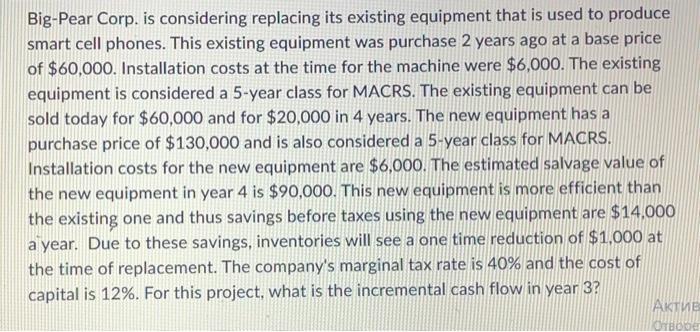

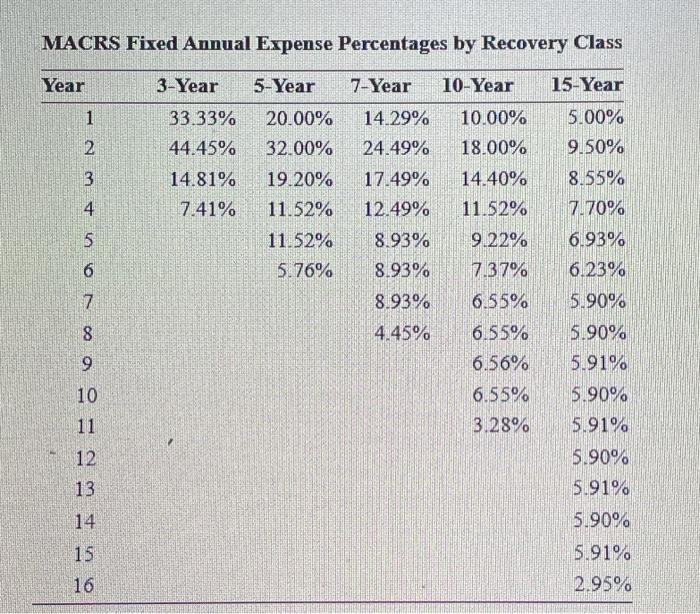

Big-Pear Corp. is considering replacing its existing equipment that is used to produce smart cell phones. This existing equipment was purchase 2 years ago at a base price of $60,000. Installation costs at the time for the machine were $6,000. The existing equipment is considered a 5 -year class for MACRS. The existing equipment can be sold today for $60,000 and for $20,000 in 4 years. The new equipment has a purchase price of $130,000 and is also considered a 5-year class for MACRS. Installation costs for the new equipment are $6,000. The estimated salvage value of the new equipment in year 4 is $90,000. This new equipment is more efficient than the existing one and thus savings before taxes using the new equipment are $14,000 a year. Due to these savings, inventories will see a one time reduction of $1,000 at the time of replacement. The company's marginal tax rate is 40% and the cost of capital is 12%. For this project, what is the incremental cash flow in year 3 ? MACRS Fixed Annual Expense Percentages by Recovery Class \begin{tabular}{crrrrr} \hline Year & 3-Year & 5-Year & 7-Year & \multicolumn{1}{c}{ 10-Year } & 15-Year \\ \hline 1 & 33.33% & 20.00% & 14.29% & 10.00% & 5.00% \\ 2 & 44.45% & 32.00% & 24.49% & 18.00% & 9.50% \\ 3 & 14.81% & 19.20% & 17.49% & 14.40% & 8.55% \\ 4 & 7.41% & 11.52% & 12.49% & 11.52% & 7.70% \\ 5 & & 11.52% & 8.93% & 9.22% & 6.93% \\ 6 & & 5.76% & 8.93% & 7.37% & 6.23% \\ 7 & & & 8.93% & 6.55% & 5.90% \\ 8 & & & 4.45% & 6.55% & 5.90% \\ 9 & & & & 6.56% & 5.91% \\ 10 & & & & 6.55% & 5.90% \\ 11 & & & & 3.28% & 5.91% \\ 12 & & & & & 5.90% \\ 13 & & & & & 5.91% \\ 14 & & & & & 5.90% \\ 15 & & & & & 5.91% \\ 16 & & & & & 2.95% \\ \hline \end{tabular} For your answer, round to the nearest dollar, do not enter the $ sign, use commas to separate thousands, use a negative sign in front of first number is the cash flow is negative (do not use parenthesis to indicate negative cash flows). For example, if your answer is $3,005.87 then enter 3,006 ; if your answer is $1,200.25 then enter 1,200 For this project, the incremental cash flow in year 3 is: Your