Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Billie Whitehorse, the plant manager of Travel Free's Indiana plant, is responsible for all of that plant's costs other than her own salary. The

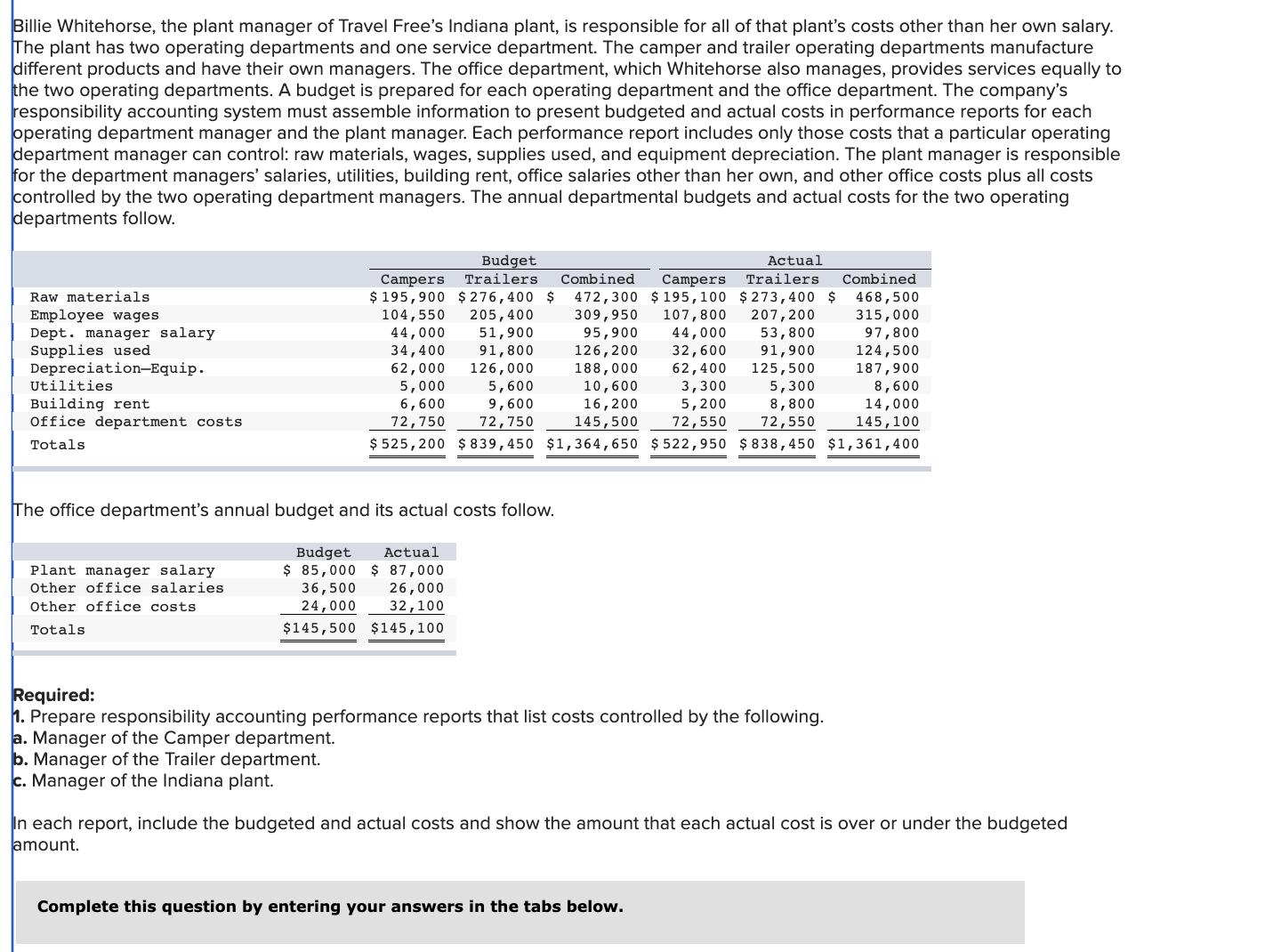

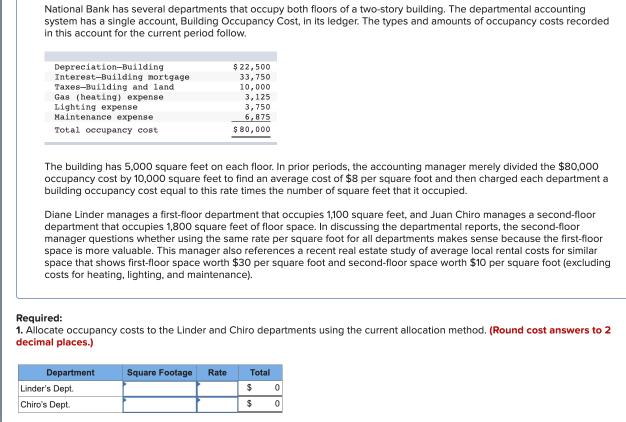

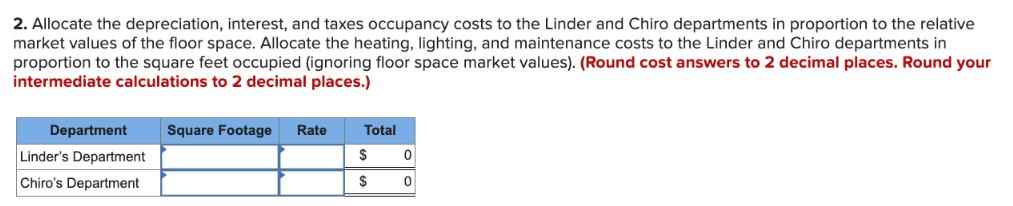

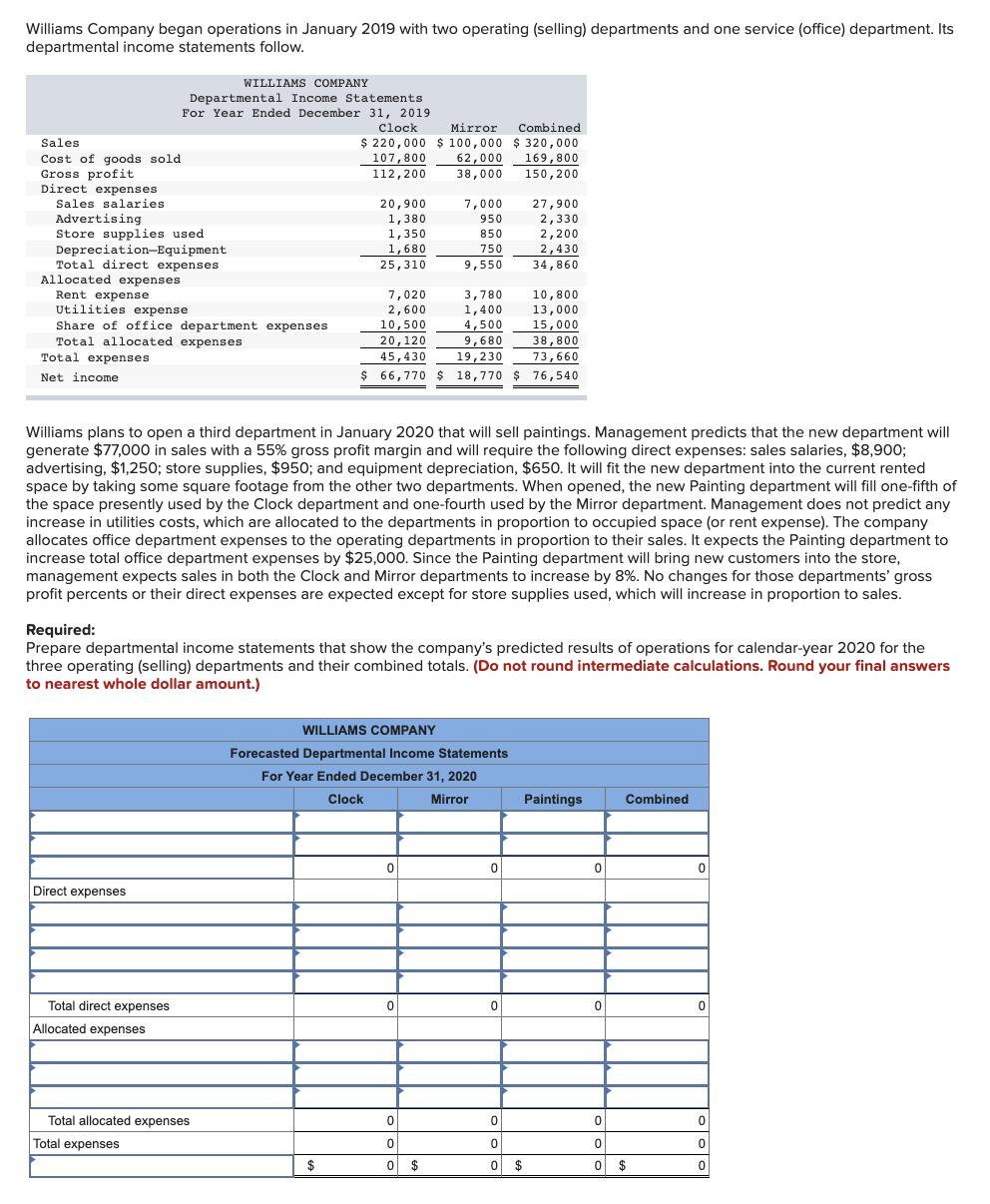

Billie Whitehorse, the plant manager of Travel Free's Indiana plant, is responsible for all of that plant's costs other than her own salary. The plant has two operating departments and one service department. The camper and trailer operating departments manufacture different products and have their own managers. The office department, which Whitehorse also manages, provides services equally to the two operating departments. A budget is prepared for each operating department and the office department. The company's responsibility accounting system must assemble information to present budgeted and actual costs in performance reports for each operating department manager and the plant manager. Each performance report includes only those costs that a particular operating department manager can control: raw materials, wages, supplies used, and equipment depreciation. The plant manager is responsible for the department managers' salaries, utilities, building rent, office salaries other than her own, and other office costs plus all costs controlled by the two operating department managers. The annual departmental budgets and actual costs for the two operating departments follow. Raw materials Employee wages Dept. manager salary Supplies used Depreciation-Equip. Utilities Building rent Office department costs Totals Budget Campers Trailers. Combined Campers $ 195,900 $276,400 $ 472,300 $ 195,100 104,550 205,400 309,950 107,800 44,000 51,900 95,900 34,400 91,800 62,000 126,000 Plant manager salary Other office salaries Other office costs Totals 5,000 6,600 72,750 97,800 124,500 187,900 8,600 14,000 145, 100 $ 525,200 $839,450 $1,364,650 $522,950 $838,450 $1,361,400 5,600 9,600 72,750 The office department's annual budget and its actual costs follow. Budget Actual $ 85,000 $ 87,000 36,500 26,000 24,000 32,100 $145,500 $145, 100 Actual Trailers Combined $273,400 $ 468,500 207, 200 315,000 44,000 53,800 126,200 32,600 91,900 188,000 62,400 125,500 10,600 5,300 3,300 16,200 5,200 8,800 145,500 72,550 72,550 Required: 1. Prepare responsibility accounting performance reports that list costs controlled by the following. a. Manager of the Camper department. b. Manager of the Trailer department. c. Manager of the Indiana plant. In each report, include the budgeted and actual costs and show the amount that each actual cost is over or under the budgeted amount. Complete this question by entering your answers in the tabs below. National Bank has several departments that occupy both floors of a two-story building. The departmental accounting system has a single account, Building Occupancy Cost, in its ledger. The types and amounts of occupancy costs recorded in this account for the current period follow. Depreciation-Building Interest-Building mortgage Taxes-Building and land Gas (heating) expense Lighting expense Maintenance expense Total occupancy cost. The building has 5,000 square feet on each floor. In prior periods, the accounting manager merely divided the $80,000 occupancy cost by 10,000 square feet to find an average cost of $8 per square foot and then charged each department a building occupancy cost equal to this rate times the number of square feet that it occupied. Diane Linder manages a first-floor department that occupies 1,100 square feet, and Juan Chiro manages a second-floor department that occupies 1,800 square feet of floor space. In discussing the departmental reports, the second-floor manager questions whether using the same rate per square foot for all departments makes sense because the first-floor space is more valuable. This manager also references a recent real estate study of average local rental costs for similar space that shows first-floor space worth $30 per square foot and second-floor space worth $10 per square foot (excluding costs for heating, lighting, and maintenance). $ 22,500 33,750 10,000 3,125 3,750 6,875 $80,000 Required: 1. Allocate occupancy costs to the Linder and Chiro departments using the current allocation method. (Round cost answers to 2 decimal places.) Department Linder's Dept. Chiro's Dept. Square Footage Rate Total $ 0 $ 0 2. Allocate the depreciation, interest, and taxes occupancy costs to the Linder and Chiro departments in proportion to the relative market values of the floor space. Allocate the heating, lighting, and maintenance costs to the Linder and Chiro departments in proportion to the square feet occupied (ignoring floor space market values). (Round cost answers to 2 decimal places. Round your intermediate calculations to 2 decimal places.) Department Linder's Department Chiro's Department Square Footage Rate Total $ $ 0 0 Williams Company began operations in January 2019 with two operating (selling) departments and one service (office) department. Its departmental income statements follow. Sales Cost of goods sold Gross profit Direct expenses Sales salaries Advertising. Store supplies used Depreciation-Equipment Total direct expenses Allocated expenses Rent expense Total expenses Net income Utilities expense Share of office department expenses Total allocated expenses Departmental Income Statements For Year Ended December 31, 2019 Direct expenses WILLIAMS COMPANY Total direct expenses Allocated expenses Total allocated expenses Total expenses Clock Mirror $ 220,000 $ 100,000 107,800 62,000 38,000 112,200 20,900 1,380 1,350 1,680 25,310 Williams plans to open a third department in January 2020 that will sell paintings. Management predicts that the new department will generate $77,000 in sales with a 55% gross profit margin and will require the following direct expenses: sales salaries, $8,900; advertising, $1,250; store supplies, $950; and equipment depreciation, $650. It will fit the new department into the current rented space by taking some square footage from the other two departments. When opened, the new Painting department will fill one-fifth of the space presently used by the Clock department and one-fourth used by the Mirror department. Management does not predict any increase in utilities costs, which are allocated to the departments in proportion to occupied space (or rent expense). The company allocates office department expenses to the operating departments in proportion to their sales. It expects the Painting department to increase total office department expenses by $25,000. Since the Painting department will bring new customers into the store, management expects sales in both the Clock and Mirror departments to increase by 8%. No changes for those departments' gross profit percents or their direct expenses are expected except for store supplies used, which will increase in proportion to sales. $ Required: Prepare departmental income statements that show the company's predicted results of operations for calendar-year 2020 for the three operating (selling) departments and their combined totals. (Do not round intermediate calculations. Round your final answers to nearest whole dollar amount.) 7,020 10,800 2,600 13,000 10,500 15,000 20,120 9,680 38,800 45,430 19,230 73,660 $ 66,770 $ 18,770 $ 76,540 WILLIAMS COMPANY Forecasted Departmental Income Statements For Year Ended December 31, 2020 Clock Mirror 0 0 7,000 950 850 750 9,550 0 3,780 1,400 4,500 0 0 $ 0 0 Combined $ 320,000 169,800 150, 200 0 0 27,900 2,330 2,200 2,430 34,860 0 $ Paintings 0 0 0 0 0 Combined $ 0 0 0 0 0

Step by Step Solution

★★★★★

3.29 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Answer a Camper Department Budgeted Amount Actual Amount Over under Budget Controllable co...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started