Answered step by step

Verified Expert Solution

Question

1 Approved Answer

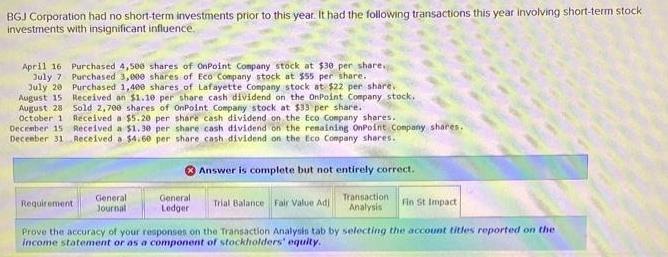

BGJ Corporation had no short-term investments prior to this year. It had the following transactions this year involving short-term stock investments with insignificant influence.

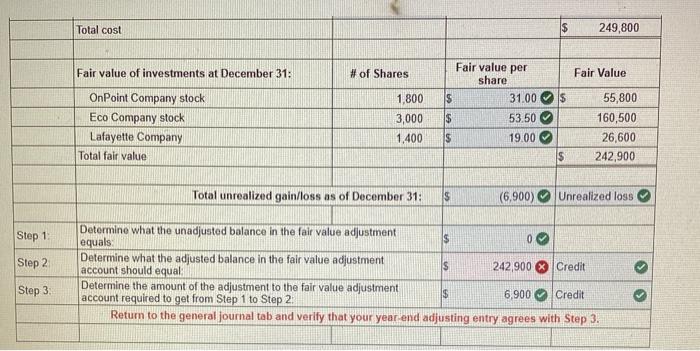

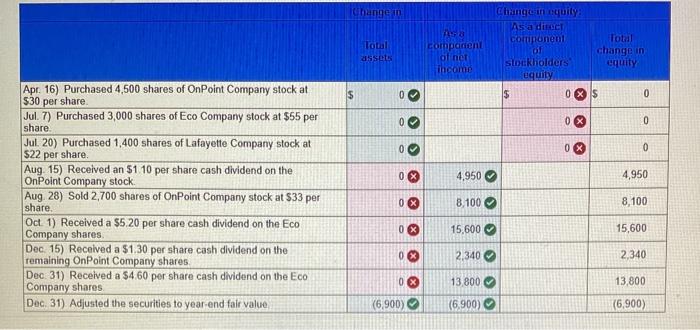

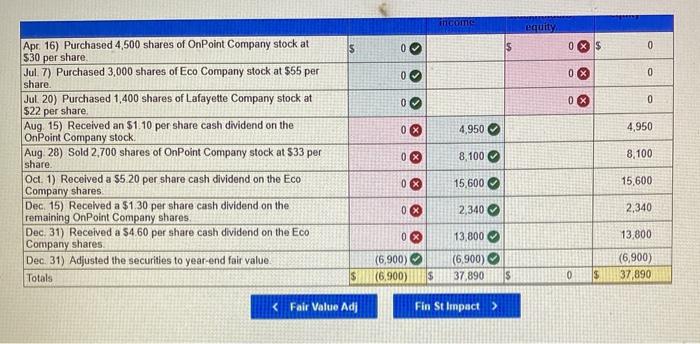

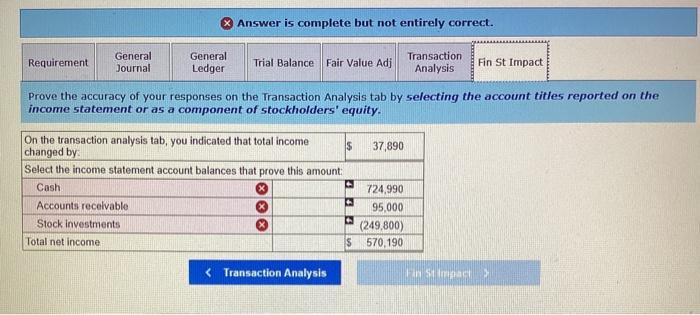

BGJ Corporation had no short-term investments prior to this year. It had the following transactions this year involving short-term stock investments with insignificant influence. April 16 July 7 July 20 Purchased 4,500 shares of OnPoint Company stock at $30 per share. Purchased 3,000 shares of Eco Company stock at $55 per share. Purchased 1,400 shares of Lafayette Company stock at $22 per share. Received an $1.10 per share cash dividend on the OnPoint Company stock, Sold 2,700 shares of OnPoint Company stock at $33 per share. August 15 August 28 October 1 Received a $5.20 per share cash dividend on the Eco Company shares. December 15 Received a $1.30 per share cash dividend on the remaining OnPoint Company shares. December 31 Received a $4.60 per share cash dividend on the Eco Company shares. General: Journal Requirement General Ledger Answer is complete but not entirely correct. Transaction Analysis Trial Balance Fair Value Adj Prove the accuracy of your responses on the Transaction Analysis tab by selecting the account titles reported on the income statement or as a component of stockholders' equity. Fin St Impact Step 1: Step 2: Step 3: Total cost Fair value of investments at December 31: OnPoint Company stock Eco Company stock Lafayette Company Total fair value # of Shares 1,800 3,000 1,400 Total unrealized gain/loss as of December 31: Determine what the unadjusted balance equals the fair value adjustment Determine what the adjusted balance in the fair value adjustment account should equal $ $ $ $ $ Fair value per share $ $ 31.00 $ 53.50 19.00 (6,900) $ 249,800 Fair Value 55,800 160,500 26,600 242,900 Unrealized loss 242,900 Credit Determine the amount of the adjustment to the fair value adjustment account required to get from Step 1 to Step 2: $ 6,900 Credit Return to the general journal tab and verify that your year-end adjusting entry agrees with Step 3. Apr. 16) Purchased 4,500 shares of OnPoint Company stock at $30 per share. Jul. 7) Purchased 3,000 shares of Eco Company stock at $55 per share. Jul. 20) Purchased 1,400 shares of Lafayette Company stock at $22 per share. Aug. 15) Received an $1.10 per share cash dividend on the OnPoint Company stock. Aug 28) Sold 2,700 shares of OnPoint Company stock at $33 per share. Oct. 1) Received a $5.20 per share cash dividend on the Eco Company shares. Dec. 15) Received a $1.30 per share cash dividend on the remaining OnPoint Company shares. Dec. 31) Received a $4.60 per share cash dividend on the Eco Company shares Dec. 31) Adjusted the securities to year-end fair value, Change 10 $ Total assets 0 > > 0x 0X 0x 0x (6,900) AS B component of net income 4,950 8,100 15,600 2,340 13,800 (6,900) Change in equity: As a direct component of stockholders equity $ 0 08 0X Total change in equity $ 0 0 0 4,950 8,100 15,600 2,340 13,800 (6,900) Apr. 16) Purchased 4,500 shares of OnPoint Company stock at $30 per share. Jul. 7) Purchased 3,000 shares of Eco Company stock at $55 per share. Jul 20) Purchased 1,400 shares of Lafayette Company stock at $22 per share. Aug. 15) Received an $1.10 per share cash dividend on the OnPoint Company stock. Aug 28) Sold 2,700 shares of OnPoint Company stock at $33 per share. Oct. 1) Received a $5.20 per share cash dividend on the Eco Company shares. Dec. 15) Received a $1.30 per share cash dividend on the remaining OnPoint Company shares. Dec. 31) Received a $4.60 per share cash dividend on the Eco Company shares. Dec. 31) Adjusted the securities to year-end fair value. Totals S equity 0 $ 0X 08 0 0 0 0 4,950 8,100 15,600 2,340 13,800 (6,900) 37,890 Requirement General Journal General Ledger Answer is complete but not entirely correct. Total net income Trial Balance Fair Value Adj On the transaction analysis tab, you indicated that total income. changed by: Prove the accuracy of your responses on the Transaction Analysis tab by selecting the account titles reported on the income statement or as a component of stockholders' equity. Select the income statement account balances that prove this amount: Cash Accounts receivable Stock investments < Transaction Analysis $ 37,890 4 4 4 Transaction Analysis 724,990 95,000 (249,800) $ 570,190 Fin St Impact Fin St Impact >

Step by Step Solution

★★★★★

3.48 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

To prove the accuracy of the 37890 change in total income on the Transaction Analysis tab you would ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started