Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Big Dog Carworks was started on January 1, 2015 by Bob Baldwin in order to repair automobiles. General Journal Entries JAN 1: Issued 1,000 shares

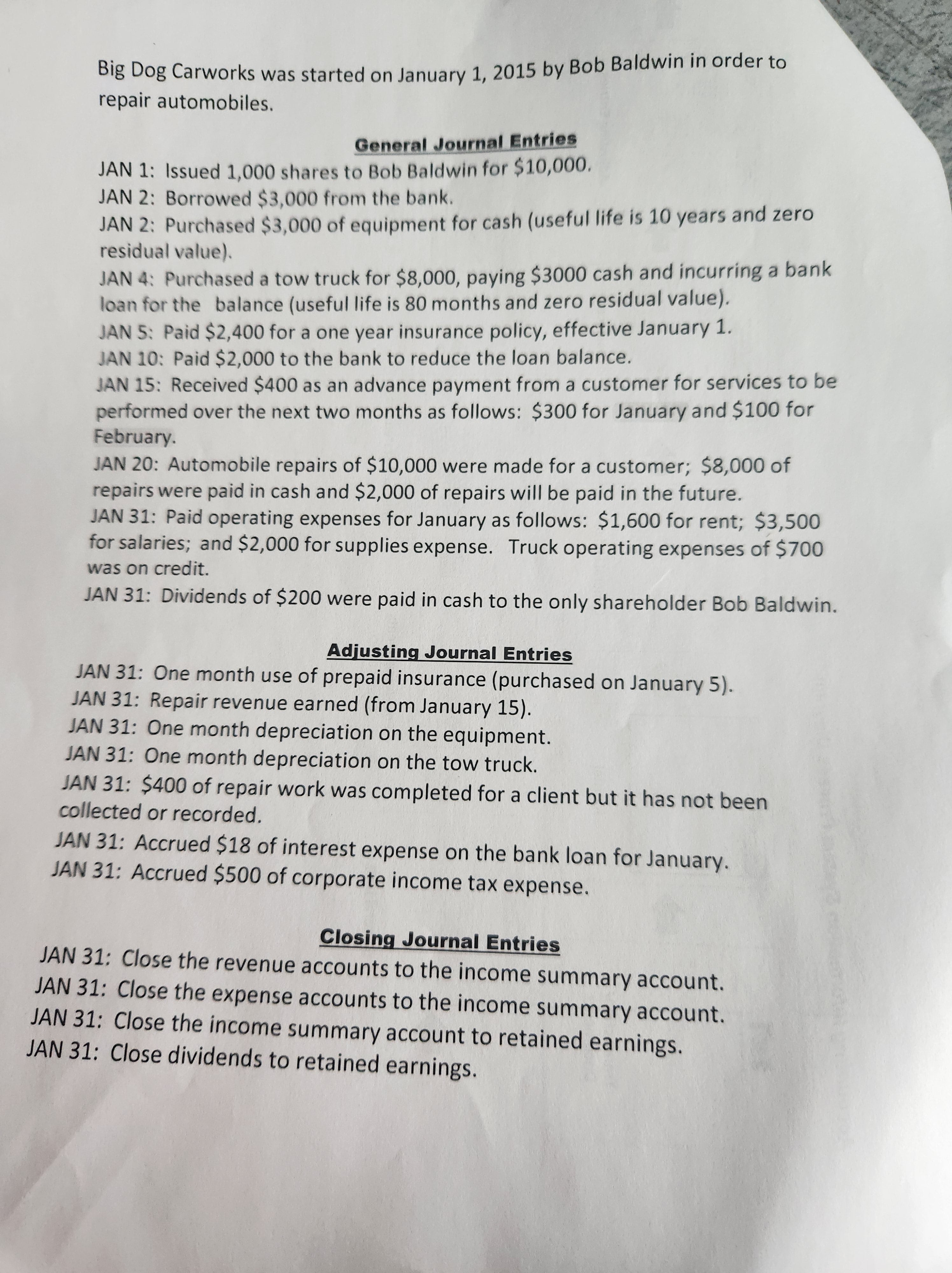

Big Dog Carworks was started on January 1, 2015 by Bob Baldwin in order to repair automobiles. General Journal Entries JAN 1: Issued 1,000 shares to Bob Baldwin for $10,000. JAN 2: Borrowed $3,000 from the bank. JAN 2: Purchased $3,000 of equipment for cash (useful life is 10 years and zero residual value). JAN 4: Purchased a tow truck for $8,000, paying $3000 cash and incurring a bank loan for the balance (useful life is 80 months and zero residual value). JAN 5: Paid $2,400 for a one year insurance policy, effective January 1 . JAN 10: Paid $2,000 to the bank to reduce the loan balance. JAN 15: Received $400 as an advance payment from a customer for services to be performed over the next two months as follows: $300 for January and $100 for February. JAN 20: Automobile repairs of $10,000 were made for a customer; $8,000 of repairs were paid in cash and $2,000 of repairs will be paid in the future. JAN 31: Paid operating expenses for January as follows: $1,600 for rent; $3,500 for salaries; and $2,000 for supplies expense. Truck operating expenses of $700 was on credit. JAN 31: Dividends of $200 were paid in cash to the only shareholder Bob Baldwin. Adjusting Journal Entries JAN 31: One month use of prepaid insurance (purchased on January 5). JAN 31: Repair revenue earned (from January 15). JAN 31: One month depreciation on the equipment. JAN 31: One month depreciation on the tow truck. JAN 31: $400 of repair work was completed for a client but it has not been collected or recorded. JAN 31: Accrued $18 of interest expense on the bank loan for January. JAN 31: Accrued $500 of corporate income tax expense. Closing Journal Entries JAN 31: Close the revenue accounts to the income summary account. JAN 31: Close the expense accounts to the income summary account. JAN 31: Close the income summary account to retained earnings. JAN 31: Close dividends to retained earnings. Big Dog Carworks was started on January 1, 2015 by Bob Baldwin in order to repair automobiles. General Journal Entries JAN 1: Issued 1,000 shares to Bob Baldwin for $10,000. JAN 2: Borrowed $3,000 from the bank. JAN 2: Purchased $3,000 of equipment for cash (useful life is 10 years and zero residual value). JAN 4: Purchased a tow truck for $8,000, paying $3000 cash and incurring a bank loan for the balance (useful life is 80 months and zero residual value). JAN 5: Paid $2,400 for a one year insurance policy, effective January 1 . JAN 10: Paid $2,000 to the bank to reduce the loan balance. JAN 15: Received $400 as an advance payment from a customer for services to be performed over the next two months as follows: $300 for January and $100 for February. JAN 20: Automobile repairs of $10,000 were made for a customer; $8,000 of repairs were paid in cash and $2,000 of repairs will be paid in the future. JAN 31: Paid operating expenses for January as follows: $1,600 for rent; $3,500 for salaries; and $2,000 for supplies expense. Truck operating expenses of $700 was on credit. JAN 31: Dividends of $200 were paid in cash to the only shareholder Bob Baldwin. Adjusting Journal Entries JAN 31: One month use of prepaid insurance (purchased on January 5). JAN 31: Repair revenue earned (from January 15). JAN 31: One month depreciation on the equipment. JAN 31: One month depreciation on the tow truck. JAN 31: $400 of repair work was completed for a client but it has not been collected or recorded. JAN 31: Accrued $18 of interest expense on the bank loan for January. JAN 31: Accrued $500 of corporate income tax expense. Closing Journal Entries JAN 31: Close the revenue accounts to the income summary account. JAN 31: Close the expense accounts to the income summary account. JAN 31: Close the income summary account to retained earnings. JAN 31: Close dividends to retained earnings

Big Dog Carworks was started on January 1, 2015 by Bob Baldwin in order to repair automobiles. General Journal Entries JAN 1: Issued 1,000 shares to Bob Baldwin for $10,000. JAN 2: Borrowed $3,000 from the bank. JAN 2: Purchased $3,000 of equipment for cash (useful life is 10 years and zero residual value). JAN 4: Purchased a tow truck for $8,000, paying $3000 cash and incurring a bank loan for the balance (useful life is 80 months and zero residual value). JAN 5: Paid $2,400 for a one year insurance policy, effective January 1 . JAN 10: Paid $2,000 to the bank to reduce the loan balance. JAN 15: Received $400 as an advance payment from a customer for services to be performed over the next two months as follows: $300 for January and $100 for February. JAN 20: Automobile repairs of $10,000 were made for a customer; $8,000 of repairs were paid in cash and $2,000 of repairs will be paid in the future. JAN 31: Paid operating expenses for January as follows: $1,600 for rent; $3,500 for salaries; and $2,000 for supplies expense. Truck operating expenses of $700 was on credit. JAN 31: Dividends of $200 were paid in cash to the only shareholder Bob Baldwin. Adjusting Journal Entries JAN 31: One month use of prepaid insurance (purchased on January 5). JAN 31: Repair revenue earned (from January 15). JAN 31: One month depreciation on the equipment. JAN 31: One month depreciation on the tow truck. JAN 31: $400 of repair work was completed for a client but it has not been collected or recorded. JAN 31: Accrued $18 of interest expense on the bank loan for January. JAN 31: Accrued $500 of corporate income tax expense. Closing Journal Entries JAN 31: Close the revenue accounts to the income summary account. JAN 31: Close the expense accounts to the income summary account. JAN 31: Close the income summary account to retained earnings. JAN 31: Close dividends to retained earnings. Big Dog Carworks was started on January 1, 2015 by Bob Baldwin in order to repair automobiles. General Journal Entries JAN 1: Issued 1,000 shares to Bob Baldwin for $10,000. JAN 2: Borrowed $3,000 from the bank. JAN 2: Purchased $3,000 of equipment for cash (useful life is 10 years and zero residual value). JAN 4: Purchased a tow truck for $8,000, paying $3000 cash and incurring a bank loan for the balance (useful life is 80 months and zero residual value). JAN 5: Paid $2,400 for a one year insurance policy, effective January 1 . JAN 10: Paid $2,000 to the bank to reduce the loan balance. JAN 15: Received $400 as an advance payment from a customer for services to be performed over the next two months as follows: $300 for January and $100 for February. JAN 20: Automobile repairs of $10,000 were made for a customer; $8,000 of repairs were paid in cash and $2,000 of repairs will be paid in the future. JAN 31: Paid operating expenses for January as follows: $1,600 for rent; $3,500 for salaries; and $2,000 for supplies expense. Truck operating expenses of $700 was on credit. JAN 31: Dividends of $200 were paid in cash to the only shareholder Bob Baldwin. Adjusting Journal Entries JAN 31: One month use of prepaid insurance (purchased on January 5). JAN 31: Repair revenue earned (from January 15). JAN 31: One month depreciation on the equipment. JAN 31: One month depreciation on the tow truck. JAN 31: $400 of repair work was completed for a client but it has not been collected or recorded. JAN 31: Accrued $18 of interest expense on the bank loan for January. JAN 31: Accrued $500 of corporate income tax expense. Closing Journal Entries JAN 31: Close the revenue accounts to the income summary account. JAN 31: Close the expense accounts to the income summary account. JAN 31: Close the income summary account to retained earnings. JAN 31: Close dividends to retained earnings Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started