Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bevan Real Estate Inc. is a real estate holding company with four properties. You estimate that the income from these properties, which is currently

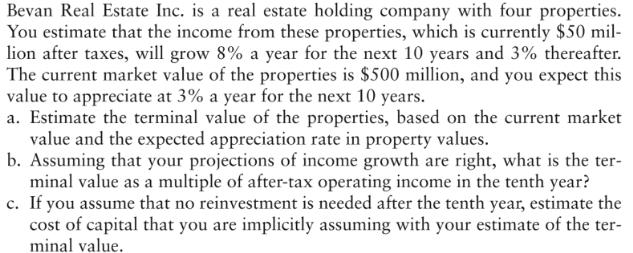

Bevan Real Estate Inc. is a real estate holding company with four properties. You estimate that the income from these properties, which is currently $50 mil- lion after taxes, will grow 8% a year for the next 10 years and 3% thereafter. The current market value of the properties is $500 million, and you expect this value to appreciate at 3% a year for the next 10 years. a. Estimate the terminal value of the properties, based on the current market value and the expected appreciation rate in property values. b. Assuming that your projections of income growth are right, what is the ter- minal value as a multiple of after-tax operating income in the tenth year? c. If you assume that no reinvestment is needed after the tenth year, estimate the cost of capital that you are implicitly assuming with your estimate of the ter- minal value.

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started