Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bijay, age 65, receives Old Age Security (OAS) payments and has a total income of $6,000. His wife Raveena, age 66, receives Canada Pension

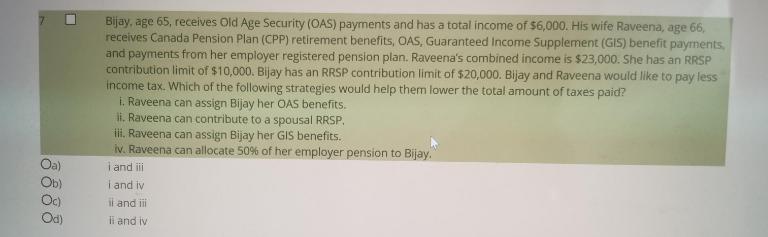

Bijay, age 65, receives Old Age Security (OAS) payments and has a total income of $6,000. His wife Raveena, age 66, receives Canada Pension Plan (CPP) retirement benefits, OAS, Guaranteed Income Supplement (GIS) benefit payments, and payments from her employer registered pension plan. Raveena's combined income is $23,000. She has an RRSP contribution limit of $10,000. Bijay has an RRSP contribution limit of $20,000. Bijay and Raveena would like to pay less income tax. Which of the following strategies would help them lower the total amount of taxes paid? i. Raveena can assign Bijay her OAS benefits. li. Raveena can contribute to a spousal RRSP. ii. Raveena can assign Bijay her GIS benefits. iv. Raveena can allocate 50% of her employer pension to Bijay. i and ii i and iv Oa) Ob) Oc) Od) il and ii ii and iv 8888

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Option A is correct i ii...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started