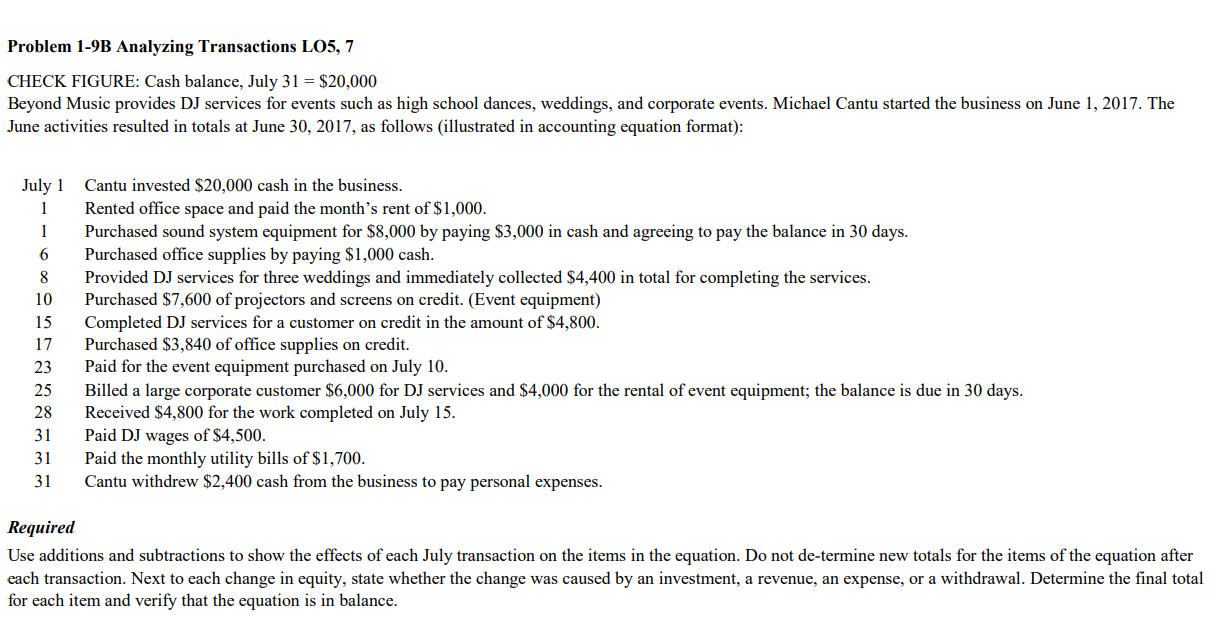

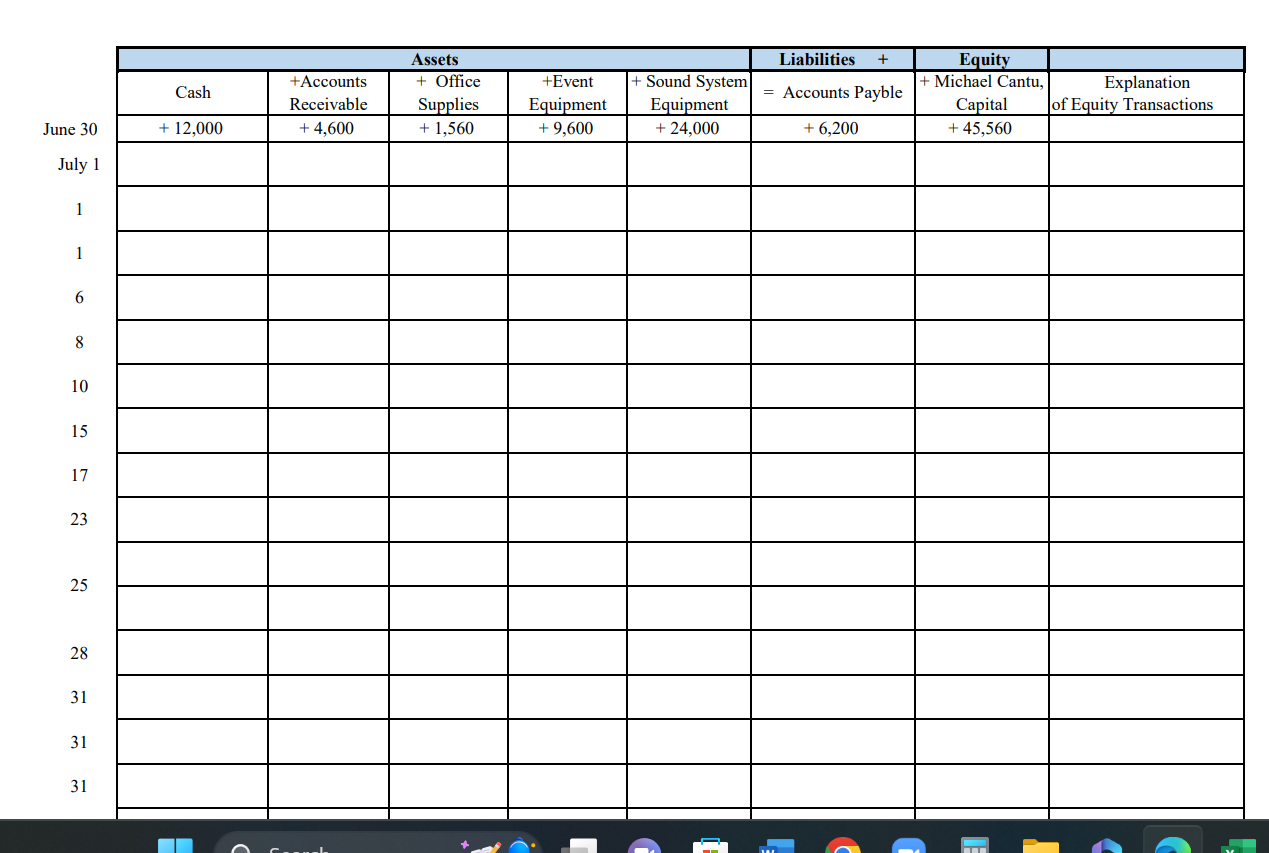

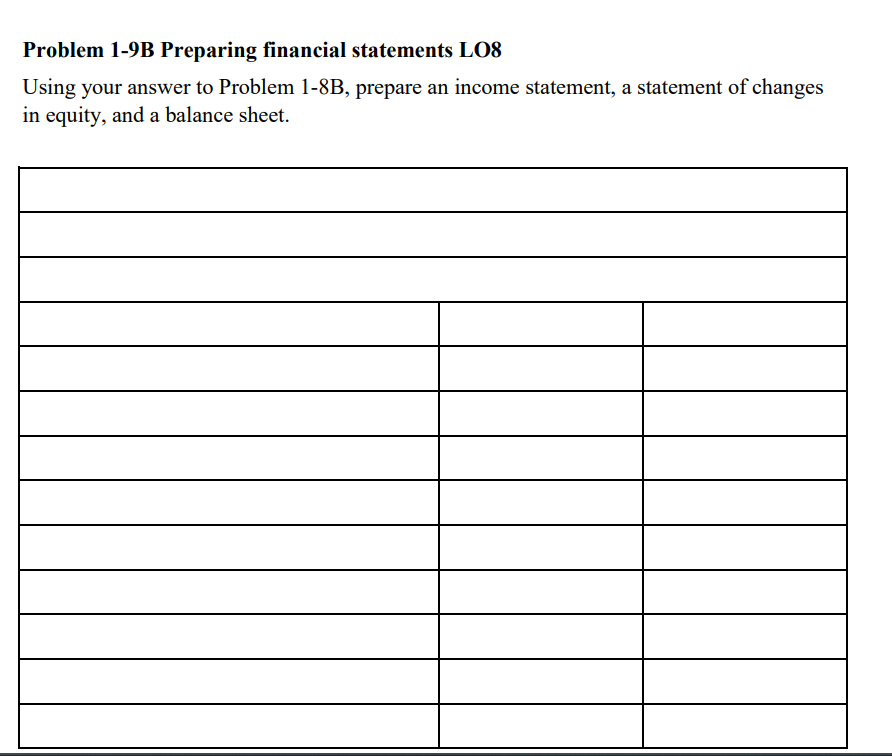

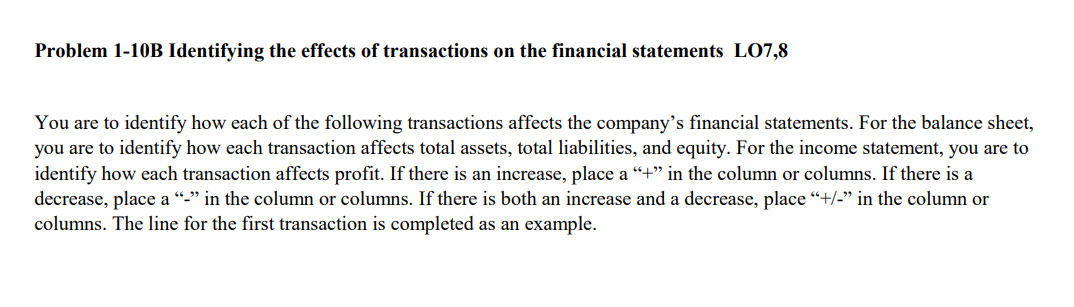

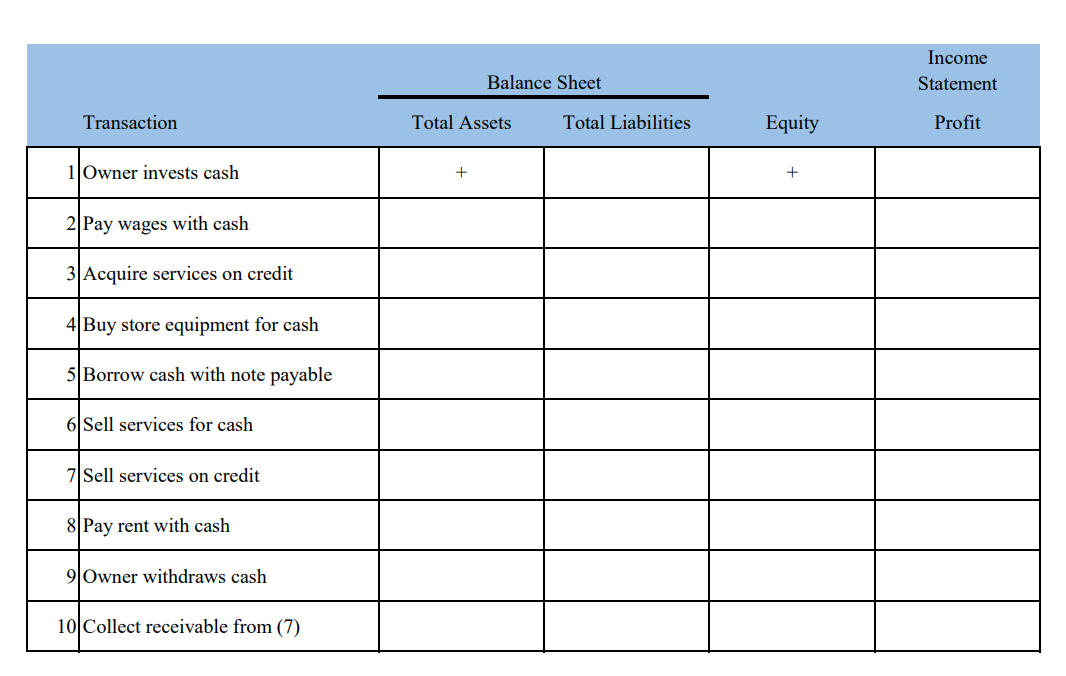

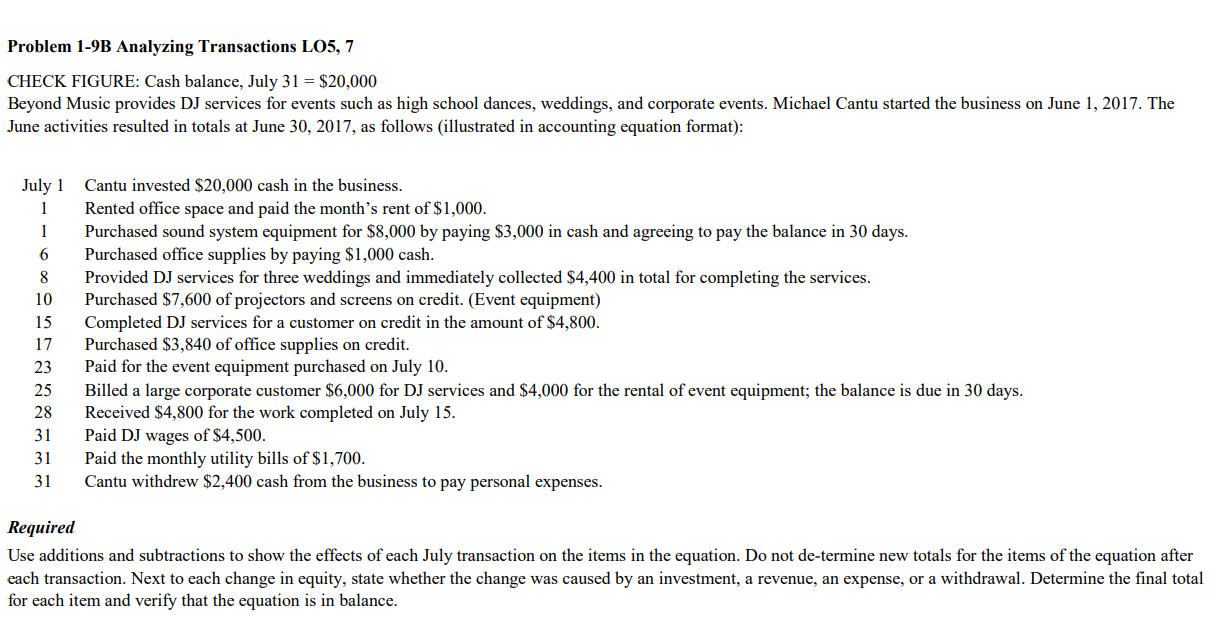

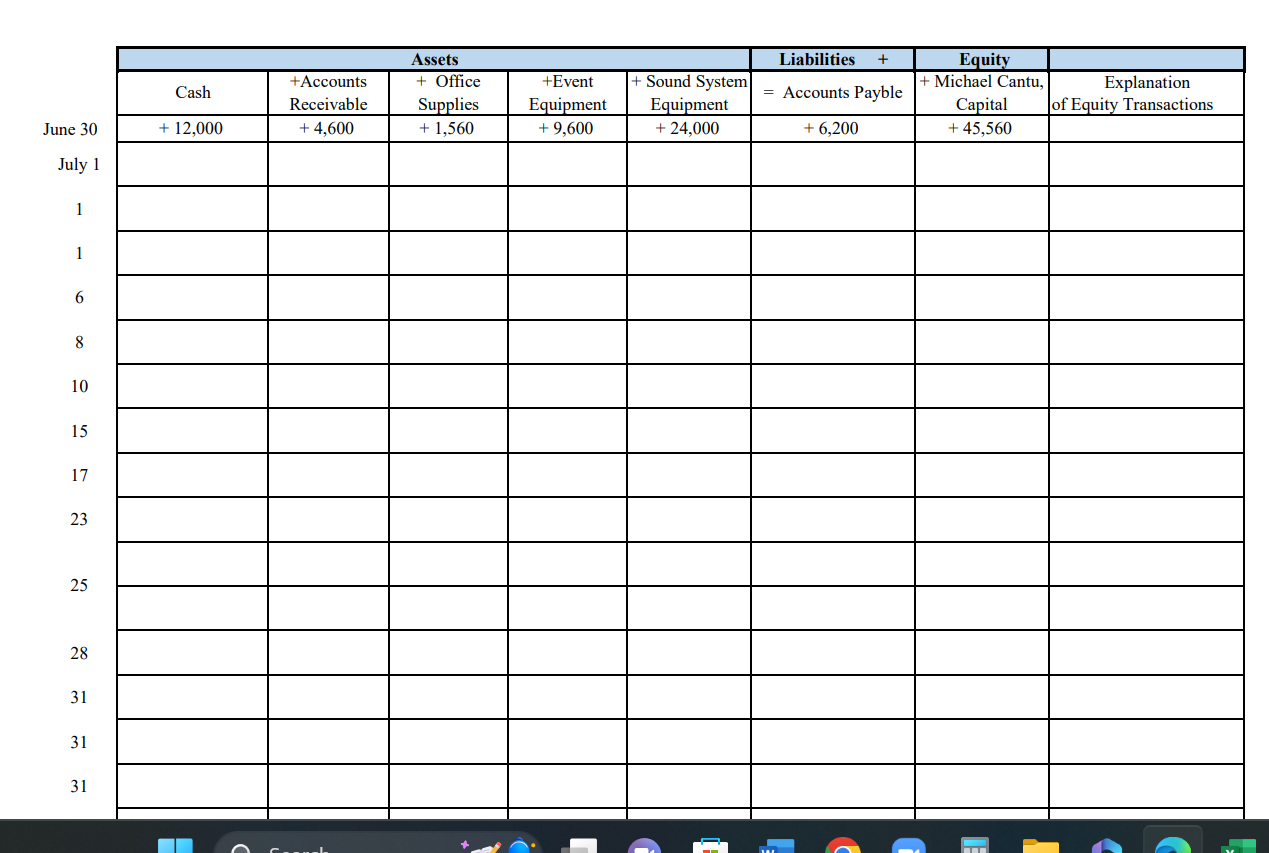

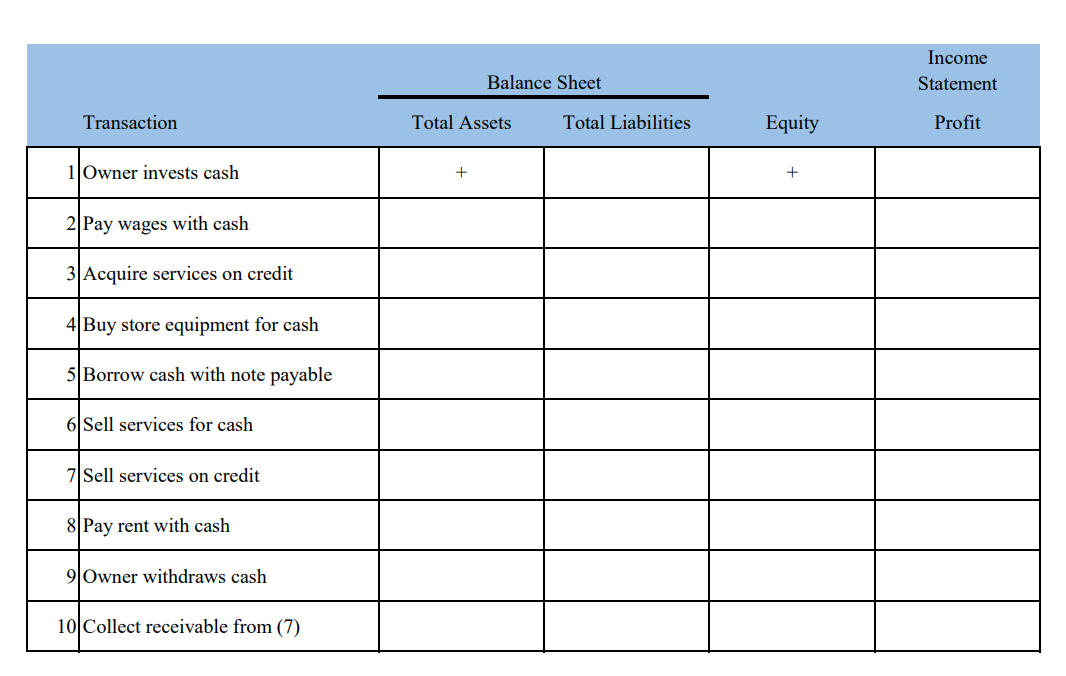

Beyond Music provides DJ services for events such as high school dances, weddings, and corporate events. Michael Cantu started the business on June 1, 2017. The June activities resulted in totals at June 30, 2017, as follows (illustrated in accounting equation format): July 1 Cantu invested $20,000 cash in the business. 1 Rented office space and paid the month's rent of $1,000. 1 Purchased sound system equipment for $8,000 by paying $3,000 in cash and agreeing to pay the balance in 30 days. 6 Purchased office supplies by paying $1,000 cash. 8 Provided DJ services for three weddings and immediately collected $4,400 in total for completing the services. 10 Purchased $7,600 of projectors and screens on credit. (Event equipment) 15 Completed DJ services for a customer on credit in the amount of $4,800. 17 Purchased $3,840 of office supplies on credit. 23 Paid for the event equipment purchased on July 10. 25 Billed a large corporate customer $6,000 for DJ services and $4,000 for the rental of event equipment; the balance is due in 30 days. 28 Received $4,800 for the work completed on July 15. 31 Paid DJ wages of $4,500. 31 Paid the monthly utility bills of $1,700. 31 Cantu withdrew $2,400 cash from the business to pay personal expenses. Required Use additions and subtractions to show the effects of each July transaction on the items in the equation. Do not de-termine new totals for the items of the equation after each transaction. Next to each change in equity, state whether the change was caused by an investment, a revenue, an expense, or a withdrawal. Determine the final total for each item and verify that the equation is in balance. June 30 July 1 Problem 1-9B Preparing financial statements LO8 Using your answer to Problem 1-8B, prepare an income statement, a statement of changes in equity, and a balance sheet. You are to identify how each of the following transactions affects the company's financial statements. For the balance sheet, you are to identify how each transaction affects total assets, total liabilities, and equity. For the income statement, you are to identify how each transaction affects profit. If there is an increase, place a "+" in the column or columns. If there is a decrease, place a "-" in the column or columns. If there is both an increase and a decrease, place "+/-" in the column or columns. The line for the first transaction is completed as an example