Answered step by step

Verified Expert Solution

Question

1 Approved Answer

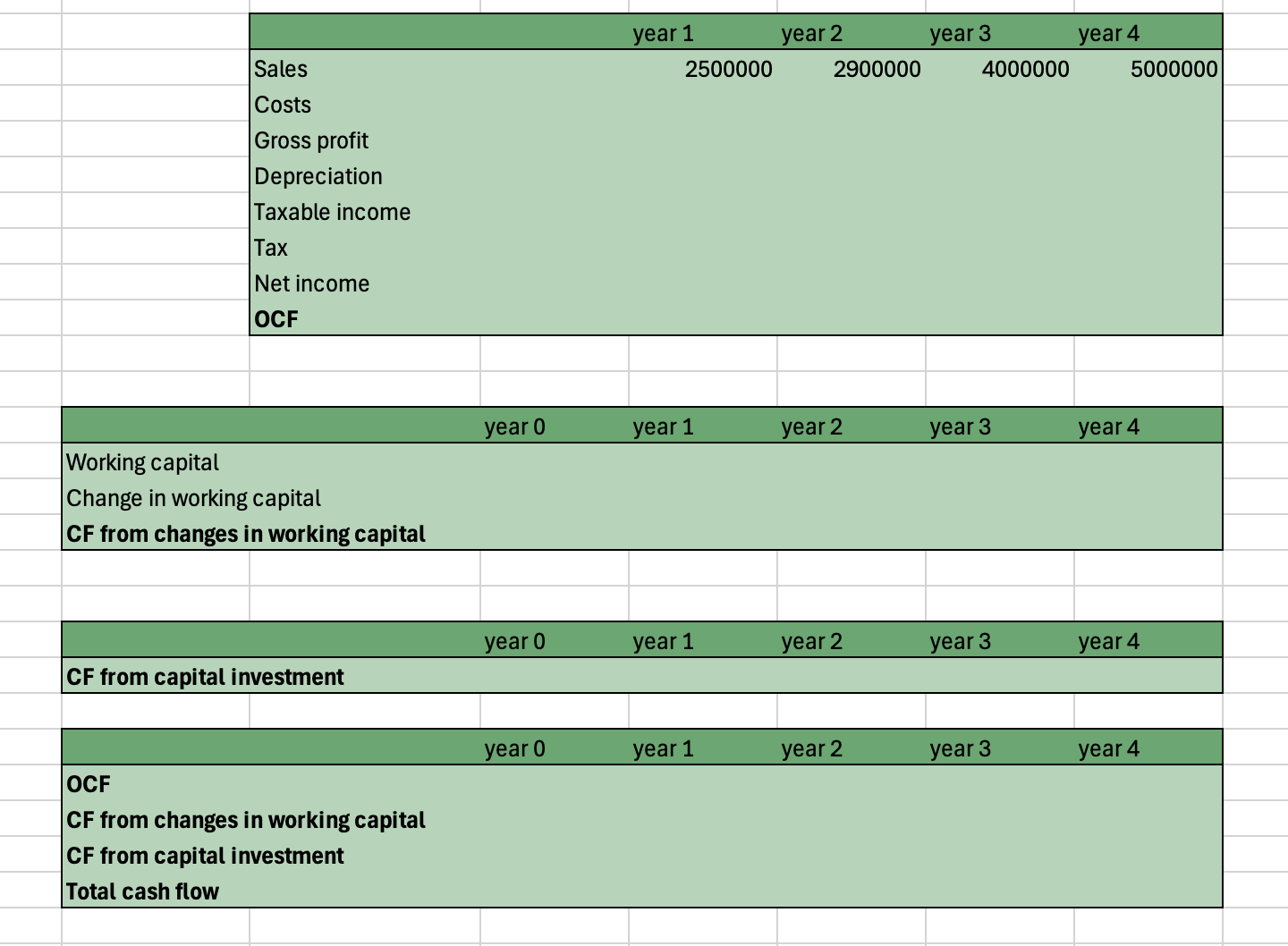

Better Mousetrap's research laboratories have developed a new trap. The project requires an initial investment in plant and equipment of $ 6 million. This investment

Better Mousetrap's research laboratories have developed a new trap. The project requires an initial investment in plant and equipment of $ million. This investment will be depreciated straightline over four years to a value of zero, but when the project comes to an end at the end of four years, the equipment will, in fact, be sold for $ The firm believes that working capital at each date must be maintained at of next year's forecasted sales starting immediately. In other words, the investment in working capital in Year Million x $ This means that the CF from the change in working capital will be different for each year. Also, remember that the working capital is assumed to be recouped at the end of the project working capital Year Production costs are estimated at of revenues. There are no marketing expenses. Sales forecasts are given below. The firm pays tax at and the required return on the project is What is the NPV

Year : sales Million

Year : sales Million

Year : sales Million

Year : sales Million

Year : sales Million

$

$

$

$

$tableyear year year year SalesCostsGross profit,,,,DepreciationTaxable income,,,,TaxNet income,,,,OCF

tableyear year year year year Working capitalChange in working capitalCF from changes in working capitalyear year year year year CF from capital investmentyear year year year year OCFCF from changes in working capitalCF from capital investmentTotal cash flow,,,,,

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started