Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bharat Plywood Private Ltd engaged in manufacturing BWR (Boiling Water Resistant) plywood which is used in kitchen, Bathroom and other outdoor areas, started its

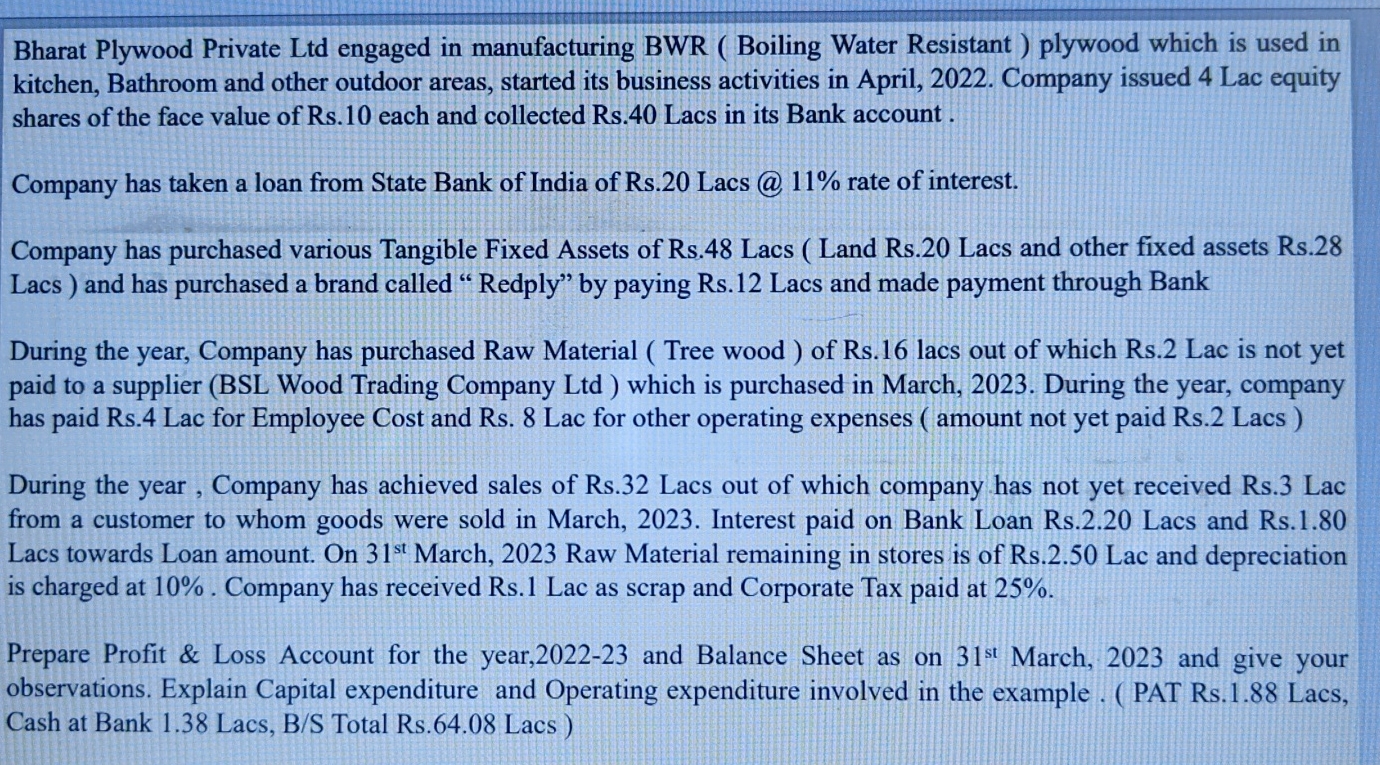

Bharat Plywood Private Ltd engaged in manufacturing BWR (Boiling Water Resistant) plywood which is used in kitchen, Bathroom and other outdoor areas, started its business activities in April, 2022. Company issued 4 Lac equity shares of the face value of Rs. 10 each and collected Rs.40 Lacs in its Bank account. Company has taken a loan from State Bank of India of Rs.20 Lacs @ 11% rate of interest. Company has purchased various Tangible Fixed Assets of Rs.48 Lacs (Land Rs.20 Lacs and other fixed assets Rs.28 Lacs) and has purchased a brand called "Redply" by paying Rs.12 Lacs and made payment through Bank During the year, Company has purchased Raw Material (Tree wood) of Rs. 16 lacs out of which Rs.2 Lac is not yet paid to a supplier (BSL Wood Trading Company Ltd) which is purchased in March, 2023. During the year, company has paid Rs.4 Lac for Employee Cost and Rs. 8 Lac for other operating expenses (amount not yet paid Rs.2 Lacs) During the year, Company has achieved sales of Rs.32 Lacs out of which company has not yet received Rs.3 Lac from a customer to whom goods were sold in March, 2023. Interest paid on Bank Loan Rs.2.20 Lacs and Rs.1.80 Lacs towards Loan amount. On 31st March, 2023 Raw Material remaining in stores is of Rs.2.50 Lac and depreciation is charged at 10%. Company has received Rs.1 Lac as scrap and Corporate Tax paid at 25%. Prepare Profit & Loss Account for the year, 2022-23 and Balance Sheet as on 31st March, 2023 and give your observations. Explain Capital expenditure and Operating expenditure involved in the example. (PAT Rs.1.88 Lacs, Cash at Bank 1.38 Lacs, B/S Total Rs.64.08 Lacs)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer Lets start by preparing the Profit Loss Account for the year 202223 Profit Loss Account for the Year Ended March 31 2023 Particulars Amount Rs ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started