Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bill Musk is the supervisor of his company's accounting department and reports to the company's assistant controller Bill's duties vary, but two things he

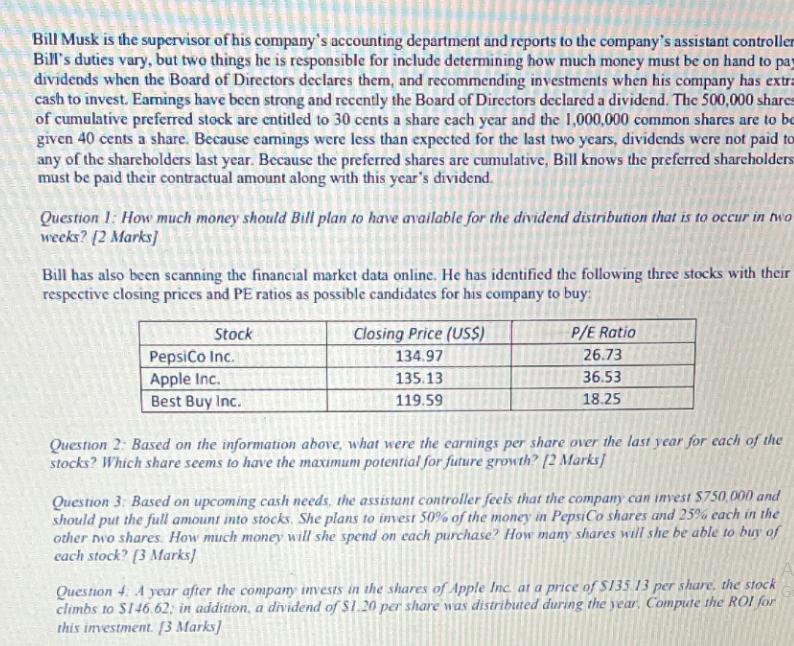

Bill Musk is the supervisor of his company's accounting department and reports to the company's assistant controller Bill's duties vary, but two things he is responsible for include determining how much money must be on hand to pay dividends when the Board of Directors declares them, and recommending investments when his company has extra cash to invest. Earnings have been strong and recently the Board of Directors declared a dividend. The 500,000 shares of cumulative preferred stock are entitled to 30 cents a share each year and the 1,000,000 common shares are to be given 40 cents a share. Because earnings were less than expected for the last two years, dividends were not paid to any of the shareholders last year. Because the preferred shares are cumulative, Bill knows the preferred shareholders must be paid their contractual amount along with this year's dividend. Question 1: How much money should Bill plan to have available for the dividend distribution that is to occur in two weeks? [2 marks] Bill has also been scanning the financial market data online. He has identified the following three stocks with their respective closing prices and PE ratios as possible candidates for his company to buy: Stock PepsiCo Inc. Apple Inc. Best Buy Inc. Closing Price (US$) 134.97 135.13 119.59 P/E Ratio 26.73 36.53 18.25 Question 2: Based on the information above, what were the earnings per share over the last year for each of the stocks? Which share seems to have the maximum potential for future growth? [2 Marks] Question 3: Based on upcoming cash needs, the assistant controller feels that the company can invest $750,000 and should put the full amount into stocks. She plans to invest 50% of the money in PepsiCo shares and 25% each in the other two shares. How much money will she spend on each purchase? How many shares will she be able to buy of each stock? (3 Marks] Question 4. A year after the company invests in the shares of Apple Inc. at a price of $135.13 per share, the stock climbs to $146.62; in addition, a dividend of $1.20 per share was distributed during the year. Compute the ROI for this investment. [3 Marks]

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

The total dividend amount for both the preferred and common shares needs to be calculated to give Bill an idea of how much money he should set aside for the dividend distribution Question 1 Fiftyhundr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started