Question

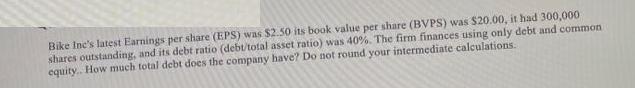

Bike Ine's latest Earnings per share (EPS) was $2.50 its book value per share (BVPS) was $20.00, it had 300,000 shares outstanding, and its

Bike Ine's latest Earnings per share (EPS) was $2.50 its book value per share (BVPS) was $20.00, it had 300,000 shares outstanding, and its debt ratio (debt/total asset ratio) was 40%. The firm finances using only debt and common equity.. How much total debt does the company have? Do not round your intermediate calculations.

Step by Step Solution

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Book value per share BVPS Total equity Number of outstanding shares Total equity BVPS ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Principles of managerial finance

Authors: Lawrence J Gitman, Chad J Zutter

12th edition

9780321524133, 132479540, 321524136, 978-0132479547

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App