Answered step by step

Verified Expert Solution

Question

1 Approved Answer

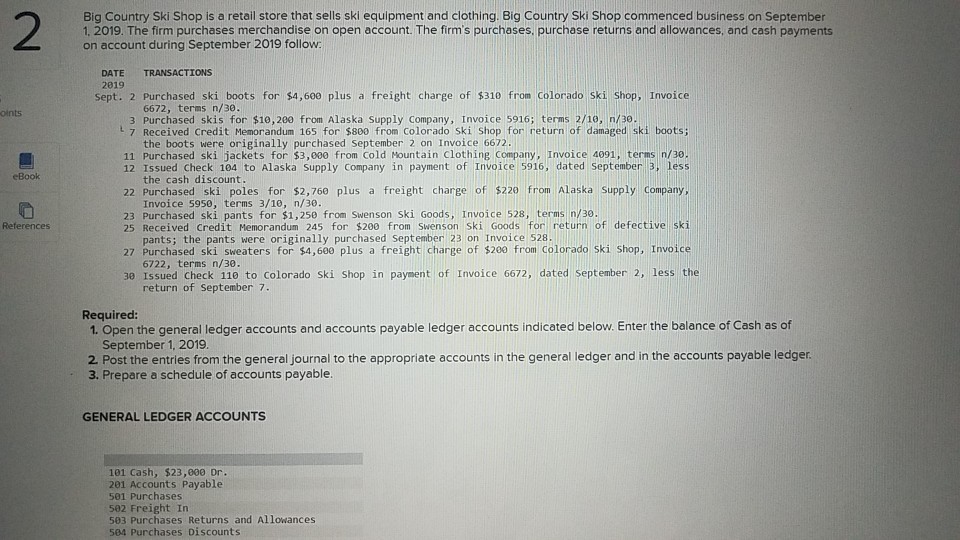

Big Country Ski Shop is a retail store that sells ski equipment and clothing. Big Country Ski Shop commenced business on September 1. 2019. The

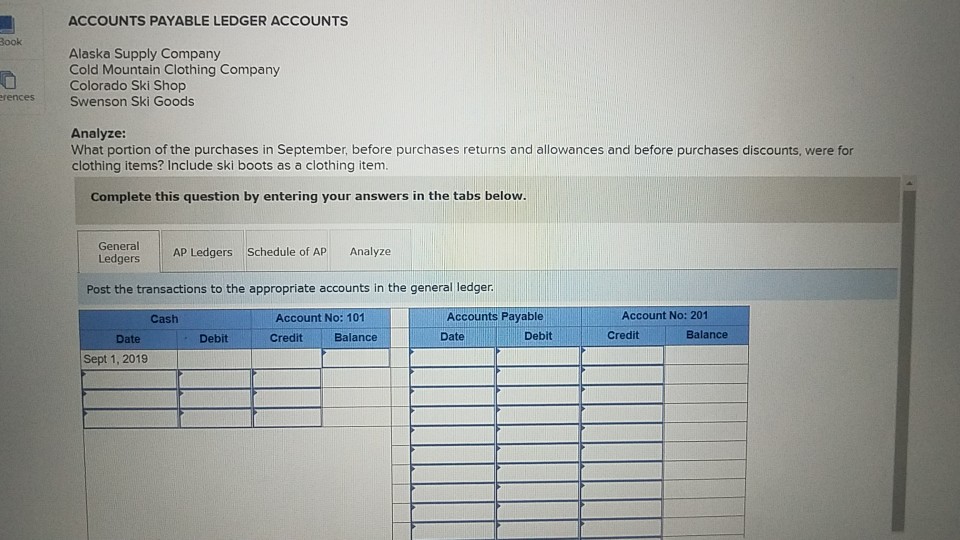

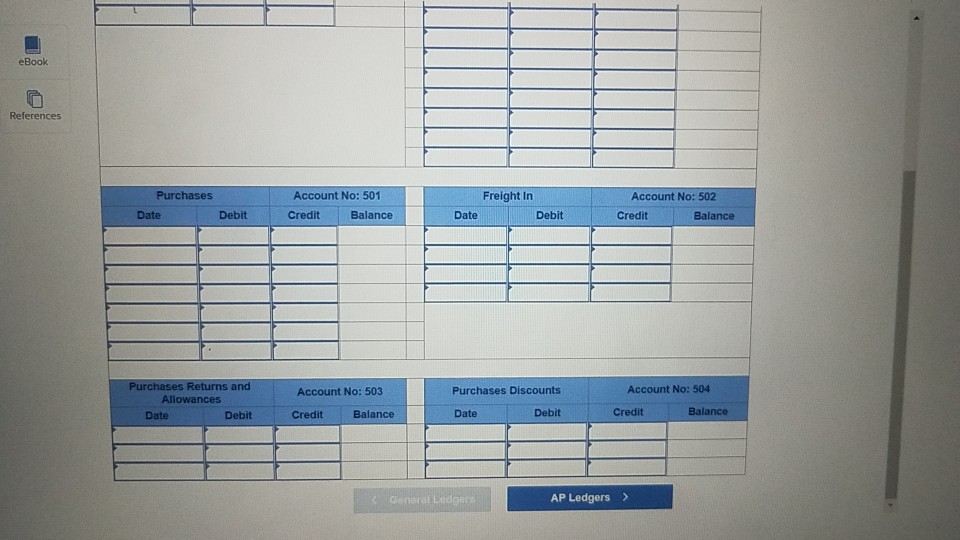

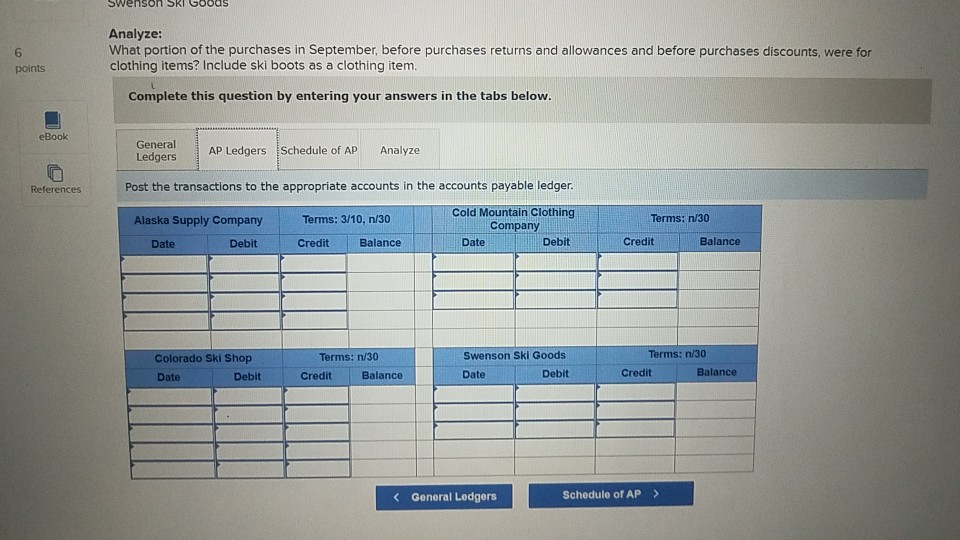

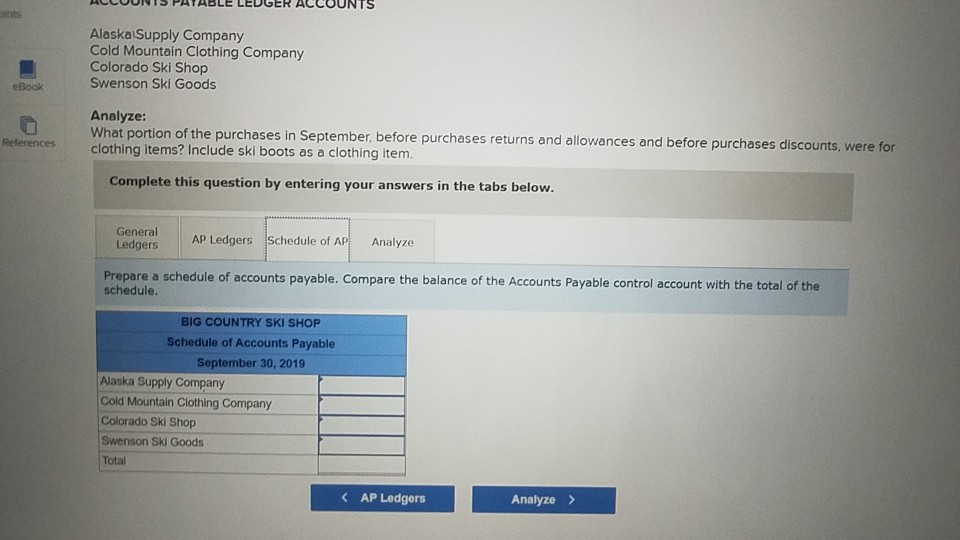

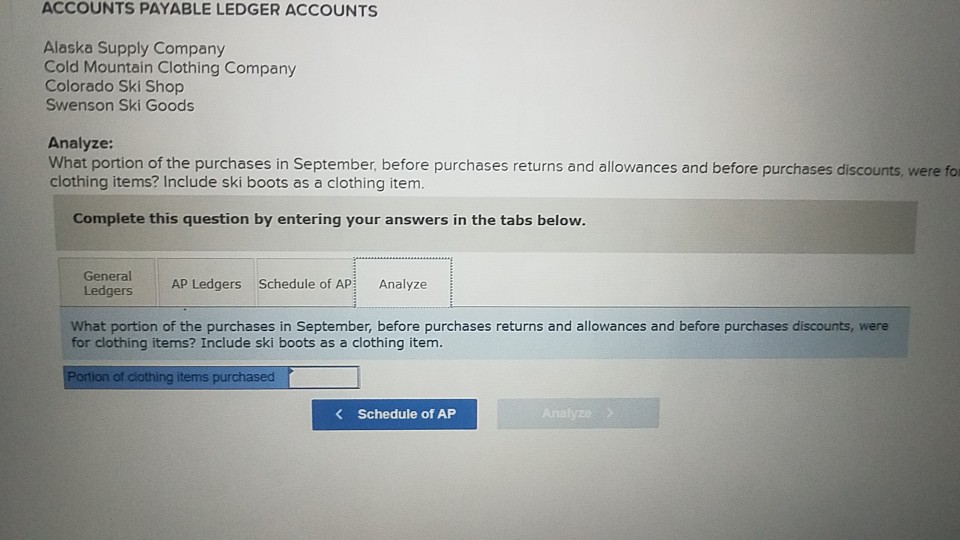

Big Country Ski Shop is a retail store that sells ski equipment and clothing. Big Country Ski Shop commenced business on September 1. 2019. The firm purchases merchandise on open account. The firm's purchases, purchase returns and allowances, and cash payments on account during September 2019 follow DATE TRANSACTIONS 2819 sept. 2 Purchased ski boots for $4,600 plus a freight charge of $310 from Colorado Ski shop, Invoice 6672, terms n/30. 3 Purchased skis for $10,200 from Alaska supply Company, Invoice 5916; terms 2/10, n(3 oints t 7 Received Credit Memorandum 165 for $800 from Colorado Ski Shop for return of damaged ski boots; the boots were originally purchased September 2 on Invoice 6672 11 Purchased ski jackets for $3,000 from Cold Mountain Clothing Company, Invoice 4091, terms n/30 12 Issued Check 104 to Alaska Supply Company in payment of Invoice 5916, dated September 3, less eBook the cash discount 22 Purchased ski poles for $2,760 plus a freight charge of $220 from Alaska Supply company 23 Purchased ski pants for $1,250 from Swenson ski Goods, Invoice 528, terms n/30. Invoice 5950, terms 3/10, n/30 25 Received Credit Memorandum 245 for $200 from Swenson Ski Goods for return of defective ski 27 Purchased ski sweaters for $4,600 plus a freight charge of $200 from Colorado Ski Shop, Invoice 30 Issued Check 110 to Colorado Ski Shop in payment of Invoice 6672, dated September 2, less the References pants; the pants were originally purchased September 23 on Invoice 528. 6722, terms n/30 return of September 7 Required: 1. Open the general ledger accounts and accounts payable ledger accounts indicated below. Enter the balance of Cash as of September 1, 2019 2. Post the entries from the general journal to the appropriate accounts in the general ledger and in the accounts payable ledger 3. Prepare a schedule of accounts payable. GENERAL LEDGER ACCOUNTS 101 cash, $23,800 Dr 201 Accounts Payable 501 Purchases 502 Freight In 503 Purchases Returns and Allowances 504 Purchases Discounts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started