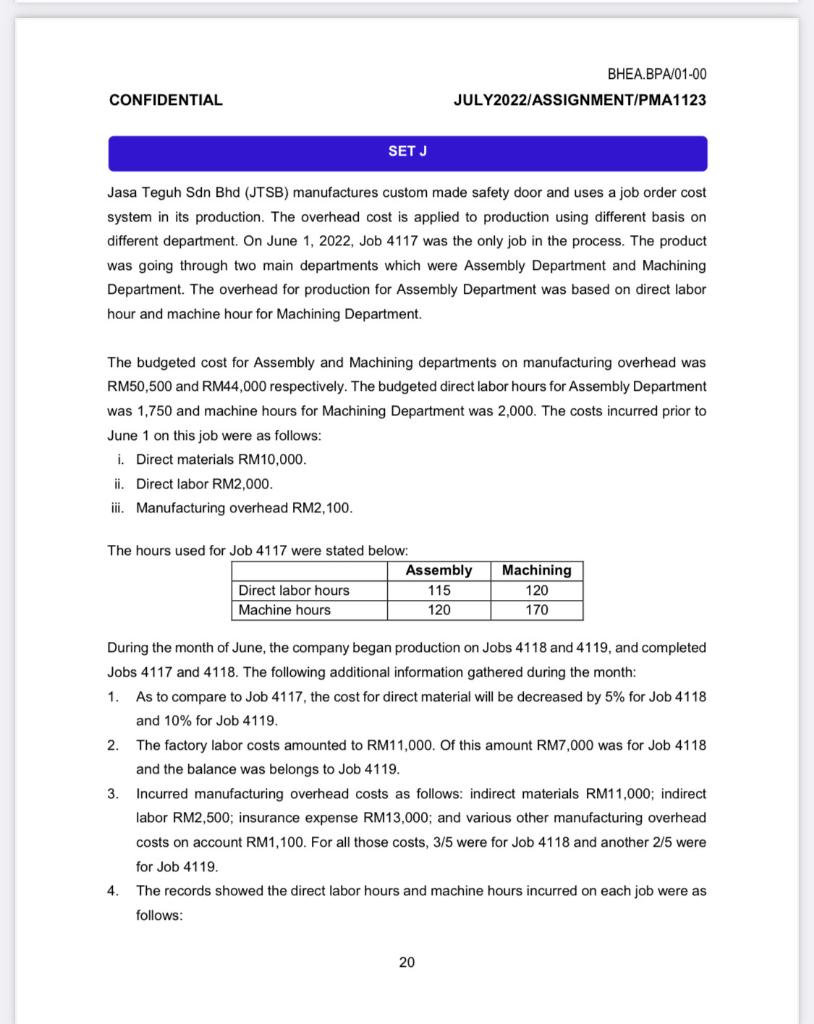

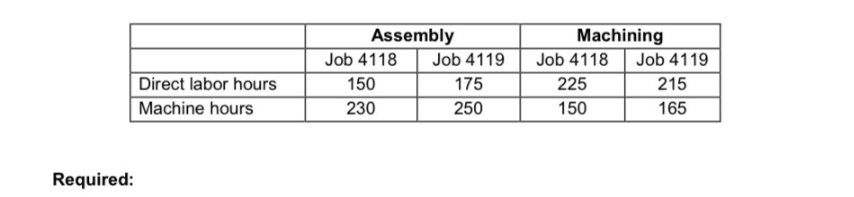

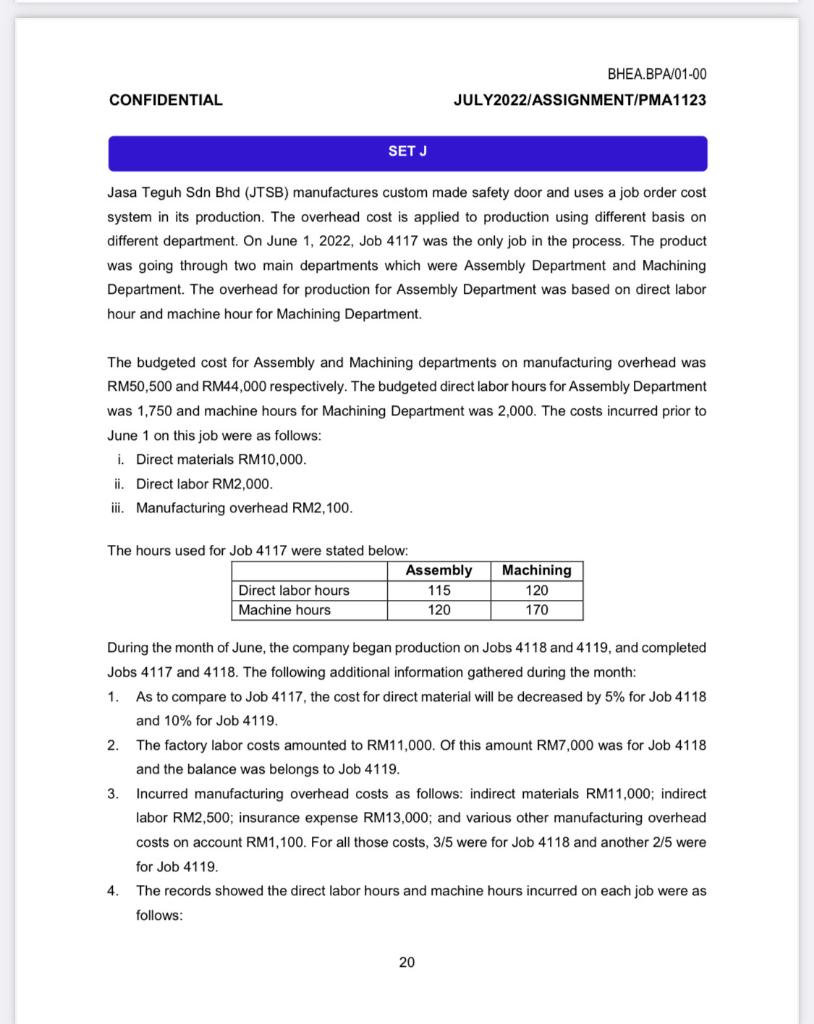

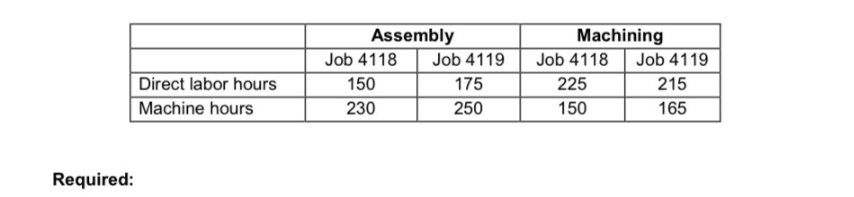

BHEA.BPA/01-00 CONFIDENTIAL JULY2022/ASSIGNMENT/PMA1123 Jasa Teguh Sdn Bhd (JTSB) manufactures custom made safety door and uses a job order cost system in its production. The overhead cost is applied to production using different basis on different department. On June 1, 2022, Job 4117 was the only job in the process. The product was going through two main departments which were Assembly Department and Machining Department. The overhead for production for Assembly Department was based on direct labor hour and machine hour for Machining Department. The budgeted cost for Assembly and Machining departments on manufacturing overhead was RM50,500 and RM44,000 respectively. The budgeted direct labor hours for Assembly Department was 1,750 and machine hours for Machining Department was 2,000. The costs incurred prior to June 1 on this job were as follows: i. Direct materials RM10,000. ii. Direct labor RM2,000. iii. Manufacturing overhead RM2,100. The hours used for Job 4117 were stated below: During the month of June, the company began production on Jobs 4118 and 4119 , and completed Jobs 4117 and 4118 . The following additional information gathered during the month: 1. As to compare to Job 4117 , the cost for direct material will be decreased by 5% for Job 4118 and 10% for Job 4119. 2. The factory labor costs amounted to RM11,000. Of this amount RM7,000 was for Job 4118 and the balance was belongs to Job 4119. 3. Incurred manufacturing overhead costs as follows: indirect materials RM11,000; indirect labor RM2,500; insurance expense RM13,000; and various other manufacturing overhead costs on account RM1,100. For all those costs, 3/5 were for Job 4118 and another 2/5 were for Job 4119. 4. The records showed the direct labor hours and machine hours incurred on each job were as follows: Required: b. Compute the applied overhead cost for each job in the production in June. (Note: Show all the calculations and round off your answer to two decimal points.) BHEA.BPA/01-00 CONFIDENTIAL JULY2022/ASSIGNMENT/PMA1123 Jasa Teguh Sdn Bhd (JTSB) manufactures custom made safety door and uses a job order cost system in its production. The overhead cost is applied to production using different basis on different department. On June 1, 2022, Job 4117 was the only job in the process. The product was going through two main departments which were Assembly Department and Machining Department. The overhead for production for Assembly Department was based on direct labor hour and machine hour for Machining Department. The budgeted cost for Assembly and Machining departments on manufacturing overhead was RM50,500 and RM44,000 respectively. The budgeted direct labor hours for Assembly Department was 1,750 and machine hours for Machining Department was 2,000. The costs incurred prior to June 1 on this job were as follows: i. Direct materials RM10,000. ii. Direct labor RM2,000. iii. Manufacturing overhead RM2,100. The hours used for Job 4117 were stated below: During the month of June, the company began production on Jobs 4118 and 4119 , and completed Jobs 4117 and 4118 . The following additional information gathered during the month: 1. As to compare to Job 4117 , the cost for direct material will be decreased by 5% for Job 4118 and 10% for Job 4119. 2. The factory labor costs amounted to RM11,000. Of this amount RM7,000 was for Job 4118 and the balance was belongs to Job 4119. 3. Incurred manufacturing overhead costs as follows: indirect materials RM11,000; indirect labor RM2,500; insurance expense RM13,000; and various other manufacturing overhead costs on account RM1,100. For all those costs, 3/5 were for Job 4118 and another 2/5 were for Job 4119. 4. The records showed the direct labor hours and machine hours incurred on each job were as follows: Required: b. Compute the applied overhead cost for each job in the production in June. (Note: Show all the calculations and round off your answer to two decimal points.)