Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Between mid-September and mid-October of 2016, the Securities and Exchange Commission (SEC) put Tesla Inc. under fire after the latter added back certain costs

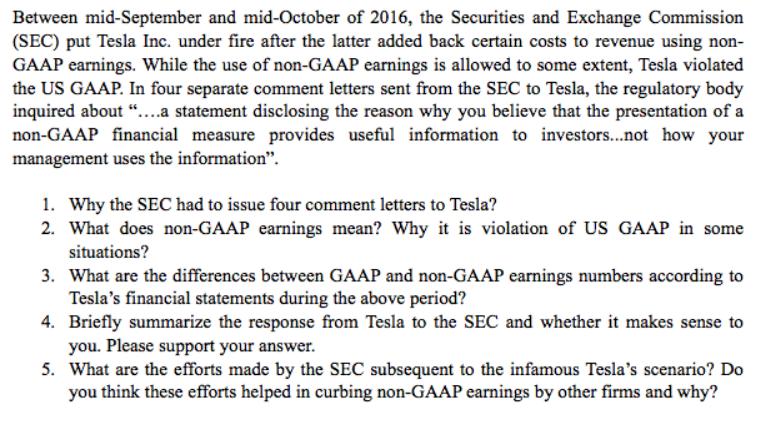

Between mid-September and mid-October of 2016, the Securities and Exchange Commission (SEC) put Tesla Inc. under fire after the latter added back certain costs to revenue using non- GAAP earnings. While the use of non-GAAP earnings is allowed to some extent, Tesla violated the US GAAP. In four separate comment letters sent from the SEC to Tesla, the regulatory body inquired about "...a statement disclosing the reason why you believe that the presentation of a non-GAAP financial measure provides useful information to investors..not how your management uses the information". 1. Why the SEC had to issue four comment letters to Tesla? 2. What does non-GAAP earnings mean? Why it is violation of US GAAP in some situations? 3. What are the differences between GAAP and non-GAAP earnings numbers according to Tesla's financial statements during the above period? 4. Briefly summarize the response from Tesla to the SEC and whether it makes sense to you. Please support your answer. 5. What are the efforts made by the SEC subsequent to the infamous Tesla's scenario? Do you think these efforts helped in curbing non-GAAP earnings by other firms and why?

Step by Step Solution

★★★★★

3.44 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

1 Companies are required to prepare their financial statements in compliance with GAAP generally accepted accounting principles SEC has issued four co...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635d539c17775_174596.pdf

180 KBs PDF File

635d539c17775_174596.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started