Question

Betty Rush, a cash basis taxpayer, is 36 years old, lives in Arizona, and is employed as a tax accountant at MM Company. Betty also

Betty Rush, a cash basis taxpayer, is 36 years old, lives in Arizona, and is employed as a tax accountant at MM Company. Betty also writes computer software programs for tax practitioners and has a part-time tax practice. Pertinent information on her 2019 W-2 from MM Company follows:

Gross wages 62,800

Federal income tax withheld 10,000

State of Arizona income tax withheld 2,954

Betty is single and has a daughter named Eleanor whom she fully supports. Eleanor is 8 years old and lives with Betty. Eleanor has a hearing disability and attends a special school for children who are deaf. Bettys mother Olivia suffers from early onset Alzheimers and is unable to live independently or to work. Olivias only income is Social Security benefits which are not taxable. Betty covers 75% of her mothers assisted living housing and care costs.

During the year Betty received interest of $1,300 from Arizona Savings Bank and $400 from Mesa Bank. She also received the following qualified dividends: $ 800 from Blue Corp., $750 from Green Corp., and $650 from Orange Corporation.

Betty received a $1,100 income tax refund from the state of Arizona on May 8, 2019. On her 2018 federal income tax return she reported total itemized deductions of $28,200 which included $2,200 of state income tax withheld by her employer.

On February 8, 2019 Betty bought 500 shares of Gray Corporation common stock for $17.60 a share. On September 12, 2019 Betty sold the stock for $14 per share.

Betty bought a used sport utility vehicle for $6,000 on June 5, 2019. She purchased it from her brother-in-law who was unemployed and was in need of cash. On November 2, 2019 she sold the vehicle to a friend for $6,500.

On January 2, 2019 Betty acquired 100 shares of Blue Corporation common stock for $30 per share. She sold the stock on December 19, 2019 for $55 a share.

Betty is not covered by a retirement plan at work. She contributed $5,000 to a Traditional IRA for 2019.

During the year Betty had revenues of $39,900 from the sale of a software program she developed and $21,470 from preparing tax returns. She bought and used $1,240 of office supplies and paid consultant fees of $3,500. Betty elected to take Section 179 and NOT to take Additional First Year Bonus depreciation on the following 100% business use assets she placed in service during the year.

Asset Class Placed in Service Date Original Cost

Computer 5 year 1/15/19 $7,000

Printer 5 year 1/15/19 $2,000

Office desk 7 year 1/15/19 $3,000

During the year Betty paid $300 for her own prescription medicines and $1,875 for her own doctor bills. Bettys employer pays 100% of her medical insurance premiums. Betty also paid $27,700 of assisted living care costs for Olivia and $8,600 for tuition for Eleanor to attend a special school for deaf children recommended by Eleanors doctor.

Betty paid real property taxes of $1,766 for her home in 2019. She also paid home mortgage interest of $3,854 and interest on her personal-use credit card of $320. She contributed a total of $2,080 to qualifying charities during the year. Betty paid $200 each quarter to have the hedge surrounding her property trimmed.

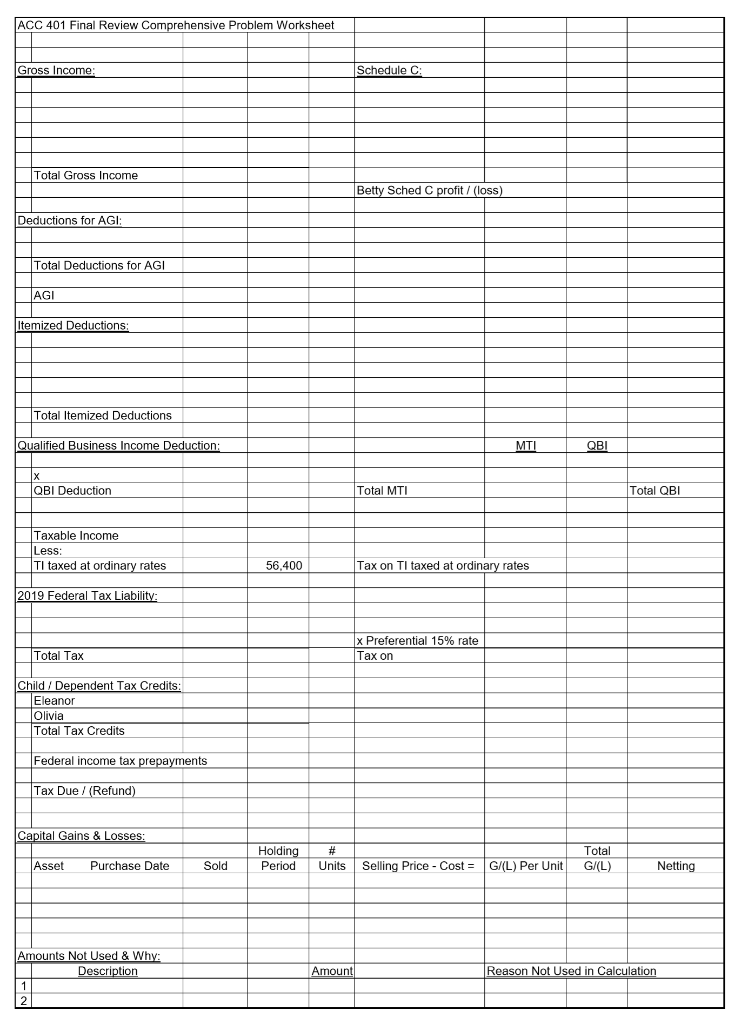

Required: Use the worksheet to calculate Bettys 2019 federal tax payable or tax refund amount. List all amounts not used in your worksheet calculations and why each amount was not used.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started