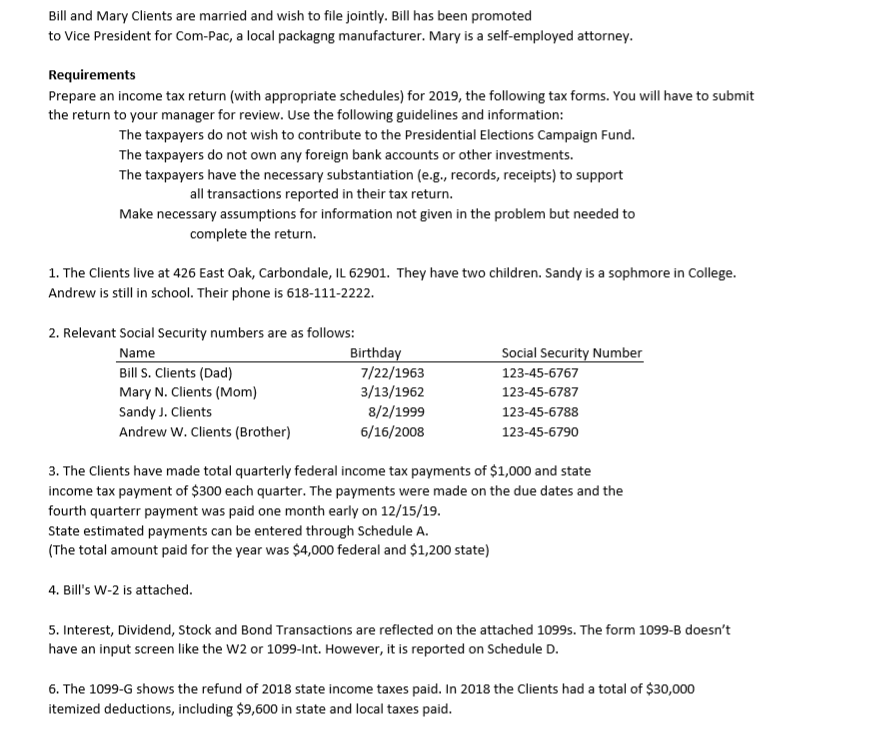

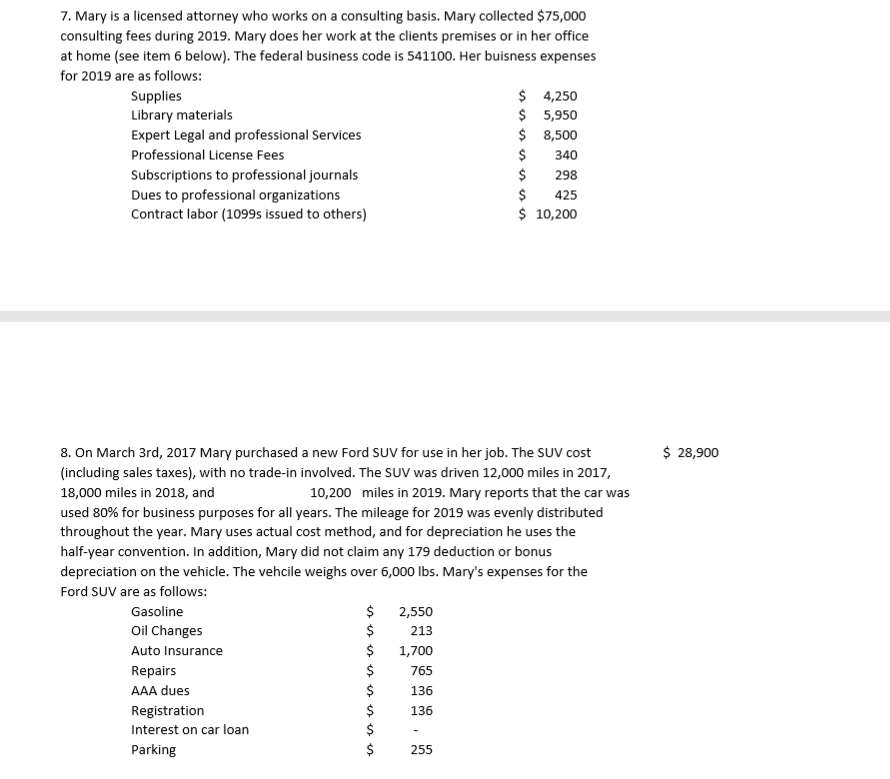

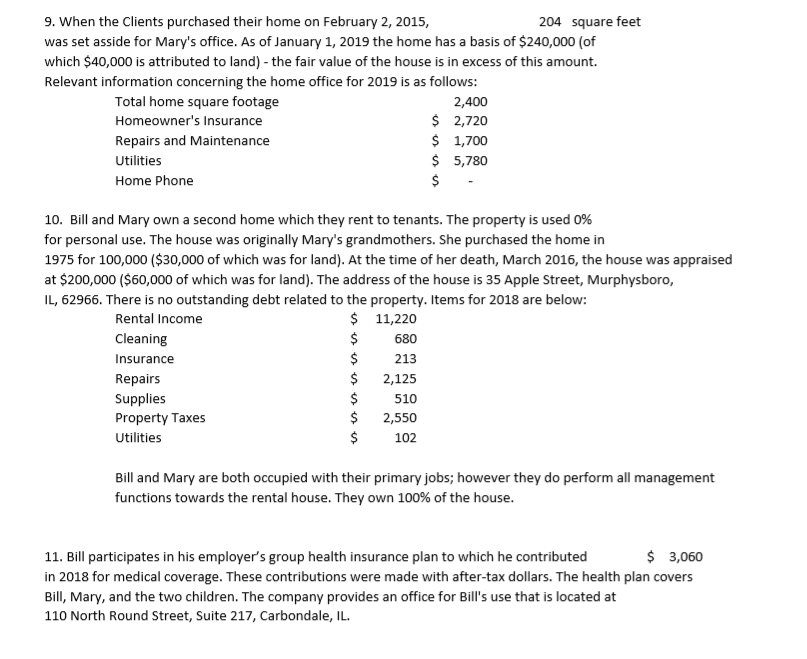

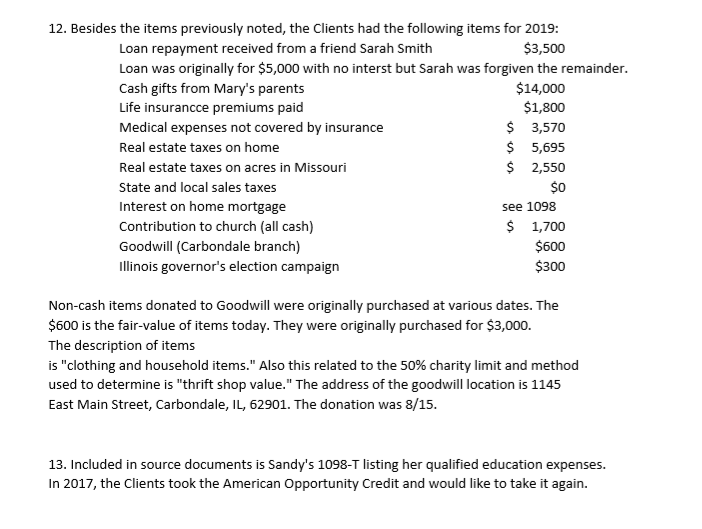

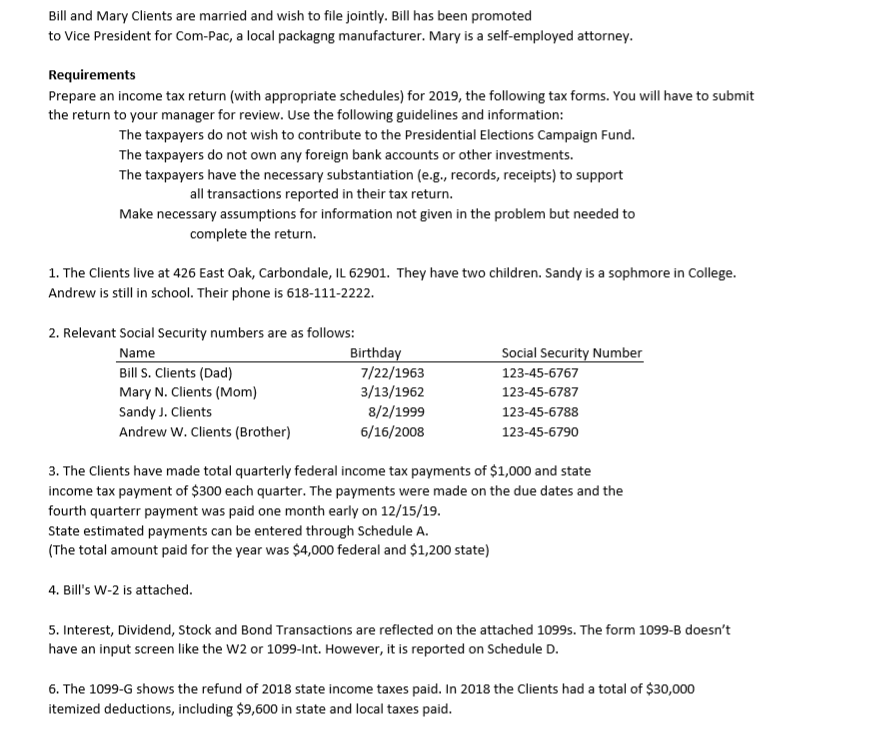

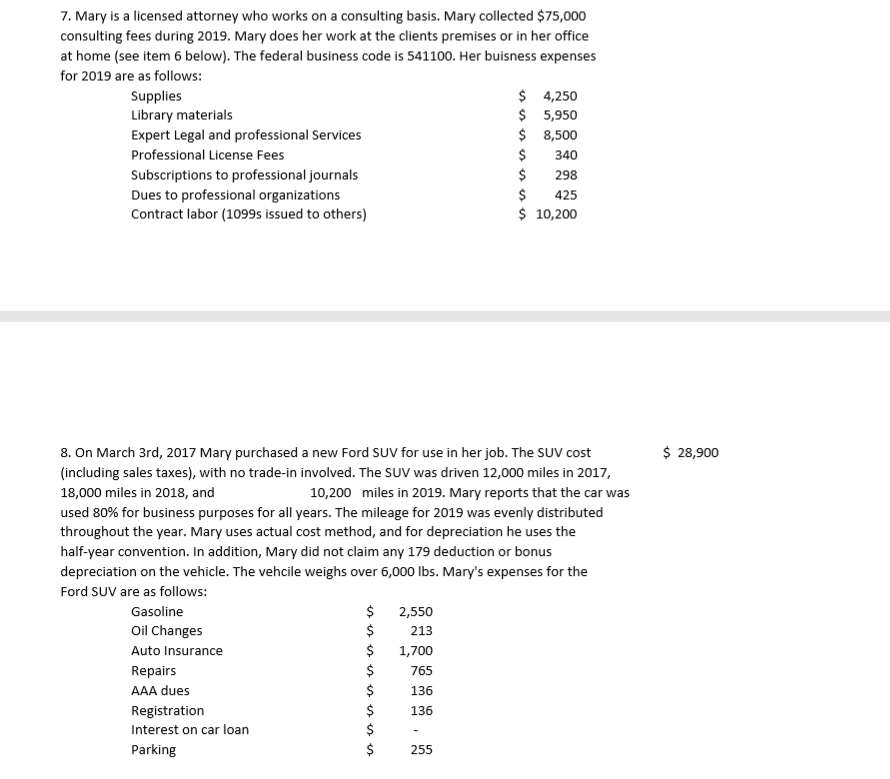

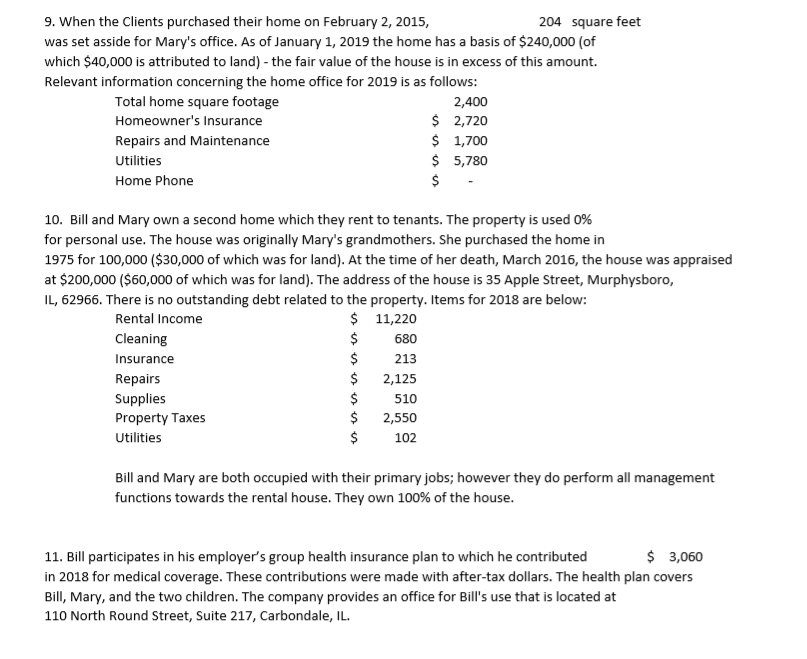

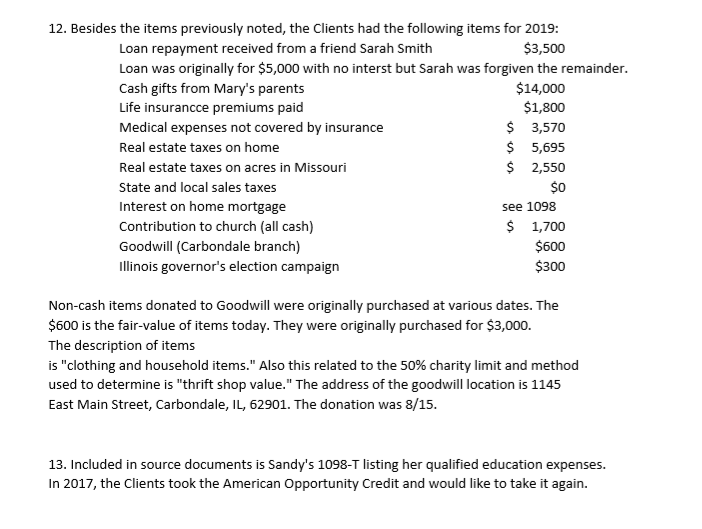

Bill and Mary Clients are married and wish to file jointly. Bill has been promoted to Vice President for Com-Pac, a local packagng manufacturer. Mary is a self-employed attorney. Requirements Prepare an income tax return (with appropriate schedules) for 2019, the following tax forms. You will have to submit the return to your manager for review. Use the following guidelines and information: The taxpayers do not wish to contribute to the Presidential Elections Campaign Fund. The taxpayers do not own any foreign bank accounts or other investments. The taxpayers have the necessary substantiation (e.g., records, receipts) to support all transactions reported in their tax return. Make necessary assumptions for information not given in the problem but needed to complete the return. 1. The Clients live at 426 East Oak, Carbondale, IL 62901. They have two children. Sandy is a sophmore in College. Andrew is still in school. Their phone is 618-111-2222. 2. Relevant Social Security numbers are as follows: Name Birthday Bill S. Clients (Dad) 7/22/1963 Mary N. Clients (Mom) 3/13/1962 Sandy J. Clients 8/2/1999 Andrew W. Clients (Brother) 6/16/2008 Social Security Number 123-45-6767 123-45-6787 123-45-6788 123-45-6790 3. The Clients have made total quarterly federal income tax payments of $1,000 and state income tax payment of $300 each quarter. The payments were made on the due dates and the fourth quarterr payment was paid one month early on 12/15/19. State estimated payments can be entered through Schedule A. (The total amount paid for the year was $4,000 federal and $1,200 state) 4. Bill's W-2 is attached. 5. Interest, Dividend, Stock and Bond Transactions are reflected on the attached 1099s. The form 1099-B doesn't have an input screen like the W2 or 1099-Int. However, it is reported on Schedule D. 6. The 1099-G shows the refund of 2018 state income taxes paid. In 2018 the Clients had a total of $30,000 itemized deductions, including $9,600 in state and local taxes paid. 7. Mary is a licensed attorney who works on a consulting basis. Mary collected $75,000 consulting fees during 2019. Mary does her work at the clients premises or in her office at home (see item 6 below). The federal business code is 541100. Her buisness expenses for 2019 are as follows: Supplies $ 4,250 Library materials $ 5,950 Expert Legal and professional Services $ 8,500 Professional License Fees $ 340 Subscriptions to professional journals $ 298 Dues to professional organizations $ 425 Contract labor (1099s issued to others) $ 10,200 $ 28,900 8. On March 3rd, 2017 Mary purchased a new Ford SUV for use in her job. The SUV cost (including sales taxes), with no trade-in involved. The SUV was driven 12,000 miles in 2017, 18,000 miles in 2018, and 10,200 miles in 2019. Mary reports that the car was used 80% for business purposes for all years. The mileage for 2019 was evenly distributed throughout the year. Mary uses actual cost method, and for depreciation he uses the half-year convention. In addition, Mary did not claim any 179 deduction or bonus depreciation on the vehicle. The vehcile weighs over 6,000 lbs. Mary's expenses for the Ford SUV are as follows: Gasoline $ 2,550 Oil Changes $ 213 Auto Insurance 1,700 Repairs 765 AAA dues 136 Registration Interest on car loan Parking 9. When the Clients purchased their home on February 2, 2015, 204 square feet was set asside for Mary's office. As of January 1, 2019 the home has a basis of $240,000 (of which $40,000 is attributed to land) - the fair value of the house is in excess of this amount. Relevant information concerning the home office for 2019 is as follows: Total home square footage 2,400 Homeowner's Insurance $ 2,720 Repairs and Maintenance $ 1,700 Utilities $ 5,780 Home Phone 10. Bill and Mary own a second home which they rent to tenants. The property is used 0% for personal use. The house was originally Mary's grandmothers. She purchased the home in 1975 for 100,000 ($30,000 of which was for land). At the time of her death, March 2016, the house was appraised at $200,000 ($60,000 of which was for land). The address of the house is 35 Apple Street, Murphysboro, IL, 62966. There is no outstanding debt related to the property. Items for 2018 are below: Rental Income $ 11,220 Cleaning $ 680 Insurance $ 213 Repairs 2,125 Supplies $ 510 Property Taxes $ 2,550 Utilities $ 102 Bill and Mary are both occupied with their primary jobs; however they do perform all management functions towards the rental house. They own 100% of the house. 11. Bill participates in his employer's group health insurance plan to which he contributed $ 3,060 in 2018 for medical coverage. These contributions were made with after-tax dollars. The health plan covers Bill, Mary, and the two children. The company provides an office for Bill's use that is located at 110 North Round Street, Suite 217, Carbondale, IL. 12. Besides the items previously noted, the Clients had the following items for 2019: Loan repayment received from a friend Sarah Smith $3,500 Loan was originally for $5,000 with no interst but Sarah was forgiven the remainder. Cash gifts from Mary's parents $14,000 Life insurancce premiums paid $1,800 Medical expenses not covered by insurance $ 3,570 Real estate taxes on home $ 5,695 Real estate taxes on acres in Missouri $ 2,550 State and local sales taxes Interest on home mortgage see 1098 Contribution to church (all cash) $ 1,700 Goodwill (Carbondale branch) $600 illinois governor's election campaign $300 SO Non-cash items donated to Goodwill were originally purchased at various dates. The $600 is the fair-value of items today. They were originally purchased for $3,000. The description of items is "clothing and household items." Also this related to the 50% charity limit and method used to determine is "thrift shop value." The address of the goodwill location is 1145 East Main Street, Carbondale, IL, 62901. The donation was 8/15. 13. Included in source documents is Sandy's 1098-T listing her qualified education expenses. In 2017, the Clients took the American Opportunity Credit and would like to take it again. Bill and Mary Clients are married and wish to file jointly. Bill has been promoted to Vice President for Com-Pac, a local packagng manufacturer. Mary is a self-employed attorney. Requirements Prepare an income tax return (with appropriate schedules) for 2019, the following tax forms. You will have to submit the return to your manager for review. Use the following guidelines and information: The taxpayers do not wish to contribute to the Presidential Elections Campaign Fund. The taxpayers do not own any foreign bank accounts or other investments. The taxpayers have the necessary substantiation (e.g., records, receipts) to support all transactions reported in their tax return. Make necessary assumptions for information not given in the problem but needed to complete the return. 1. The Clients live at 426 East Oak, Carbondale, IL 62901. They have two children. Sandy is a sophmore in College. Andrew is still in school. Their phone is 618-111-2222. 2. Relevant Social Security numbers are as follows: Name Birthday Bill S. Clients (Dad) 7/22/1963 Mary N. Clients (Mom) 3/13/1962 Sandy J. Clients 8/2/1999 Andrew W. Clients (Brother) 6/16/2008 Social Security Number 123-45-6767 123-45-6787 123-45-6788 123-45-6790 3. The Clients have made total quarterly federal income tax payments of $1,000 and state income tax payment of $300 each quarter. The payments were made on the due dates and the fourth quarterr payment was paid one month early on 12/15/19. State estimated payments can be entered through Schedule A. (The total amount paid for the year was $4,000 federal and $1,200 state) 4. Bill's W-2 is attached. 5. Interest, Dividend, Stock and Bond Transactions are reflected on the attached 1099s. The form 1099-B doesn't have an input screen like the W2 or 1099-Int. However, it is reported on Schedule D. 6. The 1099-G shows the refund of 2018 state income taxes paid. In 2018 the Clients had a total of $30,000 itemized deductions, including $9,600 in state and local taxes paid. 7. Mary is a licensed attorney who works on a consulting basis. Mary collected $75,000 consulting fees during 2019. Mary does her work at the clients premises or in her office at home (see item 6 below). The federal business code is 541100. Her buisness expenses for 2019 are as follows: Supplies $ 4,250 Library materials $ 5,950 Expert Legal and professional Services $ 8,500 Professional License Fees $ 340 Subscriptions to professional journals $ 298 Dues to professional organizations $ 425 Contract labor (1099s issued to others) $ 10,200 $ 28,900 8. On March 3rd, 2017 Mary purchased a new Ford SUV for use in her job. The SUV cost (including sales taxes), with no trade-in involved. The SUV was driven 12,000 miles in 2017, 18,000 miles in 2018, and 10,200 miles in 2019. Mary reports that the car was used 80% for business purposes for all years. The mileage for 2019 was evenly distributed throughout the year. Mary uses actual cost method, and for depreciation he uses the half-year convention. In addition, Mary did not claim any 179 deduction or bonus depreciation on the vehicle. The vehcile weighs over 6,000 lbs. Mary's expenses for the Ford SUV are as follows: Gasoline $ 2,550 Oil Changes $ 213 Auto Insurance 1,700 Repairs 765 AAA dues 136 Registration Interest on car loan Parking 9. When the Clients purchased their home on February 2, 2015, 204 square feet was set asside for Mary's office. As of January 1, 2019 the home has a basis of $240,000 (of which $40,000 is attributed to land) - the fair value of the house is in excess of this amount. Relevant information concerning the home office for 2019 is as follows: Total home square footage 2,400 Homeowner's Insurance $ 2,720 Repairs and Maintenance $ 1,700 Utilities $ 5,780 Home Phone 10. Bill and Mary own a second home which they rent to tenants. The property is used 0% for personal use. The house was originally Mary's grandmothers. She purchased the home in 1975 for 100,000 ($30,000 of which was for land). At the time of her death, March 2016, the house was appraised at $200,000 ($60,000 of which was for land). The address of the house is 35 Apple Street, Murphysboro, IL, 62966. There is no outstanding debt related to the property. Items for 2018 are below: Rental Income $ 11,220 Cleaning $ 680 Insurance $ 213 Repairs 2,125 Supplies $ 510 Property Taxes $ 2,550 Utilities $ 102 Bill and Mary are both occupied with their primary jobs; however they do perform all management functions towards the rental house. They own 100% of the house. 11. Bill participates in his employer's group health insurance plan to which he contributed $ 3,060 in 2018 for medical coverage. These contributions were made with after-tax dollars. The health plan covers Bill, Mary, and the two children. The company provides an office for Bill's use that is located at 110 North Round Street, Suite 217, Carbondale, IL. 12. Besides the items previously noted, the Clients had the following items for 2019: Loan repayment received from a friend Sarah Smith $3,500 Loan was originally for $5,000 with no interst but Sarah was forgiven the remainder. Cash gifts from Mary's parents $14,000 Life insurancce premiums paid $1,800 Medical expenses not covered by insurance $ 3,570 Real estate taxes on home $ 5,695 Real estate taxes on acres in Missouri $ 2,550 State and local sales taxes Interest on home mortgage see 1098 Contribution to church (all cash) $ 1,700 Goodwill (Carbondale branch) $600 illinois governor's election campaign $300 SO Non-cash items donated to Goodwill were originally purchased at various dates. The $600 is the fair-value of items today. They were originally purchased for $3,000. The description of items is "clothing and household items." Also this related to the 50% charity limit and method used to determine is "thrift shop value." The address of the goodwill location is 1145 East Main Street, Carbondale, IL, 62901. The donation was 8/15. 13. Included in source documents is Sandy's 1098-T listing her qualified education expenses. In 2017, the Clients took the American Opportunity Credit and would like to take it again