Answered step by step

Verified Expert Solution

Question

1 Approved Answer

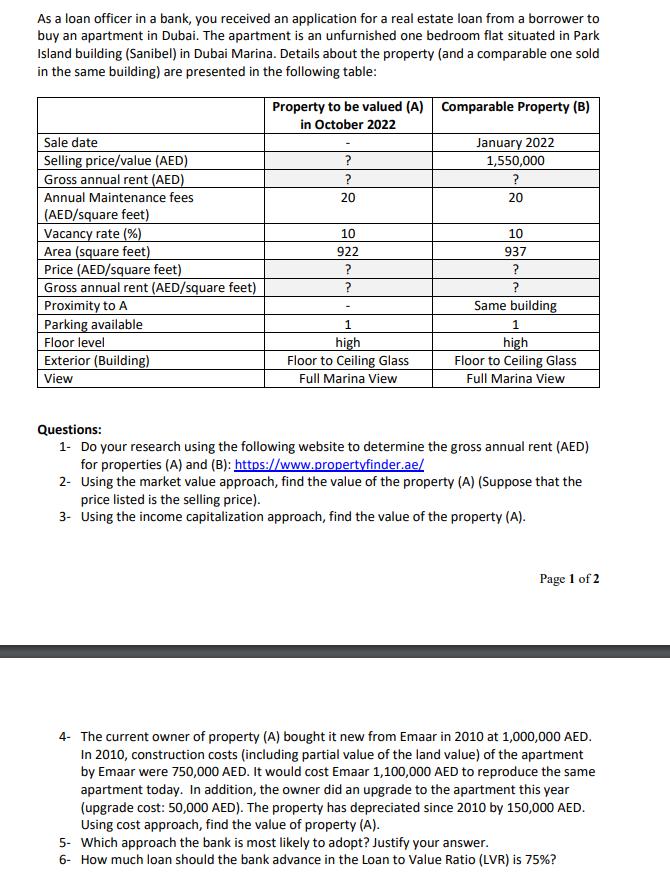

As a loan officer in a bank, you received an application for a real estate loan from a borrower to buy an apartment in

As a loan officer in a bank, you received an application for a real estate loan from a borrower to buy an apartment in Dubai. The apartment is an unfurnished one bedroom flat situated in Park Island building (Sanibel) in Dubai Marina. Details about the property (and a comparable one sold in the same building) are presented in the following table: Sale date Selling price/value (AED) Gross annual rent (AED) Annual Maintenance fees (AED/square feet) Vacancy rate (%) Area (square feet) Price (AED/square feet) Gross annual rent (AED/square feet) Proximity to A Parking available Floor level Exterior (Building) View Property to be valued (A) Comparable Property (B) in October 2022 ? ? 20 10 922 ? ? 1 high Floor to Ceiling Glass Full Marina View January 2022 1,550,000 20 10 937 ? ? Same building 1 high Floor to Ceiling Glass Full Marina View Questions: 1- Do your research using the following website to determine the gross annual rent (AED) for properties (A) and (B): https://www.propertyfinder.ae/ 2- Using the market value approach, find the value of the property (A) (Suppose that the price listed is the selling price). 3- Using the income capitalization approach, find the value of the property (A). Page 1 of 2 4- The current owner of property (A) bought it new from Emaar in 2010 at 1,000,000 AED. In 2010, construction costs (including partial value of the land value) of the apartment by Emaar were 750,000 AED. It would cost Emaar 1,100,000 AED to reproduce the same apartment today. In addition, the owner did an upgrade to the apartment this year (upgrade cost: 50,000 AED). The property has depreciated since 2010 by 150,000 AED. Using cost approach, find the value of property (A). 5- Which approach the bank is most likely to adopt? Justify your answer. 6- How much loan should the bank advance in the Loan to Value Ratio (LVR) is 75%?

Step by Step Solution

★★★★★

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

a Market Value approach is method of determining value of an asset based on ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started