Question

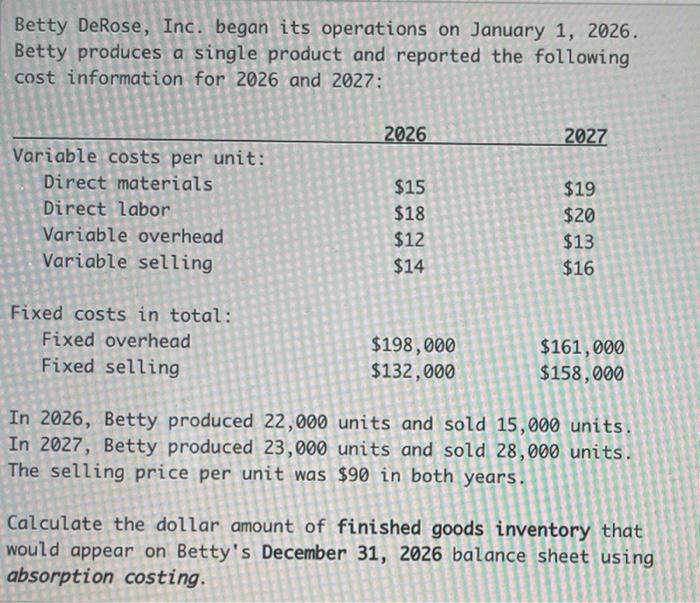

Betty DeRose, Inc. began its operations on January 1, 2026. Betty produces a single product and reported the following cost information for 2026 and

Betty DeRose, Inc. began its operations on January 1, 2026. Betty produces a single product and reported the following cost information for 2026 and 2027: 2026 2027 Variable costs per unit: Direct materials $15 $19 Direct labor $18 $20 Variable overhead $12 $13 Variable selling $14 $16 Fixed costs in total: Fixed overhead $198,000 $132,000 $161,000 $158,000 Fixed selling In 2026, Betty produced 22,000 units and sold 15,000 units. In 2027, Betty produced 23,000 units and sold 28,000 units. The selling price per unit was $90 in both years. Calculate the dollar amount of finished goods inventory that would appear on Betty's December 31, 2026 balance sheet using absorption costing.

Step by Step Solution

3.33 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

2026 Units produced 22000 Less Units sold 15000 Ending Invent...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Cost Accounting

Authors: William K. Carter

14th edition

759338094, 978-0759338098

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App