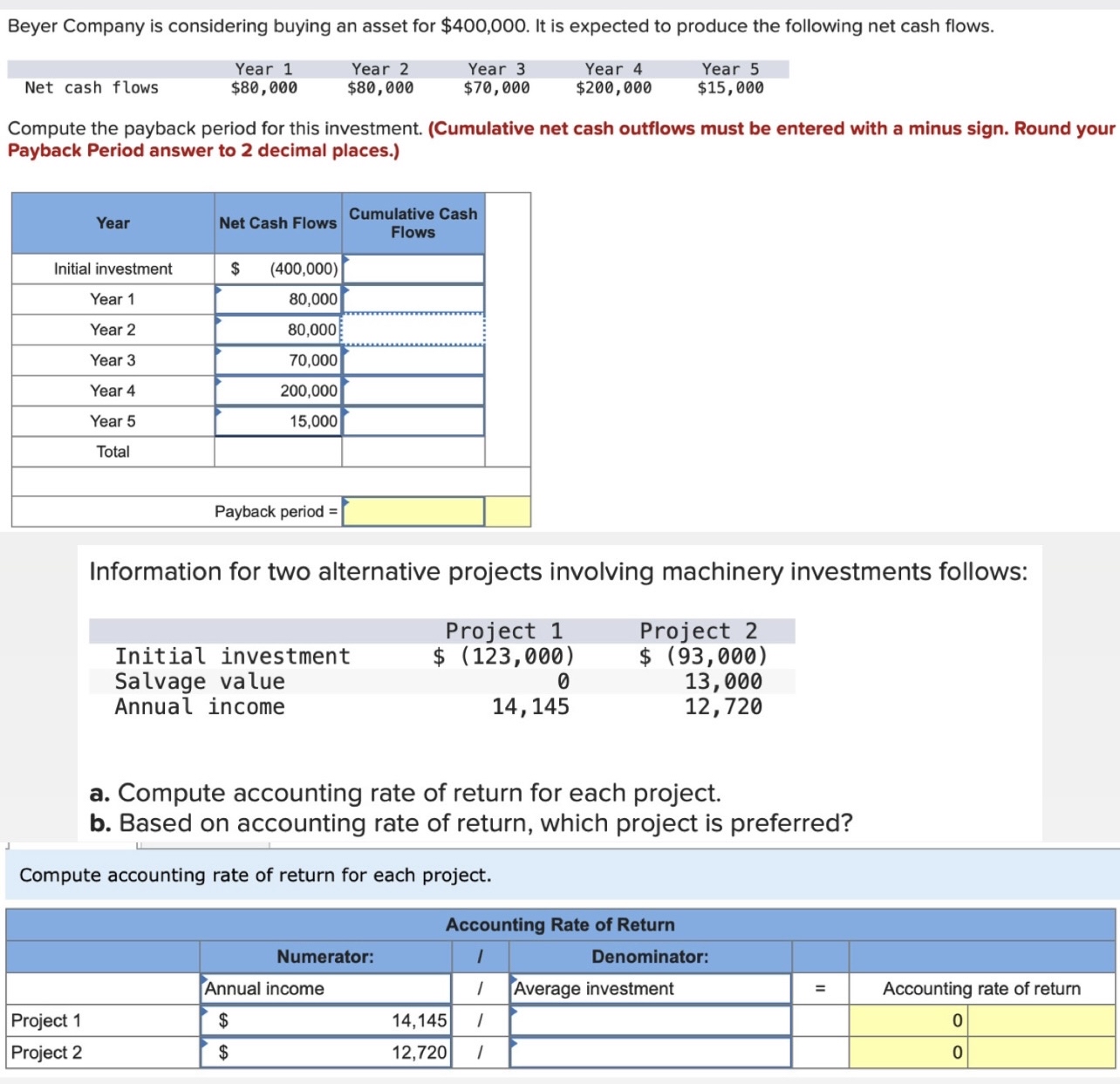

Beyer Company is considering buying an asset for $400,000. It is expected to produce the following net cash flows. Net cash flows Year 1

Beyer Company is considering buying an asset for $400,000. It is expected to produce the following net cash flows. Net cash flows Year 1 $80,000 Year 2 $80,000 Year 3 $70,000 Year 4 $200,000 Year 5 $15,000 Compute the payback period for this investment. (Cumulative net cash outflows must be entered with a minus sign. Round your Payback Period answer to 2 decimal places.) Cumulative Cash Year Net Cash Flows Flows Initial investment $ (400,000) Year 1 80,000 Year 2 80,000 Year 3 70,000 Year 4 200,000 Year 5 Total 15,000 Payback period = Information for two alternative projects involving machinery investments follows: Initial investment Project 1 $ (123,000) Project 2 $ (93,000) Salvage value 0 13,000 Annual income 14,145 12,720 a. Compute accounting rate of return for each project. b. Based on accounting rate of return, which project is preferred? Compute accounting rate of return for each project. Numerator: Annual income Project 1 $ Project 2 $ Accounting Rate of Return Denominator: 1 Average investment = Accounting rate of return 14,145 / 12,720 1 0 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started