Question

Big Test Inc. had sales last year of $100mm. Sales are expected to grow 20% next year. To support the new sales level, the

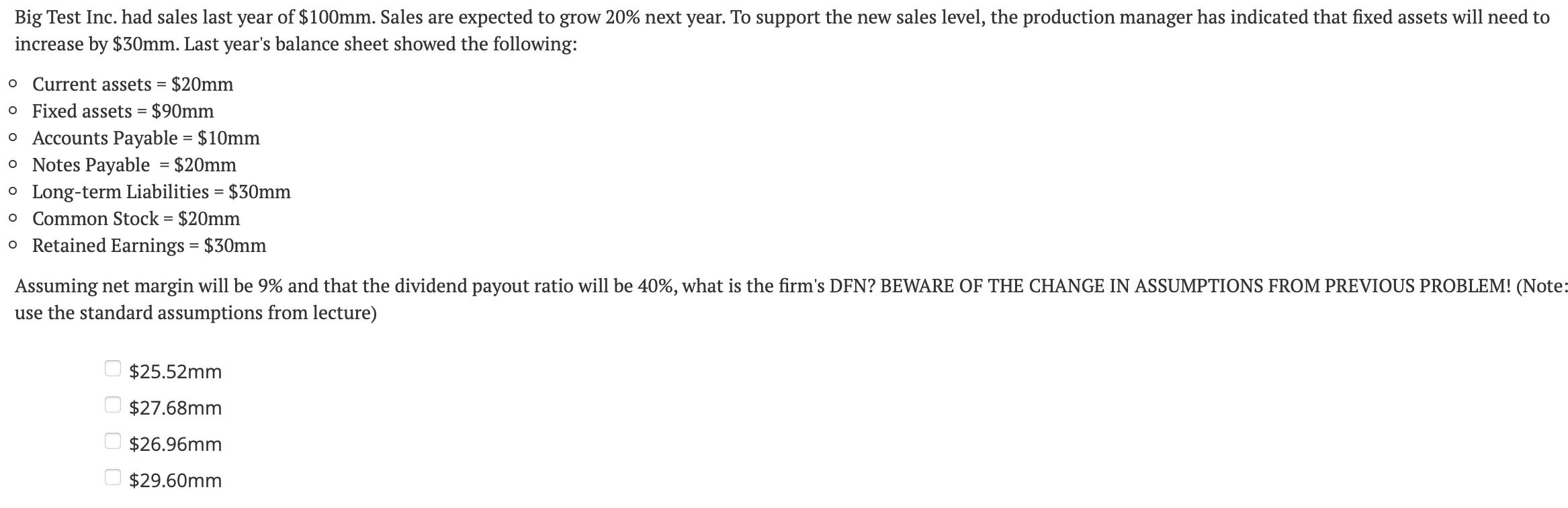

Big Test Inc. had sales last year of $100mm. Sales are expected to grow 20% next year. To support the new sales level, the production manager has indicated that fixed assets will need to increase by $30mm. Last year's balance sheet showed the following: o Current assets = $20mm o Fixed assets = $90mm o Accounts Payable = $10mm o Notes Payable = $20mm o Long-term Liabilities = $30mm o Common Stock = $20mm o Retained Earnings = $30mm Assuming net margin will be 9% and that the dividend payout ratio will be 40%, what is the firm's DFN? BEWARE OF THE CHANGE IN ASSUMPTIONS FROM PREVIOUS PROBLEM! (Note: use the standard assumptions from lecture) $25.52mm $27.68mm $26.96mm $29.60mm

Step by Step Solution

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

BU24 1 2 W N 3 456789 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 BN S...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Introduction to Finance Markets Investments and Financial Management

Authors: Melicher Ronald, Norton Edgar

15th edition

9781118800720, 1118492676, 1118800729, 978-1118492673

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App