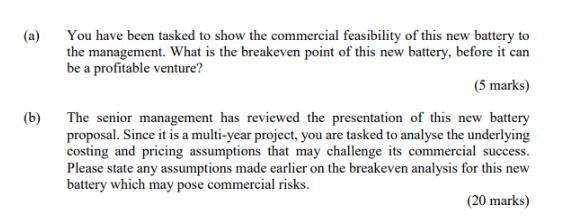

Better Battery Co. is a manufacturer of batteries. Nickel is an essential component of a battery. In recent years, price of nickel has escalated, causing nickel cathodes prices to rise. To mitigate ever-rising nickel (and cathode) costs, the Cross-Functional Team (CFT) at Better Battery has developed a new battery type which requires a lower nickel content in the cathode. The development and investment costs needed to produce this new battery is estimated at $3,500,000. Total costs of each battery is calculated at $50 based on current nickel prices. The CFT expects each battery to sell for $120 per piece, based on available market research. (a) (b) You have been tasked to show the commercial feasibility of this new battery to the management. What is the breakeven point of this new battery, before it can be a profitable venture? (5 marks) The senior management has reviewed the presentation of this new battery proposal. Since it is a multi-year project, you are tasked to analyse the underlying costing and pricing assumptions that may challenge its commercial success. Please state any assumptions made earlier on the breakeven analysis for this new battery which may pose commercial risks. (20 marks)

Step by Step Solution

★★★★★

3.44 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the breakeven point for the new battery we need to determine how many units need to be sold in order to cover the total costs The break...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started