Better Homes Products' Canadian operations are organized into two divisions: West and East. West division sells a component that could be used by East

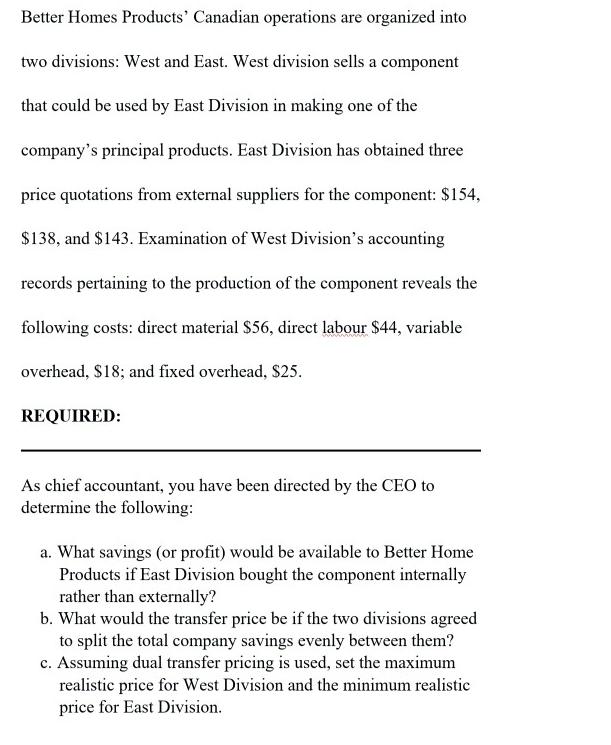

Better Homes Products' Canadian operations are organized into two divisions: West and East. West division sells a component that could be used by East Division in making one of the company's principal products. East Division has obtained three price quotations from external suppliers for the component: $154, $138, and $143. Examination of West Division's accounting records pertaining to the production of the component reveals the following costs: direct material $56, direct labour $44, variable overhead, $18; and fixed overhead, $25. REQUIRED: As chief accountant, you have been directed by the CEO to determine the following: a. What savings (or profit) would be available to Better Home Products if East Division bought the component internally rather than externally? b. What would the transfer price be if the two divisions agreed to split the total company savings evenly between them? c. Assuming dual transfer pricing is used, set the maximum realistic price for West Division and the minimum realistic price for East Division.

Step by Step Solution

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Requirement A If East division bought the component internally rather t...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started