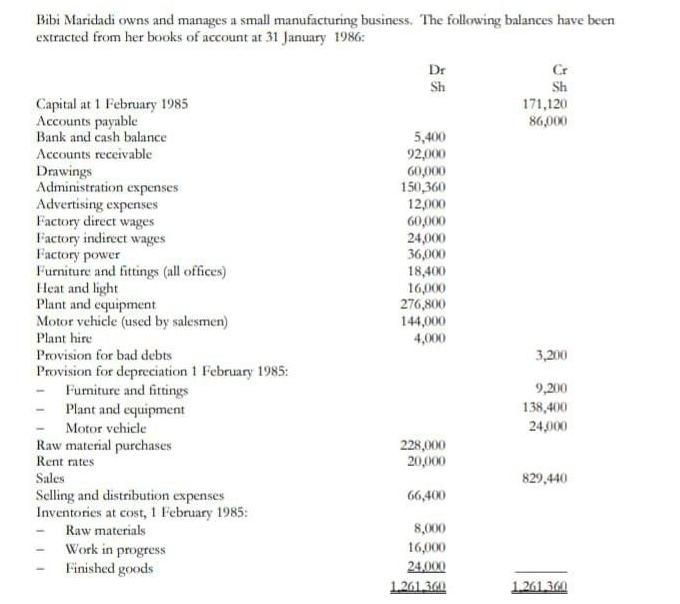

Bibi Maridadi owns and manages a small manufacturing business. The following balances have been extracted from her books of account at 31 January 1986:

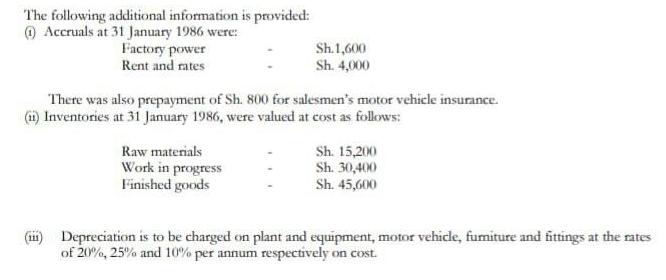

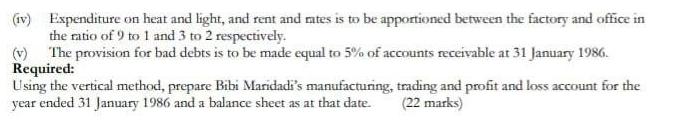

Bibi Maridadi owns and manages a small manufacturing business. The following balances have been extracted from her books of account at 31 January 1986: Capital at 1 February 1985 Accounts payable Bank and cash balance Accounts receivable Drawings Administration expenses Advertising expenses Factory direct wages Factory indirect wages Factory power Furniture and fittings (all offices) Heat and light Plant and equipment Motor vehicle (used by salesmen) Plant hire Provision for bad debts Provision for depreciation 1 February 1985: Furniture and fittings Plant and equipment Motor vehicle Raw material purchases Rent rates Sales Selling and distribution expenses Inventories at cost, 1 February 1985: Raw materials Work in progress Finished goods Dr Sh 5,400 92,000 60,000 150,360 12,000 60,000 24,000 36,000 18,400 16,000 276,800 144,000 4,000 228,000 20,000 66,400 8,000 16,000 24,000 1.261.360 Sh 171,120 86,000 3,200 9,200 138,400 24,000 829,440 1.261.360 The following additional information is provided: (1) Accruals at 31 January 1986 were: Factory power Rent and rates Sh.1,600 Sh. 4,000 There was also prepayment of Sh. 800 for salesmen's motor vehicle insurance. (ii) Inventories at 31 January 1986, were valued at cost as follows: Raw materials Work in progress Finished goods Sh. 15,200 Sh. 30,400 Sh. 45,600 (1) Depreciation is to be charged on plant and equipment, motor vehicle, furniture and fittings at the rates of 20%, 25% and 10% per annum respectively on cost. (iv) Expenditure on heat and light, and rent and rates is to be apportioned between the factory and office in the ratio of 9 to 1 and 3 to 2 respectively. (v) The provision for bad debts is to be made equal to 5% of accounts receivable at 31 January 1986. Required: Using the vertical method, prepare Bibi Maridadi's manufacturing, trading and profit and loss account for the year ended 31 January 1986 and a balance sheet as at that date. (22 marks)

Step by Step Solution

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Manufacturing Account Raw materials purchases Sh 228000 Add Opening raw materials inventory Sh 66400 Total raw materials available Sh 228000 66400 Sh ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started