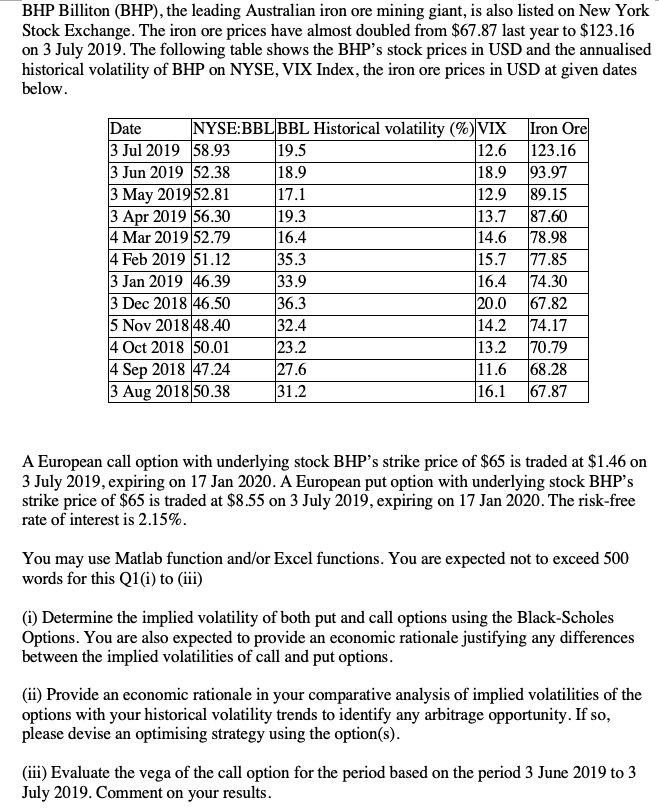

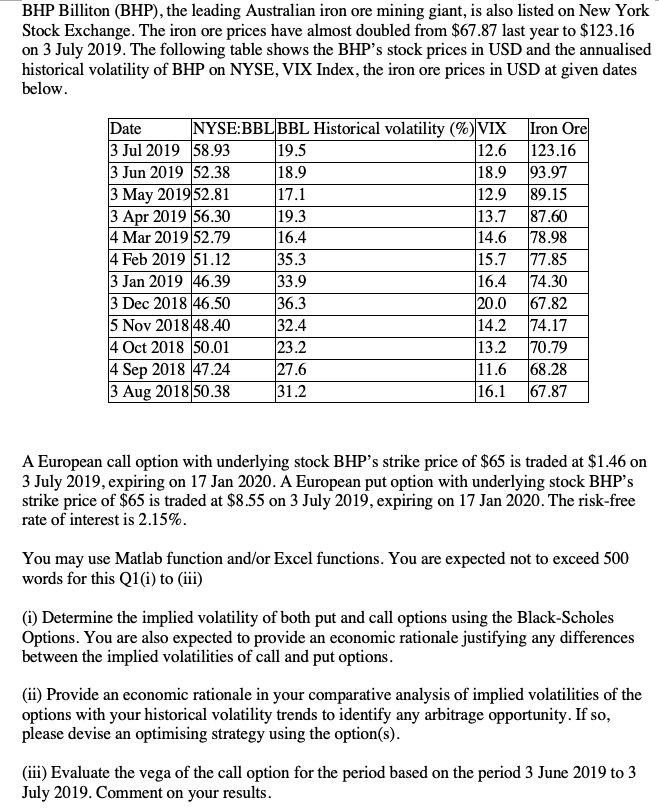

BHP Billiton (BHP), the leading Australian iron ore mining giant, is also listed on New York Stock Exchange. The iron ore prices have almost doubled from $67.87 last year to $123.16 on 3 July 2019. The following table shows the BHP's stock prices in USD and the annualised historical volatility of BHP on NYSE, VIX Index, the iron ore prices in USD at given dates below. Date NYSE:BBLBBL Historical volatility (%) VIX 3 Jul 2019 58.93 19.5 12.6 3 Jun 2019 52.38 18.9 18.9 3 May 201952.81 17.1 12. 9 3 Apr 2019 56.30 19.3 13.7 4 Mar 2019 52.79 16.4 14.6 4 Feb 2019 51.12 35.3 15.7 3 Jan 2019 46.39 16.4 3 Dec 2018 46.50 36.3 20.0 5 Nov 2018 48.40 32.4 14.2 4 Oct 2018 50.01 23.2 13.2 4 Sep 2018 47.24 11.6 3 Aug 2018 50.38 16.1 Iron Ore 123.16 93.97 89.15 87.60 78.98 77.85 74.30 67.82 74.17 70.79 68.28 67.87 33.9 147.24 27.6 A European call option with underlying stock BHP's strike price of $65 is traded at $1.46 on 3 July 2019, expiring on 17 Jan 2020. A European put option with underlying stock BHP's strike price of $65 is traded at $8.55 on 3 July 2019, expiring on 17 Jan 2020. The risk-free rate of interest is 2.15%. You may use Matlab function and/or Excel functions. You are expected not to exceed 500 words for this Q1(i) to (iii) (i) Determine the implied volatility of both put and call options using the Black-Scholes Options. You are also expected to provide an economic rationale justifying any differences between the implied volatilities of call and put options. (ii) Provide an economic rationale in your comparative analysis of implied volatilities of the options with your historical volatility trends to identify any arbitrage opportunity. If so, please devise an optimising strategy using the option(s). (iii) Evaluate the vega of the call option for the period based on the period 3 June 2019 to 3 July 2019. Comment on your results. BHP Billiton (BHP), the leading Australian iron ore mining giant, is also listed on New York Stock Exchange. The iron ore prices have almost doubled from $67.87 last year to $123.16 on 3 July 2019. The following table shows the BHP's stock prices in USD and the annualised historical volatility of BHP on NYSE, VIX Index, the iron ore prices in USD at given dates below. Date NYSE:BBLBBL Historical volatility (%) VIX 3 Jul 2019 58.93 19.5 12.6 3 Jun 2019 52.38 18.9 18.9 3 May 201952.81 17.1 12. 9 3 Apr 2019 56.30 19.3 13.7 4 Mar 2019 52.79 16.4 14.6 4 Feb 2019 51.12 35.3 15.7 3 Jan 2019 46.39 16.4 3 Dec 2018 46.50 36.3 20.0 5 Nov 2018 48.40 32.4 14.2 4 Oct 2018 50.01 23.2 13.2 4 Sep 2018 47.24 11.6 3 Aug 2018 50.38 16.1 Iron Ore 123.16 93.97 89.15 87.60 78.98 77.85 74.30 67.82 74.17 70.79 68.28 67.87 33.9 147.24 27.6 A European call option with underlying stock BHP's strike price of $65 is traded at $1.46 on 3 July 2019, expiring on 17 Jan 2020. A European put option with underlying stock BHP's strike price of $65 is traded at $8.55 on 3 July 2019, expiring on 17 Jan 2020. The risk-free rate of interest is 2.15%. You may use Matlab function and/or Excel functions. You are expected not to exceed 500 words for this Q1(i) to (iii) (i) Determine the implied volatility of both put and call options using the Black-Scholes Options. You are also expected to provide an economic rationale justifying any differences between the implied volatilities of call and put options. (ii) Provide an economic rationale in your comparative analysis of implied volatilities of the options with your historical volatility trends to identify any arbitrage opportunity. If so, please devise an optimising strategy using the option(s). (iii) Evaluate the vega of the call option for the period based on the period 3 June 2019 to 3 July 2019. Comment on your results