Question: BFIN 255 Group Case Study DUE Friday March 10, 2023 MAKING ENDS MEET IN SMALL TOWN ALBERTA Jack and Judy are planning for a

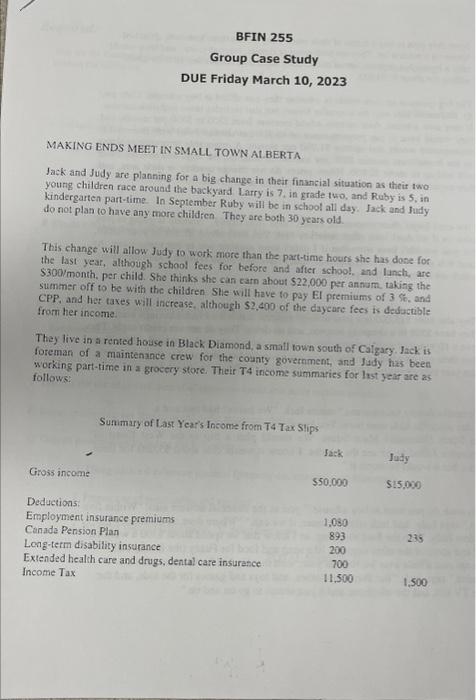

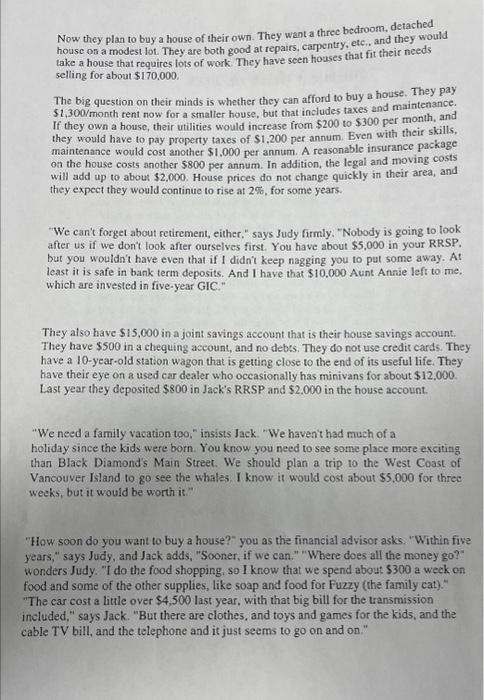

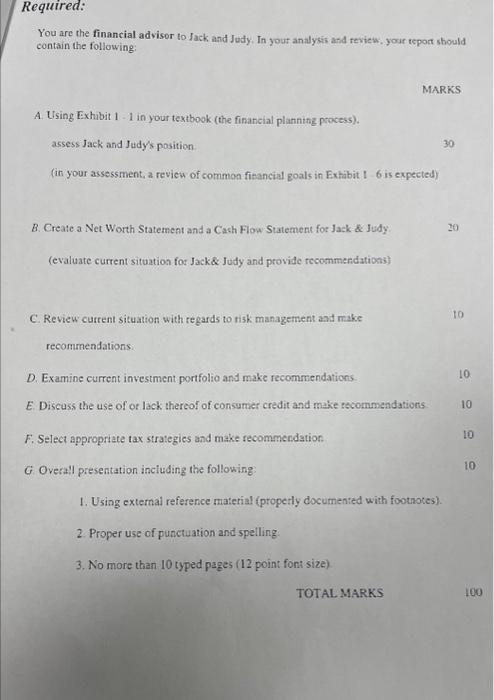

BFIN 255 Group Case Study DUE Friday March 10, 2023 MAKING ENDS MEET IN SMALL TOWN ALBERTA Jack and Judy are planning for a big change in their financial situation as their two young children race around the backyard Larry is 7, in grade two, and Ruby is 5, in kindergarten part-time. In September Ruby will be in school all day. Jack and Judy do not plan to have any more children. They are both 30 years old. This change will allow Judy to work more than the part-time hours she has done for the last year, although school fees for before and after school, and lanch, are $300/month, per child. She thinks she can earn about $22,000 per annum, taking the summer off to be with the children. She will have to pay El premiums of 3 %, and CPP, and her taxes will increase, although $2,400 of the daycare fees is deductible from her income. They live in a rented house in Black Diamond, a small town south of Calgary, Jack is foreman of a maintenance crew for the county government, and Jady has been working part-time in a grocery store. Their T4 income summaries for last year are as follows: Summary of Last Year's Income from T4 Tax Slips Gross income Deductions: Employment insurance premiums Canada Pension Plan Long-term disability insurance Extended health care and drugs, dental care insurance Income Tax Jack $50,000 1,080 893 200 700 11,500 Judy $15,000 238 1,500 Now they plan to buy a house of their own. They want a three bedroom, detached house on a modest lot. They are both good at repairs, carpentry, etc., and they would take a house that requires lots of work. They have seen houses that fit their needs selling for about $170,000. The big question on their minds is whether they can afford to buy a house. They pay $1,300/month rent now for a smaller house, but that includes taxes and maintenance. If they own a house, their utilities would increase from $200 to $300 per month, and they would have to pay property taxes of $1,200 per annum. Even with their skills, maintenance would cost another $1,000 per annum. A reasonable insurance package on the house costs another $800 per annum. In addition, the legal and moving costs will add up to about $2,000. House prices do not change quickly in their area, and they expect they would continue to rise at 2%, for some years. "We can't forget about retirement, either," says Judy firmly. "Nobody is going to look after us if we don't look after ourselves first. You have about $5,000 in your RRSP. but you wouldn't have even that if I didn't keep nagging you to put some away. At least it is safe in bank term deposits. And I have that $10,000 Aunt Annie left to me. which are invested in five-year GIC." They also have $15,000 in a joint savings account that is their house savings account. They have $500 in a chequing account, and no debts. They do not use credit cards. They have a 10-year-old station wagon that is getting close to the end of its useful life. They have their eye on a used car dealer who occasionally has minivans for about $12,000. Last year they deposited $800 in Jack's RRSP and $2.000 in the house account. "We need a family vacation too," insists Jack. "We haven't had much of a holiday since the kids were born. You know you need to see some place more exciting than Black Diamond's Main Street. We should plan a trip to the West Coast of Vancouver Island to go see the whales. I know it would cost about $5,000 for three weeks, but it would be worth it." "How soon do you want to buy a house?" you as the financial advisor asks. "Within five years," says Judy, and Jack adds, "Sooner, if we can." "Where does all the money go?" wonders Judy. "I do the food shopping, so I know that we spend about $300 a week on food and some of the other supplies, like soap and food for Fuzzy (the family cat)." "The car cost a little over $4,500 last year, with that big bill for the transmission included," says. Jack. "But there are clothes, and toys and games for the kids, and the cable TV bill, and the telephone and it just seems to go on and on." Required: You are the financial advisor to Jack and Judy. In your analysis and review, your report should contain the following: A. Using Exhibit 1-1 in your textbook (the financial planning process). assess Jack and Judy's position. (in your assessment, a review of common financial goals in Exhibit 1-6 is expected) B. Create a Net Worth Statement and a Cash Flow Statement for Jack & Judy. (evaluate current situation for Jack & Judy and provide recommendations) C. Review current situation with regards to risk management and make recommendations. MARKS D. Examine current investment portfolio and make recommendations. E Discuss the use of or lack thereof of consumer credit and make recommendations F. Select appropriate tax strategies and make recommendation G Overall presentation including the following 1. Using external reference material (properly documented with footnotes). 2. Proper use of punctuation and spelling 3. No more than 10 typed pages (12 point font size). TOTAL MARKS 30 20 10 10 10 10 10 100

Step by Step Solution

3.36 Rating (165 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts