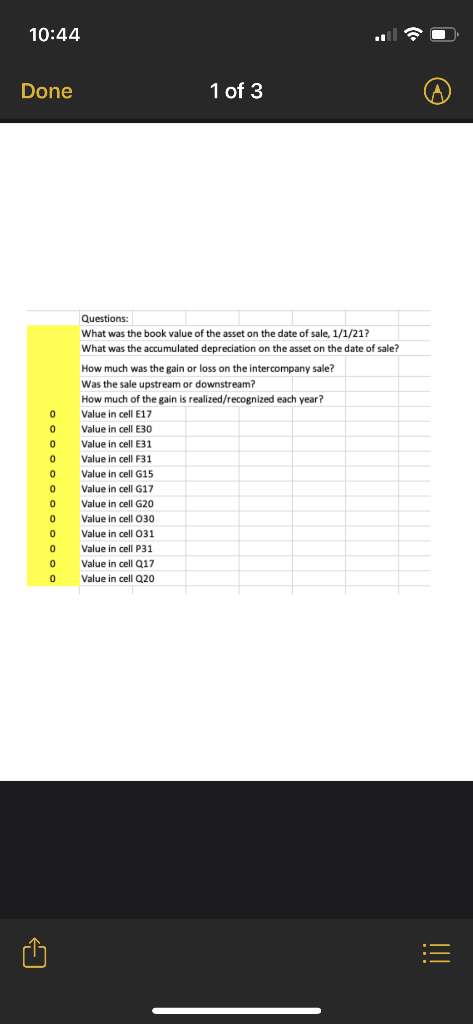

Question

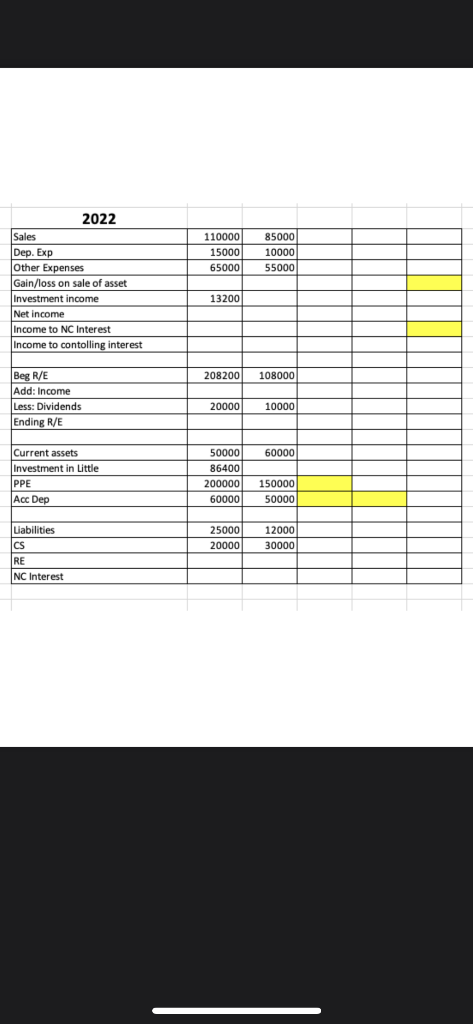

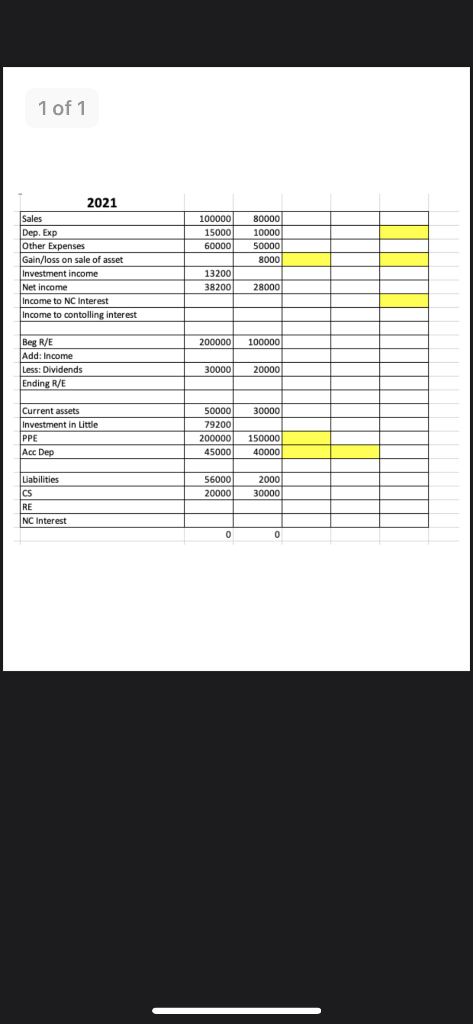

Big Co. owns 60% of Little Co, and uses the full equity method to account for their investment. Assume Little had zero accumulated depreciation at

Big Co. owns 60% of Little Co, and uses the full equity method to account for their investment.

Assume Little had zero accumulated depreciation at acquisition several years ago.

It is now 2021. On 1/1/21 Little sells PPE to Big for $28,000. The PPE originally cost $50,000, and was originally purchased on 1/1/15.

It was expected to have a 10 year useful life.

1. What was the book value of the asset on the date of sale?

2. What was the accumulated Depreciation on the asset?

3. How much was the gain or loss on the intercompany sale?

4. Was the sale upstream or downstream?

5. How much of the gain or loss is recognized each year? Required: Prepare elimination entries and complete the following worksheets, find values of yellow cells.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started