Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Biggy Ltd manufactures shoes. Below are the company's sales and purchases transactions for the year 2020. January 1, 2020 February 5, 2020 April 8,

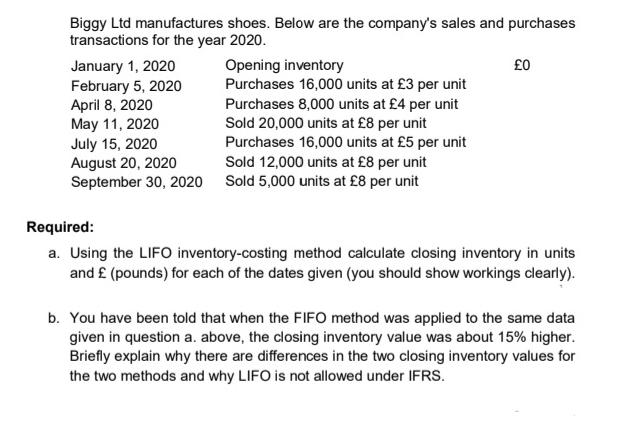

Biggy Ltd manufactures shoes. Below are the company's sales and purchases transactions for the year 2020. January 1, 2020 February 5, 2020 April 8, 2020 May 11, 2020 July 15, 2020 August 20, 2020 September 30, 2020 Opening inventory Purchases 16,000 units at 3 per unit Purchases 8,000 units at 4 per unit Sold 20,000 units at 8 per unit Purchases 16,000 units at 5 per unit Sold 12,000 units at 8 per unit Sold 5,000 units at 8 per unit 0 Required: a. Using the LIFO inventory-costing method calculate closing inventory in units and (pounds) for each of the dates given (you should show workings clearly). b. You have been told that when the FIFO method was applied to the same data given in question a. above, the closing inventory value was about 15% higher. Briefly explain why there are differences in the two closing inventory values for the two methods and why LIFO is not allowed under IFRS.

Step by Step Solution

★★★★★

3.31 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a Calculate Closing Inventory using LIFO Inventory Costing Method Answer Closing Inventory using LIFO Inventory Costing Method 3000 Units 3 per unit 9...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started