Answered step by step

Verified Expert Solution

Question

1 Approved Answer

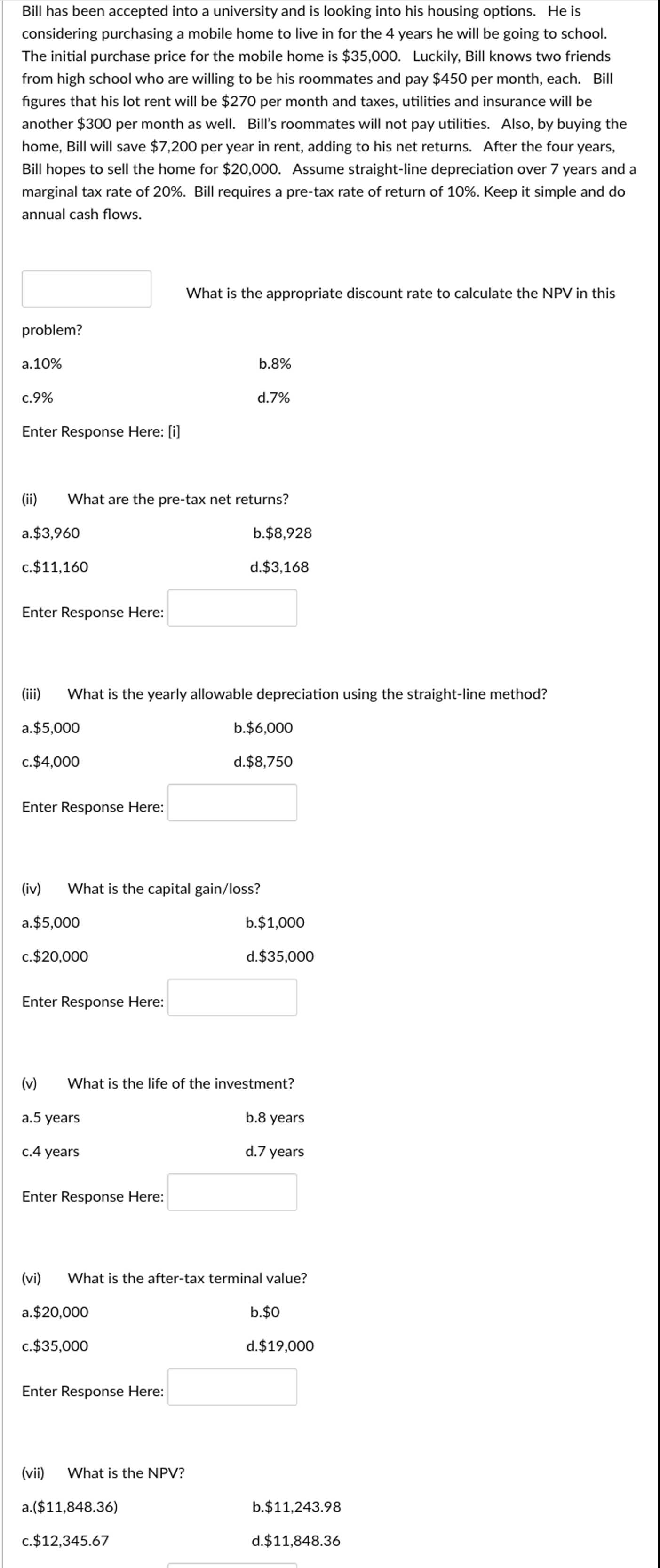

Bill has been accepted into a university and is looking into his housing options. He is considering purchasing a mobile home to live in for

Bill has been accepted into a university and is looking into his housing options. He is

considering purchasing a mobile home to live in for the years he will be going to school.

The initial purchase price for the mobile home is $ Luckily, Bill knows two friends

from high school who are willing to be his roommates and pay $ per month, each. Bill

figures that his lot rent will be $ per month and taxes, utilities and insurance will be

another $ per month as well. Bill's roommates will not pay utilities. Also, by buying the

home, Bill will save $ per year in rent, adding to his net returns. After the four years,

Bill hopes to sell the home for $ Assume straightline depreciation over years and a

marginal tax rate of Bill requires a pretax rate of return of Keep it simple and do

annual cash flows.

What is the appropriate discount rate to calculate the NPV in this

problem?

a

b

c

d

Enter Response Here: i

ii What are the pretax net returns?

a $

b $

c $

d $

Enter Response Here:

iii What is the yearly allowable depreciation using the straightline method?

a $

b $

c $

d $

Enter Response Here:

iv What is the capital gainloss

a $

b $

c $

d $

Enter Response Here:

v What is the life of the investment?

a years

b years

c years

d years

Enter Response Here:

vi What is the aftertax terminal value?

a $

b $

c $

d $

Enter Response Here:

vii What is the NPV

a$

b $

c $

d $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started