Question

Billowy Materials Company makes various pillow fill for a wide variety of resellers. Because of the semi-custom nature of Billowlys production, Billowly has traditionally used

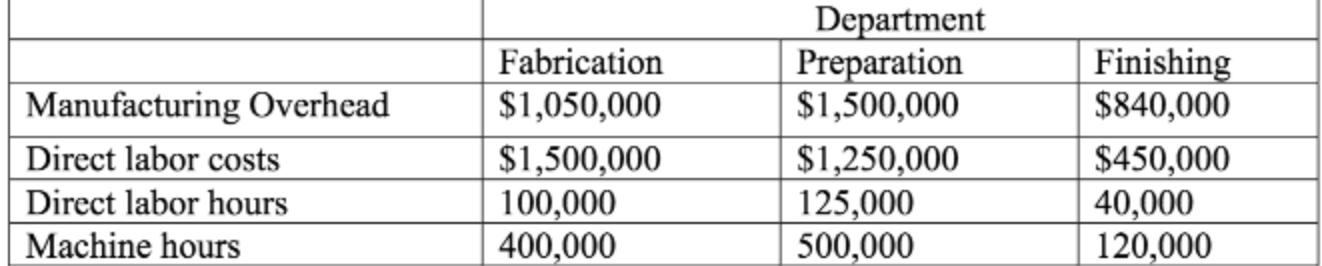

Billowy Materials Company makes various pillow fill for a wide variety of resellers. Because of the semi-custom nature of Billowly’s production, Billowly has traditionally used a job costing system in each of its three manufacturing departments. Manufacturing overhead is currently being applied to jobs on the basis of direct labor costs in the fabrication department, direct labor hours in the preparation department, and machine hours in the finishing department. For the current year, the following estimates had been generated by management based on a recent period’s results and expectations for changes in market demand

Please refer to the department and job cost records data file for job-specific cost and pricing information (where appropriate), as well as manufacturing overhead incurred in each department, for the current month. Note that a blank selling price reflects a job that is still in process, which will also be denoted in the status field. Using the estimates above and the job cost records data, answer the following: 1) What was the predetermined overhead rate for each department?

Fabrication: 1,050,000 1,500,000 =.7 Preparation:1,500,000 125,000 =12 Finishing:840,000 120,000 = 7

2) What were the total manufacturing costs assigned to jobs in each department this month?

Manufacturing Overhead Direct labor costs Direct labor hours Machine hours Fabrication $1,050,000 $1,500,000 100,000 400,000 Department Preparation $1,500,000 $1,250,000 125,000 500,000 Finishing $840,000 $450,000 40,000 120,000

Step by Step Solution

3.36 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

1 Predetermined overhead rate for each department for the year B ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started