Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Police Chief Hopper is planning to retire in 9 years. He would like to receive $6000 at the end of every quarter for 17

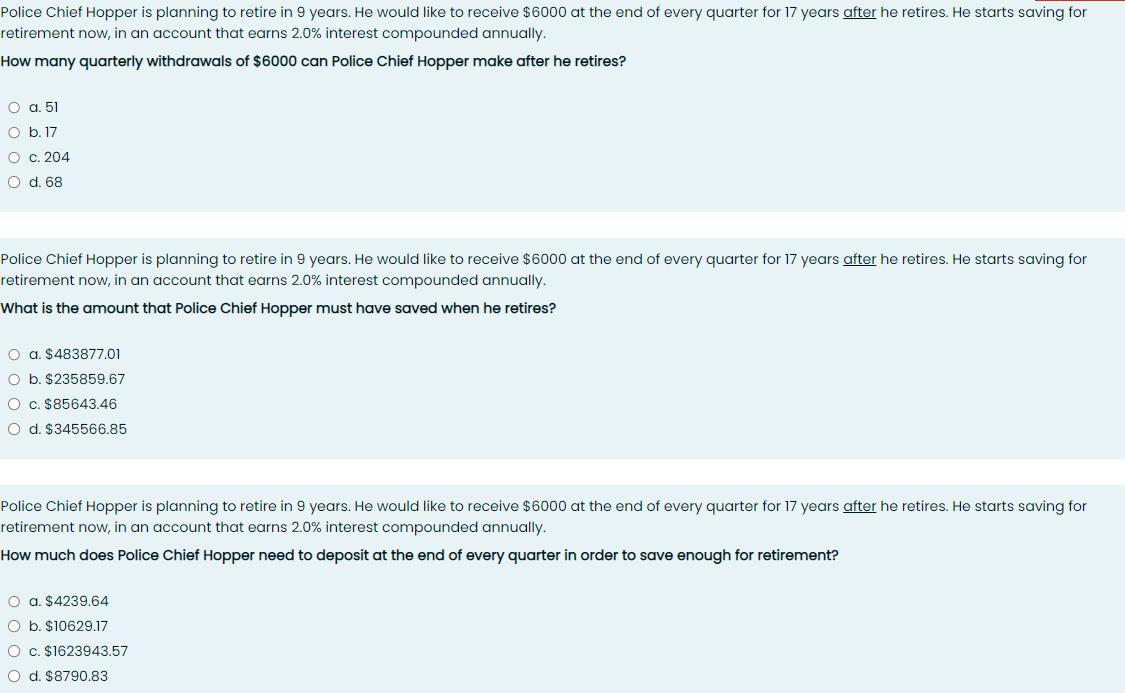

Police Chief Hopper is planning to retire in 9 years. He would like to receive $6000 at the end of every quarter for 17 years after he retires. He starts saving for retirement now, in an account that earns 2.0% interest compounded annually. How many quarterly withdrawals of $6000 can Police Chief Hopper make after he retires? O a. 51 O b. 17 O c. 204 O d. 68 Police Chief Hopper is planning to retire in 9 years. He would like to receive $6000 at the end of every quarter for 17 years after he retires. He starts saving for retirement now, in an account that earns 2.0% interest compounded annually. What is the amount that Police Chief Hopper must have saved when he retires? O a. $483877.01 O b. $235859.67 O c. $85643.46 O d. $345566.85 Police Chief Hopper is planning to retire in 9 years. He would like to receive $6000 at the end of every quarter for 17 years after he retires. He starts saving for retirement now, in an account that earns 2.0% interest compounded annually. How much does Police Chief Hopper need to deposit at the end of every quarter in order to save enough for retirement? O a. $4239.64 O b. $10629.17 O c. $1623943.57 O d. $8790.83

Step by Step Solution

★★★★★

3.59 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Police Chief Hoppers Retirement Savings 1 Number of quarterly withdrawals after retirement Incorrect ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started