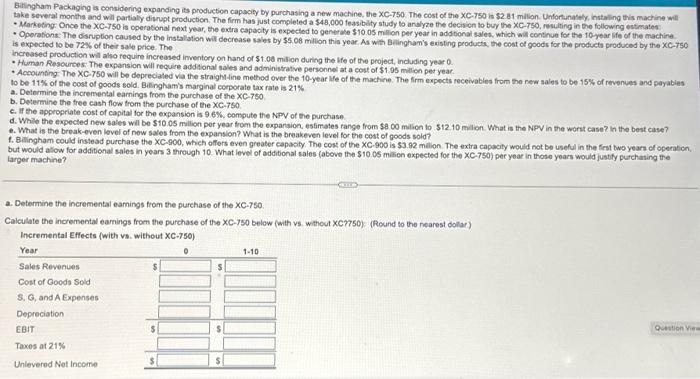

Bilingham Packaging is considering expanding is production capacily by purchasing a new machine, the XC-T50-The cost of the XC-T50 is $2 at millon. Unforunately, installing this machine will - Marketing Once the XC-750 is operatonal next year, the exdra capacity is expected to genterwe $10.05million per year in adstional sales, which will continue for the 10 -year Ife of the machine. - Operations: The disruption caused by the instal ation wil decrease sales by 55.08 millon this year. As with Belingham's existing products, the cost of goods for the preducte produced by the XC-750 is expected to be 72% of their sale price. The increased production will also require increased imentory on hand of $1.00 milion during the lfe of the project, including year 0 . - Human Resourees: The expansion will require additonal sales and administrative personnel at a cost of $1.95 milion ped year. - Acoounting The XC-750 will be depreciated va the straighM-ine methed over the 10 -year Me of the machine. The firm expects receivables from the rew sales to be 15% of revenves and payables to be 11% of the cost of goods sold. Bilingham's marginal coporate tax rate is 21% a. Determine the incremental earnings from the purchase of the XC750 b. Determine the free cash flow trom the purchase of the xCC750 c. If the appropriate cost of capital for the expansion is 96%, compute the NPV of the purchase d. While the expected new sales wil be $10.05 million per year trom the exparsion, estimates tange from $800 milion to $12.10 milon. What is the NpV in the worst case? In the best case? 6. What is the break-even level of new saves from the expansion? What is the breakeven level for the cest of goods sold? 4. Balingham could instead purchase the XC.900, which offers even greater capasity. The cost of the XC. 900 is $3.92 malion. The extra capacily would not be useful in the frost two years of operation, but would atow for additional sales in years 3 through 10 . What level of additional sales (above the $10.05 mition expected for the XC-750) per year in those yoars would justify purchating the larper machine? a. Determine the incremental eamings from the purchase of the XC750 : Calculate the incremental earnings from the purchase of the XC750 below (with vs. without XC7750 ) (Round to the nearest dollar) Incremental Effects (with va. without XC-750)