Question

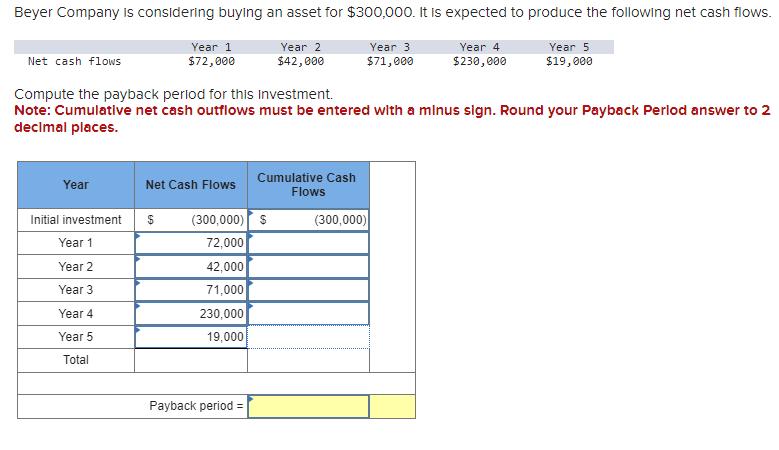

Beyer Company is considering buying an asset for $300,000. It is expected to produce the following net cash flows. Net cash flows Year Year

Beyer Company is considering buying an asset for $300,000. It is expected to produce the following net cash flows. Net cash flows Year Year 1 $72,000 Initial investment Year 1 Year 2 Year 3 Year 4 Year 5 Total Net Cash Flows Compute the payback period for this Investment. Note: Cumulative net cash outflows must be entered with a minus sign. Round your Payback Perlod answer to 2 decimal places. Year 2 $42,000 $ (300,000) $ 72,000 42,000 71,000 230,000 19,000 Payback period= Cumulative Cash Flows Year 3. $71,000 Year 4. $230,000 (300,000) Year 5 $19,000

Step by Step Solution

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the payback period we need to determine the amount of time it takes for the net cash in...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

College Algebra

Authors: Margaret L. Lial, John Hornsby, David I. Schneider, Callie Daniels

12th edition

134697022, 9780134313795 , 978-0134697024

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App