Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Beutel Goodman provides investment management for individuals, family offices, not for profit organizations, foundations, and pensions Information on a prospective investment for Beutel Goodman is

Beutel Goodman provides investment management for individuals, family offices, not for profit organizations, foundations, and pensions Information on a prospective investment for Beutel Goodman is given below

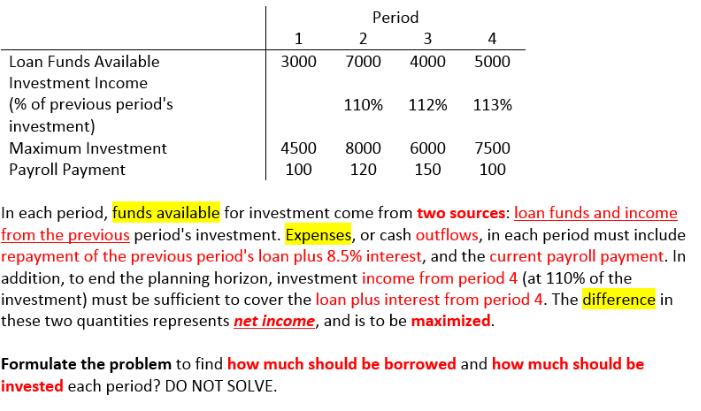

Period 1 2 3 4 Loan Funds Available 3000 7000 4000 5000 Investment Income (% of previous period's investment) 110% 112% 113% Maximum Investment 4500 8000 6000 7500 Payroll Payment 100 120 150 100 In each period, funds available for investment come from two sources: loan funds and income from the previous period's investment. Expenses, or cash outflows, in each period must include repayment of the previous period's loan plus 8.5% interest, and the current payroll payment. In addition, to end the planning horizon, investment income from period 4 (at 110% of the investment) must be sufficient to cover the loan plus interest from period 4. The difference in these two quantities represents net income, and is to be maximized. Formulate the problem to find how much should be borrowed and how much should be invested each period? DO NOT SOLVE.

Step by Step Solution

★★★★★

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

From the details it is very clear that the net income for each period is to be computed and maximize...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started