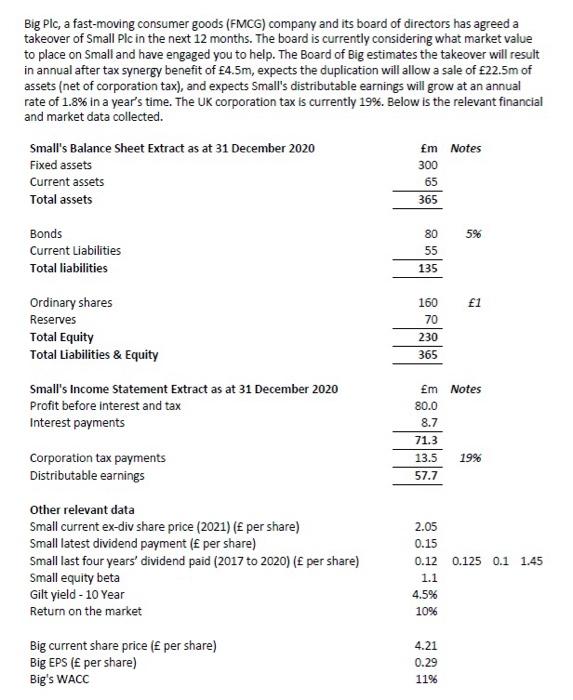

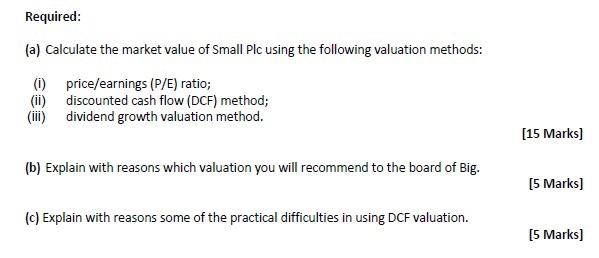

Big Plc, a fast-moving consumer goods (FMCG) company and its board of directors has agreed a takeover of Small Plc in the next 12 months. The board is currently considering what market value to place on Small and have engaged you to help. The Board of Big estimates the takeover will result in annual after tax synergy benefit of 4.5m, expects the duplication will allow a sale of 22.5m of assets (net of corporation tax), and expects Small's distributable earnings will grow at an annual rate of 1.8% in a year's time. The UK corporation tax is currently 19%. Below is the relevant financial and market data collected. Small's Balance Sheet Extract as at 31 December 2020 m Notes Fixed assets 300 Current assets Total assets 65 365 5% Bonds Current Liabilities Total liabilities 80 55 135 1 Ordinary shares Reserves Total Equity Total Liabilities & Equity 160 70 230 365 Small's Income Statement Extract as at 31 December 2020 Profit before interest and tax Interest payments m Notes 80.0 8.7 71.3 13.5 19% 57.7 Corporation tax payments Distributable earnings Other relevant data Small current ex-div share price (2021) ( per share) Small latest dividend payment ( per share) Small last four years' dividend paid (2017 to 2020) ( per share) Small equity beta Gilt yield - 10 Year Return on the market 2.05 0.15 0.12 0.125 0.1 1.45 1.1 4.5% 10% Big current share price ( per share) Big EPS ( per share) Big's WACC 4.21 0.29 11% Required: (a) Calculate the market value of Small Plc using the following valuation methods: (i) price/earnings (P/E) ratio; (ii) discounted cash flow (DCF) method; (ii) dividend growth valuation method. [15 Marks] (b) Explain with reasons which valuation you will recommend to the board of Big. [5 Marks) (c) Explain with reasons some of the practical difficulties in using DCF valuation. [5 Marks) Big Plc, a fast-moving consumer goods (FMCG) company and its board of directors has agreed a takeover of Small Plc in the next 12 months. The board is currently considering what market value to place on Small and have engaged you to help. The Board of Big estimates the takeover will result in annual after tax synergy benefit of 4.5m, expects the duplication will allow a sale of 22.5m of assets (net of corporation tax), and expects Small's distributable earnings will grow at an annual rate of 1.8% in a year's time. The UK corporation tax is currently 19%. Below is the relevant financial and market data collected. Small's Balance Sheet Extract as at 31 December 2020 m Notes Fixed assets 300 Current assets Total assets 65 365 5% Bonds Current Liabilities Total liabilities 80 55 135 1 Ordinary shares Reserves Total Equity Total Liabilities & Equity 160 70 230 365 Small's Income Statement Extract as at 31 December 2020 Profit before interest and tax Interest payments m Notes 80.0 8.7 71.3 13.5 19% 57.7 Corporation tax payments Distributable earnings Other relevant data Small current ex-div share price (2021) ( per share) Small latest dividend payment ( per share) Small last four years' dividend paid (2017 to 2020) ( per share) Small equity beta Gilt yield - 10 Year Return on the market 2.05 0.15 0.12 0.125 0.1 1.45 1.1 4.5% 10% Big current share price ( per share) Big EPS ( per share) Big's WACC 4.21 0.29 11% Required: (a) Calculate the market value of Small Plc using the following valuation methods: (i) price/earnings (P/E) ratio; (ii) discounted cash flow (DCF) method; (ii) dividend growth valuation method. [15 Marks] (b) Explain with reasons which valuation you will recommend to the board of Big. [5 Marks) (c) Explain with reasons some of the practical difficulties in using DCF valuation. [5 Marks)