Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bill Bostic, Sue Chung, and Sam De Felice were assigned ihe task of explaining the elements of financial management to PNC's board of directors,

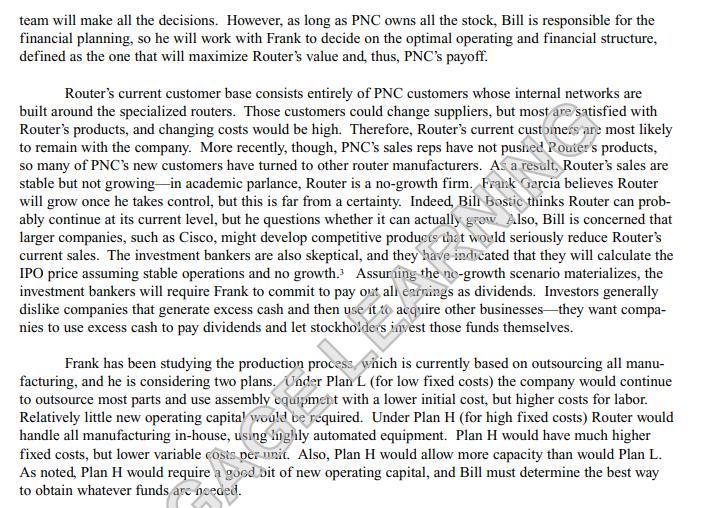

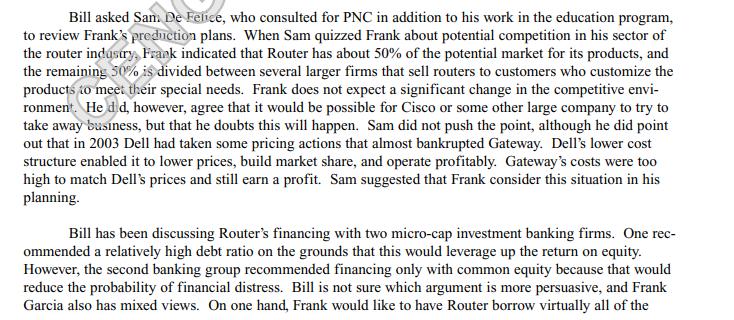

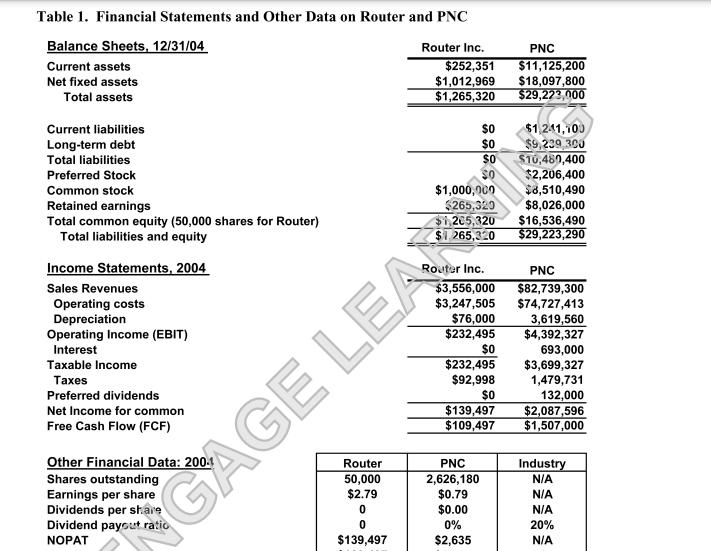

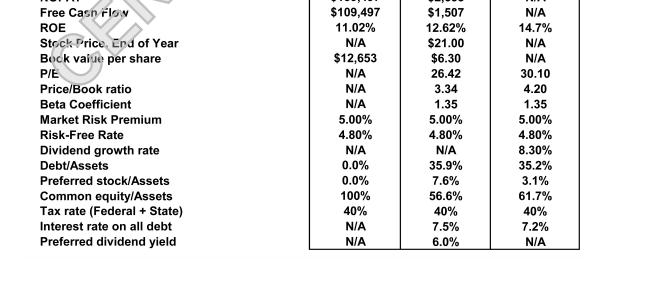

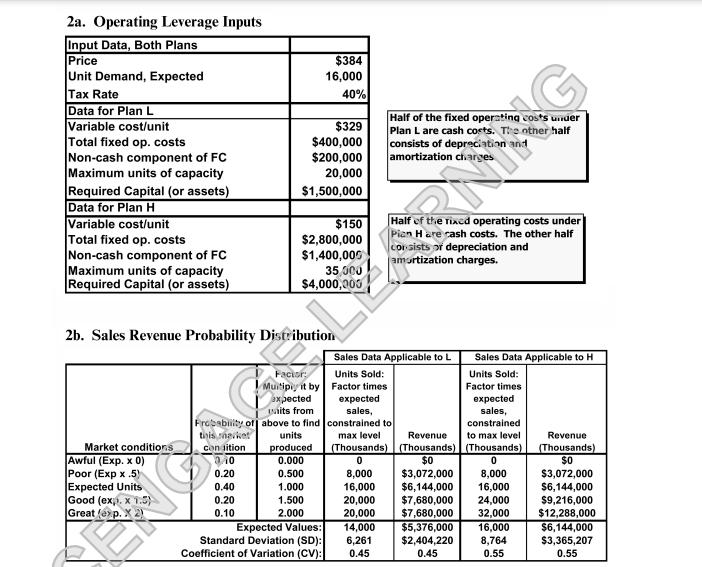

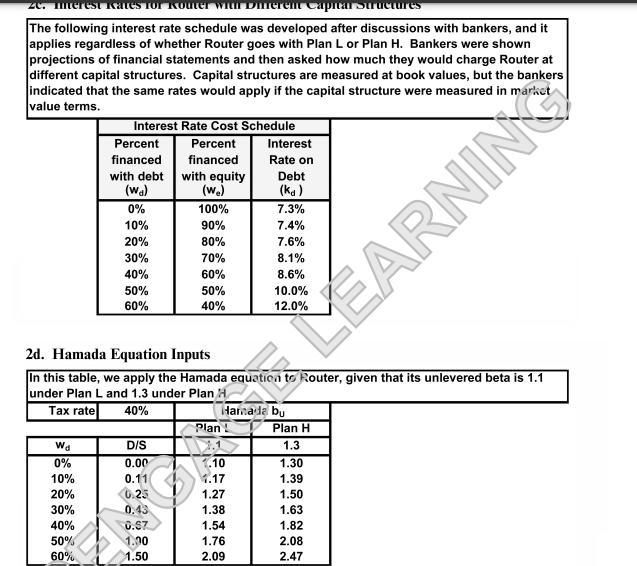

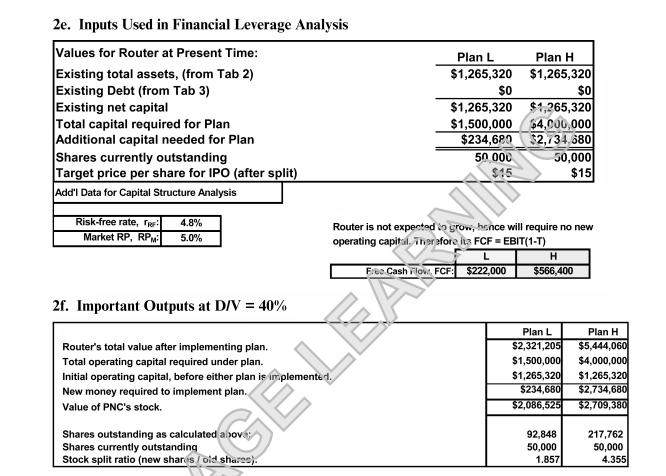

Bill Bostic, Sue Chung, and Sam De Felice were assigned ihe task of explaining the elements of financial management to PNC's board of directors, ard the rext session will deal with capital structure. Previous sessions have covered risk, the CAPM, stock and bond valuation, the cost of capital, and capital budgeting. Future sessions will cover dividend policy. financial forecasting, leasing, merger analysis, and venture capital investing. Capital structure is a particularly important issue at the present time-PNC is planning to spin off a wholly owned subsidiary, and it must choose a capital structure for the subsidiary before the spin off. The directors have heen debating the issue, and discussions with various investment bankers have suggested debt ratios ranging from zero to 80 percent. Since PNC and its stockholders will receive the proceeds from the spin off, the directors want to choose the capital structure that will maximize the new firm's value. The subsidiary, PNC Fouter Inc., was created several years ago when PNC agreed to provide spe- cialized routers to some of its customers who did not want to use standard routers for their internal net- works. Router's president, Frank Garcia, has been pushing for permission-and the funds-to expand and modernize his operauors. However, PNC President Ray Reed is focused on PNC's core products and thus has not paid much attention to Router. This has frustrated Frank, and it has also bothered Ray, who thinks that Frank is a good employee and that his plan might be quite sound. So, to resolve the problem, Ray and the Board decided to spin PNC Router off. With Router gone, PNC can concentrate on its primary prod- ucts and thus maintain its focus, and Frank Garcia will have the freedom to run Router and possibly to improve its performance. Currently, PNC owns all of Router's stock, but the plan is for Router to finalize its operating plan and capital structure and then to sell shares to the public in an IPO. Router will undoubt- edly need some additional capital to support its expansion, and that capital could come either as debt or as equity, depending on (1) how much additional capital is needed and (2) how it decides to finance its opera- tions. In any event, PNC will end up selling its Router shares in the IPO and receiving the proceeds of the sale, less fees paid to the investment bankers.? Once the spinoff is completed, Frank and his management team will make all the decisions. However, as long as PNC owns all the stock, Bill is responsible for the financial planning, so he will work with Frank to decide on the optimal operating and financial structure, defined as the one that will maximize Router's value and, thus, PNC's payoff. Router's current customer base consists entirely of PNC customers whose internal networks are built around the specialized routers. Those customers could change suppliers, but most are satisfied with Router's products, and changing costs would be high. Therefore, Router's current customers are most likely to remain with the company. More recently, though, PNC's sales reps have not pushed Pouter s products, so many of PNC's new customers have turned to other router manufacturers. As a result, Router's sales are stable but not growing in academic parlance, Router is a no-growth firm. Frank Garcia believes Router will grow once he takes control, but this is far from a certainty. Indeed, Bil Bostic thinks Router can prob- ably continue at its current level, but he questions whether it can actually grow Also, Bill is concerned that larger companies, such as Cisco, might develop competitive producte that would seriously reduce Router's current sales. The investment bankers are also skeptical, and they have indicated that they will calculate the IPO price assuming stable operations and no growth. Assuning the ne-growth scenario materializes, the investment bankers will require Frank to commit to pay out alh earnings as dividends. Investors generally dislike companies that generate excess cash and then use it to acquire other businesses-they want compa- nies to use excess cash to pay dividends and let stockholders invest those funds themselves. Frank has been studying the production process, which is currently based on outsourcing all manu- facturing, and he is considering two plans. Under Plan L (for low fixed costs) the company would continue to outsource most parts and use assembly equipmett with a lower initial cost, but higher costs for labor. Relatively little new operating capita would be required. Under Plan H (for high fixed costs) Router would handle all manufacturing in-house, usng highly automated equipment. Plan H would have much higher fixed costs, but lower variable costs pr unit. Also, Plan H would allow more capacity than would Plan L. As noted, Plan H would require a good bit of new operating capital, and Bill must determine the best way to obtain whatever funds are needed. Bill asked San. De Felice, who consulted for PNC in addition to his work in the education program, to review Frank's preduction plans. When Sam quizzed Frank about potential competition in his sector of the router industry, Frank indicated that Router has about 50% of the potential market for its products, and the remaining 50% is divided between several larger firms that sell routers to customers who customize the products to meet their special needs. Frank does not expect a significant change in the competitive envi- ronment. He did, however, agree that it would be possible for Cisco or some other large company to try to take away business, but that he doubts this will happen. Sam did not push the point, although he did point out that in 2003 Dell had taken some pricing actions that almost bankrupted Gateway. Dell's lower cost structure enabled it to lower prices, build market share, and operate profitably. Gateway's costs were too high to match Dell's prices and still earn a profit. Sam suggested that Frank consider this situation in his planning. Bill has been discussing Router's financing with two micro-cap investment banking firms. One rec- ommended a relatively high debt ratio on the grounds that this would leverage up the return on equity. However, the second banking group recommended financing only with common equity because that would reduce the probability of financial distress. Bill is not sure which argument is more persuasive, and Frank Garcia also has mixed views. On one hand, Frank would like to have Router borrow virtually all of the funds to buy out PNC. He and his management team would be granted options, and the more leverage, the higher the ROE if operations are successful, and thus the higher stock price is likely to be. On the other hand, Frank can see the merits of having Router finance only with equity, because then the company will carry less risk and, even more important, he would have borrowing capacity that could be used to finance expansion if things go as well as he expects. PNC's directors will make the final decision; they want to get the most for the shares, so they want Router to adopt the value-maximizing capital siructure, whatever it happens to be. Bill originally planned to use the capital structure session to discuss PNC'S own target capital struc- ture, but he decided to focus on Router because it is a simpler company ad also hecause its financing plans must be firmed up soon. Bill thought that Frank Garcia should be involved, so he invited him to join the team for that one session. When the four of them met, they decided that they should first consider the operating situation, and specifically whether Router should adopt Plan i er Plan H. Since PNC currently owns all the Router stock, its directors will have to sign off on this decision. Once the operating plan is determined, they will move on to capital structure. Although the ditectors (other than Ray Reed) have sub- stantial investments in other assets, Ray, Bill, and the other PNC officers have most of their personal wealth tied up in PNC stock. Bill wonders if this should affect che capital structure decisions of either Router or PNC itself. Before the first session, Bill had provided the directors with the latest edition of a widely used finance textbook. Most don't spend mucn time with it before the sessions, but several have been going over the relevant chapters and sending hn e-niail messages with questions they would like to see dis- cussed. Here are two questions relating to the capital structure session: Director 1: The background materials you provided rely heavily on the theories of Modigliani, Miller, and Hamada. However, those theories are based on assumptions that are clearly not cor- rect. Therefore is it possible that the theories simply don't produce reliable results? I am particu- larly interested in ki owing if the Hamada formula gives a correct reading on the effects of capital structure on the cosi of equity. Director 2 It seems clear that more debt leads to more risk, which is bad, but more debt also leads to higher expected returns, which is good. However, finding the optimal capital balance seems quite neoulous. Moreover, the textbook indicates that capital structures vary widely across firms, ever among firms within the same industry. This makes me wonder: If there really is an optimal eapital structure, wouldn't firms migrate toward it, with the result that firms' capital structures would be more similar than they are within any given industry? Bill will have to address these questions in the session. Table 1 provides some background information on PNC and Router, while Table 2 gives some data that Sue developed to use in the capital structure analysis. The operating cost data were obtained from Frank Garcia and his sales and production people, and the financial data came from PNC's commercial and investment bankers. Bill, Sue, and Sam (with input from Frank) then identified a set of issues that should be discussed during the session, and Bill asked Sue to develop a set of questions that deal with those issues. As with the other sessions, Bill also asked Sue to develop an Excel model that can be used to quantify the analysis and also to help the directors learn more about Excel. Obviously, some issues cannot at this point be quantified, but Bill wants to discuss qualitative as well as quantitative issues. Assume that you are Sue Chung, and you must now prepare for the session. QUESTIONS 1. Define the terms (a) operating leverage (b) financial leverage, (c) business risk, and (d) financial risk. Identify some factors that affect each of them, and indicate how they com- bine to affect the firm's investment risk. 2. Based on all the relevant operating information provided in the case (i.e., information before considering the effects of financial leverage), which plan do you think is more risky, I. or H? Explain your answer. 3. What is the expected return on invested capital (ROIC) under each operating plan? 4. Is Sam De Felice's point about the Dell-Gateway situation relevant to the decision between Plans L and H? If so, how should it be taken into account? 5. Summarize the pros and cons of Plans L and H. Based en the analysis thus far, which plan do you think Router should adopt? You should revisi your answer later, after considering the effects of financial leverage. 6. Now consider Router's use of financial leverage. information Table 2 indicates the relation- ship between the amount of debt used ard the cost of debt. What is the source of that infor- mation, and how reliable would you expect it to be? 7. Suppose Router borrowed 20% of its capital at a 7.6% rate, then borrowed an additional 20% at a higher rate, bringing its debt up to a total of 40% of capital. If it did this, would it end up with an average cost of debt that is lower than if it had just borrowed the entire 40% in the first place? Wonld yeu recommend that it adopt such a strategy? 8. Is the return on invested capital (ROIC) affected by the amount of financial leverage Router uses? Explaia. 9. Is the return on equity (ROE) affected by the use of financial leverage? Why does this result occur? Sheuld Router choose the capital structure that maximizes its expected ROE? Explain 10. Is the capital structure that maximizes the value of a firm consistent with the capital struc- ture that minimizes its WACC? Explain. 11. To find either the value of a firm or its WACC, we need an estimate of the cost of common equity. What is the Hamada Equation, and how is it used to help determine the cost of equi- ty? Since Hamada developed his equation by synthesizing the MM with tax theory and the CAPM theory, and since both of those theories have been questioned, the Hamada equation might not properly describe the relationship between leverage and the cost of common equi- ty. What alternative method or methods can you think of for finding the cost of equity under different capital structures? (Hint: Think about getting equity costs the way the cost of debt schedule was developed.) 12. What is Router's optimal capital structure? Is the same debt ratio optimai regardless of whether the firm chooses operating Plan L or H? Does this optimal D/V ratio minimize risk as measured by either the coefficient of variation of ROE or the times interest earned ratio? Does it maximize the firm's earnings per share? If not then what is "optimal" about the optimal D/V ratio? 13. On the basis of your analysis, which plan should Router adopt, L or H, and what capital structure should it use? Additional questions to be covered in the session if time permits: 14. The maturity of whatever debt is used has not been considered up to now. When analyzing financial leverage, should debt maturity be taken into account, and if so, how might this be done? 15. "Agency problems," which refer to situations where managers have incentives to take actions that benefit themselves even though those actions do not maximize shareholder wealth, sometimes arise. Can you think of any potential agency problems that might exist with regard to Ray Reed, Frank Garcia, or any other PNC executive? If so, how might those problems be mitigated? GE 16. Fiad Router's Degree of Operating Leverage (DOL), Degree of Financial Leverage (DFL), and Degree of Total Leverage (DTL) at the expected sales level. Then compare the degree of leverage approach to the type of analysis done previously in the case. 17. iscuss Modigliani and Miller's theory of capital structure, with and without corporate taxes. Then explain the tradeoff model and contrast it with the MM with-tax model. Are either or both of these approaches consistent with your recommended capital structure for Router? Table 1. Financial Statements and Other Data on Router and PNC Balance Sheets, 12/31/04 Router Inc. PNC $252,351 $1,012,969 $1,265,320 $11,125,200 $18,097,800 $29,223,000 Current assets Net fixed assets Total assets Current liabilities $1,241,100 $0 $0 $0 Long-term debt $9,239 300 ST0,480,400 $2,206,400 $8,510,490 $8,026,000 $16,536,490 $29,223,290 Total liabilities Preferred Stock $1,000,000 $265,320 $1,205,320 $1 265,320 Common stock Retained earnings Total common equity (50,000 shares for Router) Total liabilities and equity Income Statements, 2004 Router Inc. PNC $3,556,000 $3,247,505 $76,000 $232,495 $82,739,300 $74,727,413 3,619,560 $4,392,327 Sales Revenues Operating costs Depreciation Operating Income (EBIT) Interest $0 693,000 $3,699,327 1,479,731 Taxable Income $232,495 es $92,998 $0 $139,497 $109,497 132,000 $2,087,596 $1,507,000 Preferred dividends Net Income for common Free Cash Flow (FCF) Other Financial Data: 200- Shares outstanding Earnings per share Dividends per share Dividend payout ratio Router PNC 50,000 2,626,180 Industry N/A $2.79 $0.79 $0.00 N/A N/A 0% 20% NOPAT $139,497 $2,635 N/A SAGE LE Free Casn rloiw $109,497 $1,507 N/A ROE 11.02% 12.62% 14.7% Stock Price, End of Year Bock vaiue per share N/A $21.00 N/A $12,653 $6.30 N/A P/E N/A 26.42 30.10 Price/Book ratio N/A 3.34 4.20 Beta Coefficient N/A 1.35 1.35 Market Risk Premium 5.00% 4.80% N/A 0.0% 5.00% 5.00% Risk-Free Rate 4.80% 4.80% Dividend growth rate N/A 8.30% Debt/Assets 35.9% 35.2% Preferred stock/Assets 0.0% 7.6% 3.1% Common equity/Assets Tax rate (Federal + State) 100% 56.6% 61.7% 40% 40% 40% Interest rate on all debt N/A 7.5% 7.2% Preferred dividend yield N/A 6.0% N/A 2a. Operating Leverage Inputs Input Data, Both Plans Price Unit Demand, Expected Tax Rate Data for Plan L Variable cost/unit Total fixed op.costs Non-cash component of FC Maximum units of capacity Required Capital (or assets) Data for Plan H Variable cost/unit Total fixed op. costs Non-cash component of FC Maximum units of capacity Required Capital (or assets) $384 16,000 40% $329 $400,000 $200,000 20,000 Half of the fixed operating costs under Plan L are cash coets. Te otner half consists of depreciation and amortization charges $1,500,000 Half of the rixed operating costs under Pian Hare rash costs. The other half cor sists or depreciation and amortization charges. $150 $2,800,000 $1,400,000 35 00 $4,000,005 2b. Sales Revenue Probability Distribution Sales Data Applicable to L Sales Data Applicable to H Facior: Units Sold: Units Sold: Muitipiy it by Factor times Factor times axpected aits from Frobabity of above to find constrained to units expected sales, xpected sales, constrained tisis navket max level Revenue to max level Revenue Market conditions Awful (Exp. x 0) Poor (Exp x .5) Expected Units Good (ex. x 1.5) Great (ep. X 2) (Thousands) (Thousands) (Thousands) $0 $3,072,000 $6,144,000 $7,680,000 $7,680,000 $5,376,000 $2,404,220 0.45 produced 0.000 (Thousands) $0 Con sition 0.500 8,000 $3,072,000 $6,144,000 $9,216,000 0.20 16,000 20,000 20,000 8,000 16,000 24,000 32,000 0.40 1.000 0.20 1.500 0.10 2.000 $12,288,000 $6,144,000 Expected Values: Standard Deviation (SD): Coefficient of Variation (CV): 14,000 16,000 6,261 0.45 8,764 0.55 $3,365,207 0.55 zC. merest Kates Capitar Sructure Koute The following interest rate schedule was developed after discussions with bankers, and it applies regardless of whether Router goes with Plan L or Plan H. Bankers were shown projections of financial statements and then asked how much they would charge Router at different capital structures. Capital structures are measured at book values, but the bankers indicated that the same rates would apply if the capital structure were measured in market value terms. Interest Rate Cost Schedule Interest Percent Percent financed financed Rate on with debt (Wa) with equity (w.) Debt (ka) 0% 100% 7.3% 10% 20% 90% 7.4% 80% 7.6% 30% 70% 8.1% 40% 60% 8.6% 50% 50% 10.0% LEARNIN 60% 40% 2d. Hamada Equation Inputs In this table, we apply the Hamada equation to Router, given that its unlevered beta is 1.1 under Plan L and 1.3 under Plan A Tax rate Harmade by Plan! 40% Plan H Wa DIS 1.3 0% 0.00 10 1.30 10% 1.17 1.39 20% 1.27 1.50 30% 1.38 1.63 40% 1.54 1.82 50% 1.76 2.08 60% 2.09 2.47 2e. Inputs Used in Financial Leverage Analysis Values for Router at Present Time: Existing total assets, (from Tab 2) Existing Debt (from Tab 3) Existing net capital Total capital required for Plan Additional capital needed for Plan Shares currently outstanding Target price per share for IPO (after split) Plan L Plan H $1,265,320 $1,265,320 $0 $0 $1,265,320 $1,265,320 $1,500,000 54,c00,000 $234,620 $2,734.680 50 00 50,000 $15 Add'I Data for Capital Structure Analysis Risk-free rate, re: 4.8% Router is not expented in grow, hence will require no new Market RP, RPM 5.0% operating capital, Therafore ls FCF = EBIT(1-T) L H Fee Cash ilov, FCF: $222,000 $566,400 2f. Important Outputs at D/V = 40% Plan L Plan H $2,321,205 $1,500,000 $1,265,320 $234,680 $5,444,060 $4,000,000 $1,265,320 $2,734,680 Router's total value after implementing plan. Total operating capital required under plan. Initial operating capital, before either plan ie implemente 1. New money required to implement plan. Value of PNC's stock. $2,086,525 $2,709,380 GELEASMING Shares outstanding as calculated a ova Shares currently outstanding Stock split ratio (new shares / old sharee). 92,848 50,000 1.857 217,762 50,000 4.355

Step by Step Solution

★★★★★

3.39 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Question 1 a Operating Leverage Operating leverage refers to the extent to which fixed costs are present in a companys operations Factors affecting operating leverage include the proportion of fixed c...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started