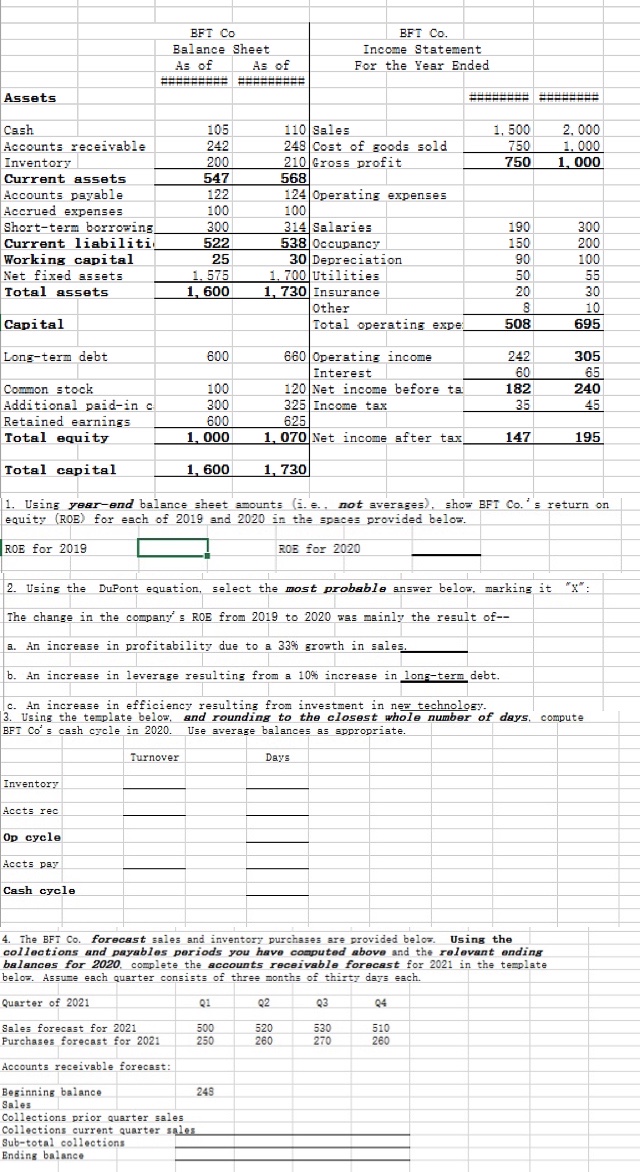

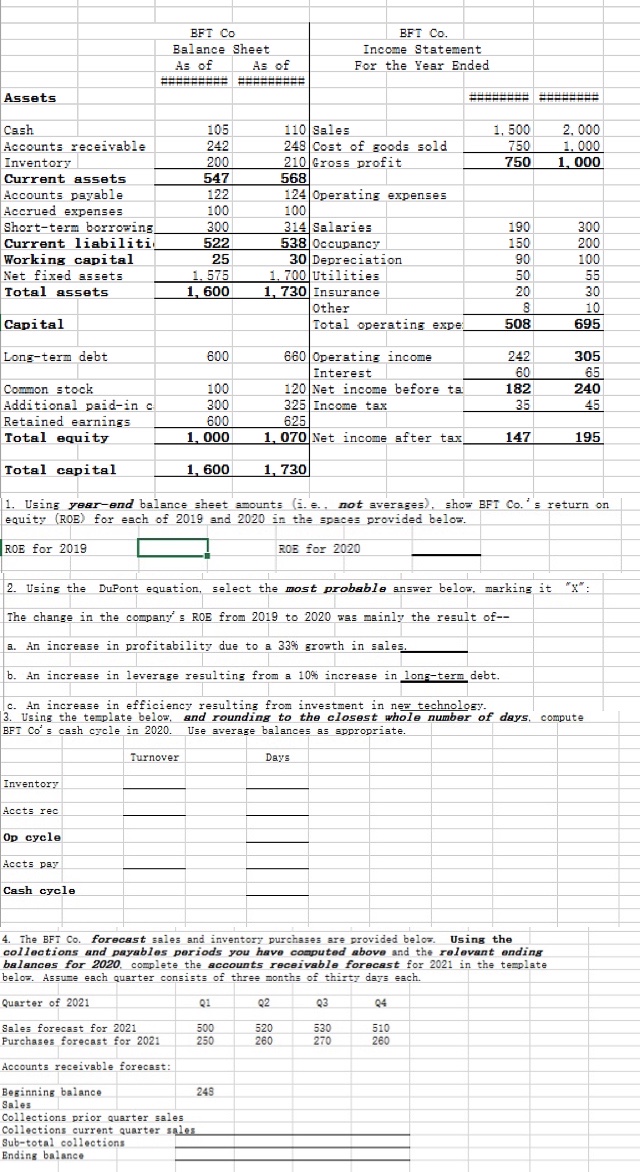

BFT CO Balance Sheet As of As of HEREEEEE BFT Co. Income Statement For the Year Ended Assets EEEEEEE Cash 1,500 750 750 2.000 1.000 1.000 Accounts receivable Teuen Inventory Current assets Accounts payable expenses Short-term borrowing t. Current liabiliti Working capital Net fixed assets Total assets Accrued 105 242 200 547 190 122 100 100 300 522 25 1. 575 1, 600 110 Sales 248 Cost of goods sold 210 Gross profit 568 124 Operating expenses 100 314 Salaries 538 Occupancy 30 Depreciation 1.700 Utilities 1, 730 Insurance Other Total operating expe 190 150 90 50 20 300 200 100 55 30 10 695 Capital 508 Long-term debt 600 242 60 182 35 660 Operating income Interest 120 Net income before ta 325 Income tax 625 1. 070 Net income after tax 305 65 240 45 Common stock Additional paid-in c Retained earnings Total equity 100 300 600 1. 000 147 195 Total capital 1, 600 1, 730 1. Using year-end balance sheet amounts 6. e. not averages), shox BFT Co.'s return on equity (ROE) for each of 2019 and 2020 in the spaces provided belos. ROE for 2019 ROE for 2020 2. Using the DuPont equation, select the most probable answer below, marking it "x": The change in the company's ROE from 2019 to 2020 was mainly the result of - a. An increase in profitability due to a 33% growth in sales. b. An increase in leverage resulting from a 10% increase in lons-term debt. c. An increase in efficiency resulting from investment in new technolosy. 3. Using the template below, and rounding to the closest whole number of days. compute BFT Co's cash cycle in 2020. Use average balances as sppropriate. Turnover Days Inventory Accts rec Op cycle Accts pay Cash cycle 4. The BFT Co. forecast sales and inventory purchases are provided belos Using the collections and payables periods you have computed above and the relevant ending balances for 2020, complete the accounts receivable forecast for 2021 in the template belos. Assuse each quarter consists of three months of thirty days each. Quarter of 2021 QI Q2 Q3 Sales forecast for 2021 Purchases forecast for 2021 500 250 520 260 530 270 510 260 Accounts receivable forecast: Beginning balance 248 Sales Collections prior quarter sales Collections current quarter sales Sub-total collections Ending balance