Answered step by step

Verified Expert Solution

Question

1 Approved Answer

BFAR Mfg manufactured 5,000 microchips at $6,000 per unit. The material cost assigned to each unit is $1,756. Direct labor accounts for 28% of

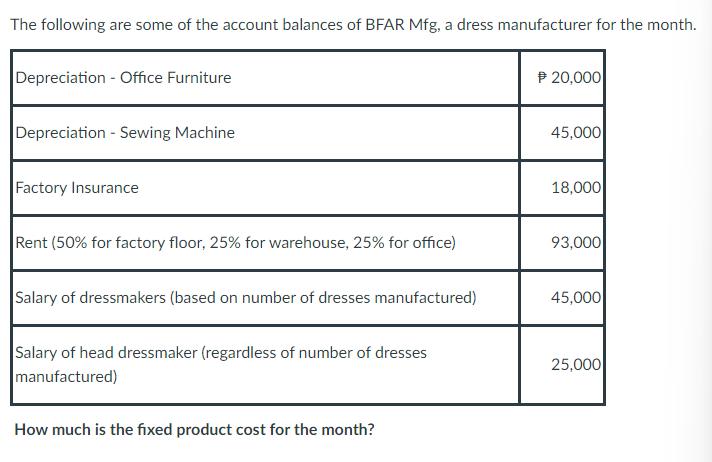

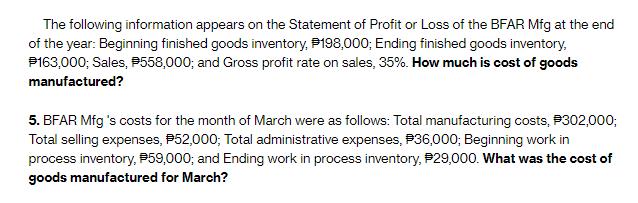

BFAR Mfg manufactured 5,000 microchips at $6,000 per unit. The material cost assigned to each unit is $1,756. Direct labor accounts for 28% of the total manufacturing cost. How much is the manufacturing overhead cost per unit? 2. You were provided with the following data of BFAR Mfg for the month of March: Cost of goods manufactured, P300,000; Finished Goods Inventory (March 1), P90,000; Owner, Capital, (March 1), P134,000; Owner, Capital (March 31), #236,000; Sales, P464,000; and Total operating expenses, $14,000. There were no owner withdrawals or additional investments in March. How much was Finished Goods Inventory on March 31? The following are some of the account balances of BFAR Mfg, a dress manufacturer for the month. Depreciation - Office Furniture Depreciation - Sewing Machine Factory Insurance Rent (50% for factory floor, 25% for warehouse, 25% for office) Salary of dressmakers (based on number of dresses manufactured) Salary of head dressmaker (regardless of number of dresses manufactured) How much is the fixed product cost for the month? 20,000 45,000 18,000 93,000 45,000 25,000 The following information appears on the Statement of Profit or Loss of the BFAR Mfg at the end of the year: Beginning finished goods inventory, #198,000; Ending finished goods inventory, 163,000; Sales, P558,000; and Gross profit rate on sales, 35%. How much is cost of goods manufactured? 5. BFAR Mfg 's costs for the month of March were as follows: Total manufacturing costs, #302,000; Total selling expenses, P52,000; Total administrative expenses, P36,000; Beginning work in process inventory, P59,000; and Ending work in process inventory, P29,000. What was the cost of goods manufactured for March?

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

1 To calculate the manufacturing overhead cost per unit we need to determine the total manufacturing cost per unit and subtract the material cost and direct labor cost Total manufacturing cost per uni...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started