Question

Bigger Company purchases Smallish Company on 12/31/X3. On that date, the fair value of Bigger Company's stock is $40 per share. Smallish Company continues to

Bigger Company purchases Smallish Company on 12/31/X3. On that date, the fair value of Bigger Company's stock is $40 per share. Smallish Company continues to exist as a legal entity.

On 12/31/X3:

- Bigger Company issues 3,000 shares of common stock to the Smallish Company shareholders for the purchase.

- Bigger Company pays $13,000 in legal fees and $5,000 in costs related to issuing the new shares.

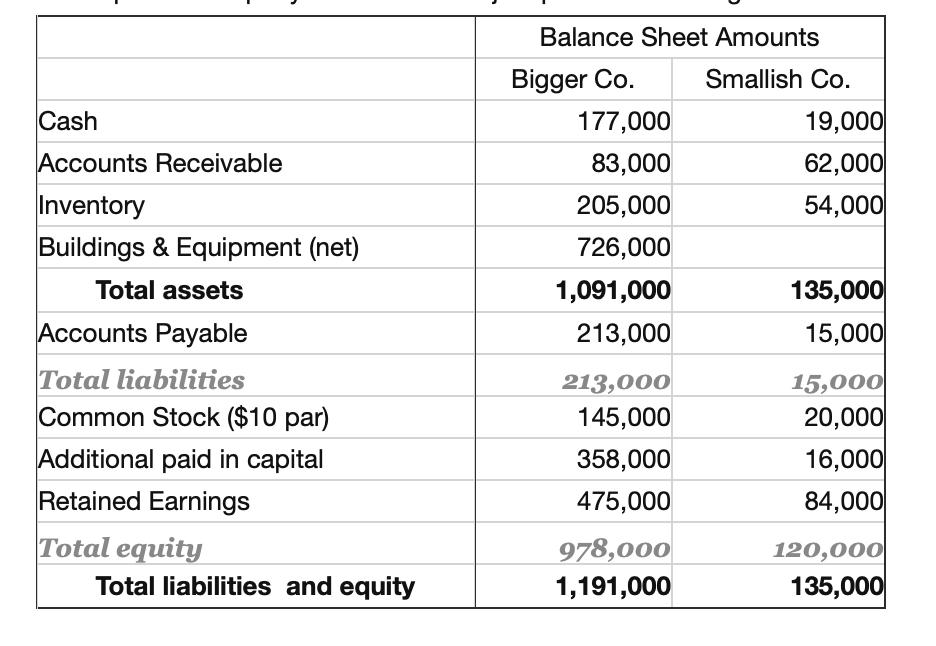

The separate company balance sheets just prior to recording the transactions above are as follows:

1. After recording the acquisition, what is the balance on the separate balance sheet for Bigger Company in the Additional paid in capital account?

2. After recording the acquisition, what is the balance on the separate balance sheet for Bigger Company in the Retained Earnings account?

3. After recording the acquisition, what is the balance on the consolidated balance sheet in the Retained Earnings account?

Cash Accounts Receivable Inventory Buildings & Equipment (net) Total assets Accounts Payable Total liabilities Common Stock ($10 par) Additional paid in capital Retained Earnings Total equity Total liabilities and equity Balance Sheet Amounts Bigger Co. 177,000 83,000 205,000 726,000 1,091,000 213,000 213,000 145,000 358,000 475,000 978,000 1,191,000 Smallish Co. 19,000 62,000 54,000 135,000 15,000 15,000 20,000 16,000 84,000 120,000 135,000

Step by Step Solution

3.30 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Balance in Additional Paidin Capital for Bigger Company Bigger Company issued 3000 shares of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started