Question

Better Mousetraps has come out with an improved product, and the world is beating a path to its door. As a result, the firm projects

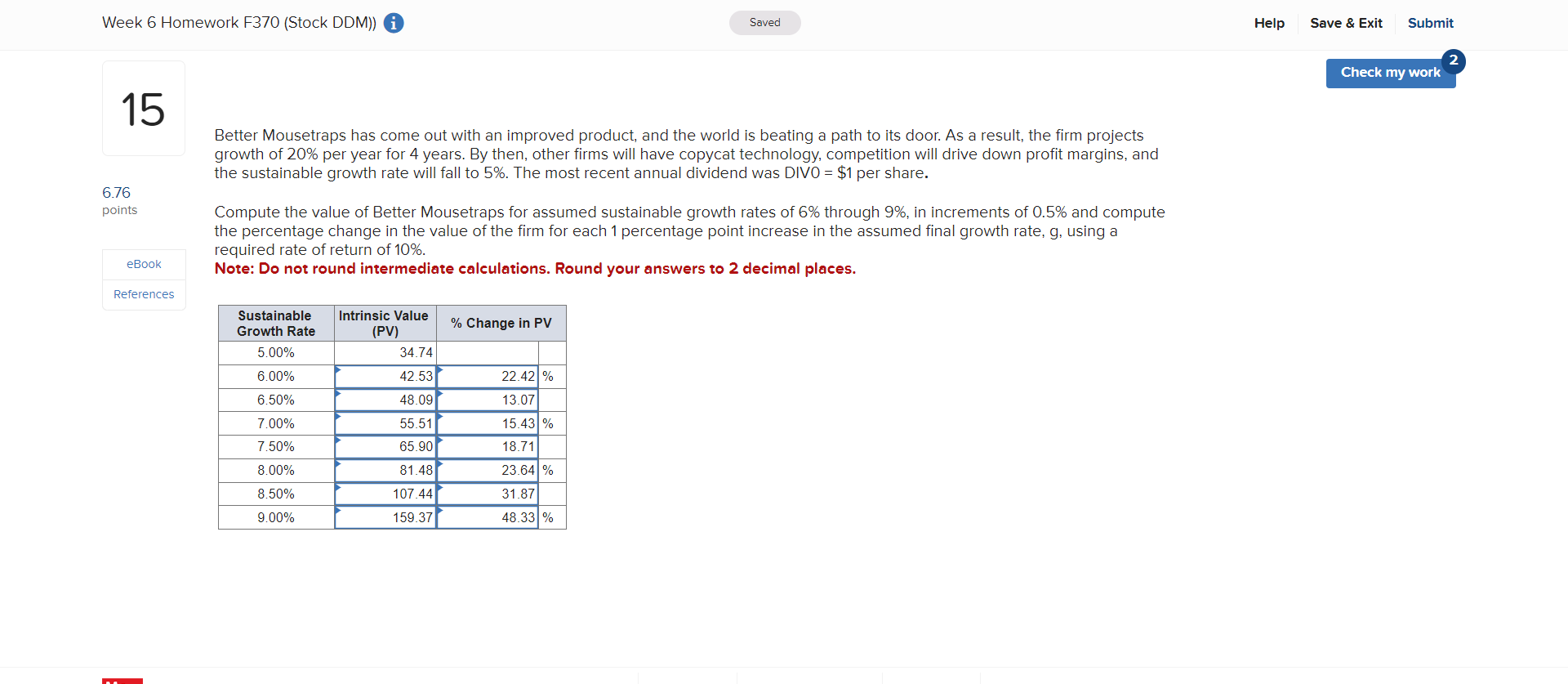

Better Mousetraps has come out with an improved product, and the world is beating a path to its door. As a result, the firm projects growth of 20% per year for 4 years. By then, other firms will have copycat technology, competition will drive down profit margins, and the sustainable growth rate will fall to 5%. The most recent annual dividend was DIV0 = $1 per share.

Compute the value of Better Mousetraps for assumed sustainable growth rates of 6% through 9%, in increments of 0.5% and compute the percentage change in the value of the firm for each 1 percentage point increase in the assumed final growth rate, g, using a required rate of return of 10%.

Better Mousetraps has come out with an improved product, and the world is beating a path to its door. As a result, the firm projects growth of 20% per year for 4 years. By then, other firms will have copycat technology, competition will drive down profit margins, and the sustainable growth rate will fall to 5%. The most recent annual dividend was DIV0 =$1 per share. Compute the value of Better Mousetraps for assumed sustainable growth rates of 6% through 9%, in increments of 0.5% and compute the percentage change in the value of the firm for each 1 percentage point increase in the assumed final growth rate, g, using a required rate of return of 10%. Note: Do not round intermediate calculations. Round your answers to 2 decimal places

Better Mousetraps has come out with an improved product, and the world is beating a path to its door. As a result, the firm projects growth of 20% per year for 4 years. By then, other firms will have copycat technology, competition will drive down profit margins, and the sustainable growth rate will fall to 5%. The most recent annual dividend was DIV0 =$1 per share. Compute the value of Better Mousetraps for assumed sustainable growth rates of 6% through 9%, in increments of 0.5% and compute the percentage change in the value of the firm for each 1 percentage point increase in the assumed final growth rate, g, using a required rate of return of 10%. Note: Do not round intermediate calculations. Round your answers to 2 decimal places Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started