Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bill's Trucks Rental Company Valuing a Company for Purchase and Sale Given recent worldwide events vis--vis the global pandemic, you believe that shipping companies will

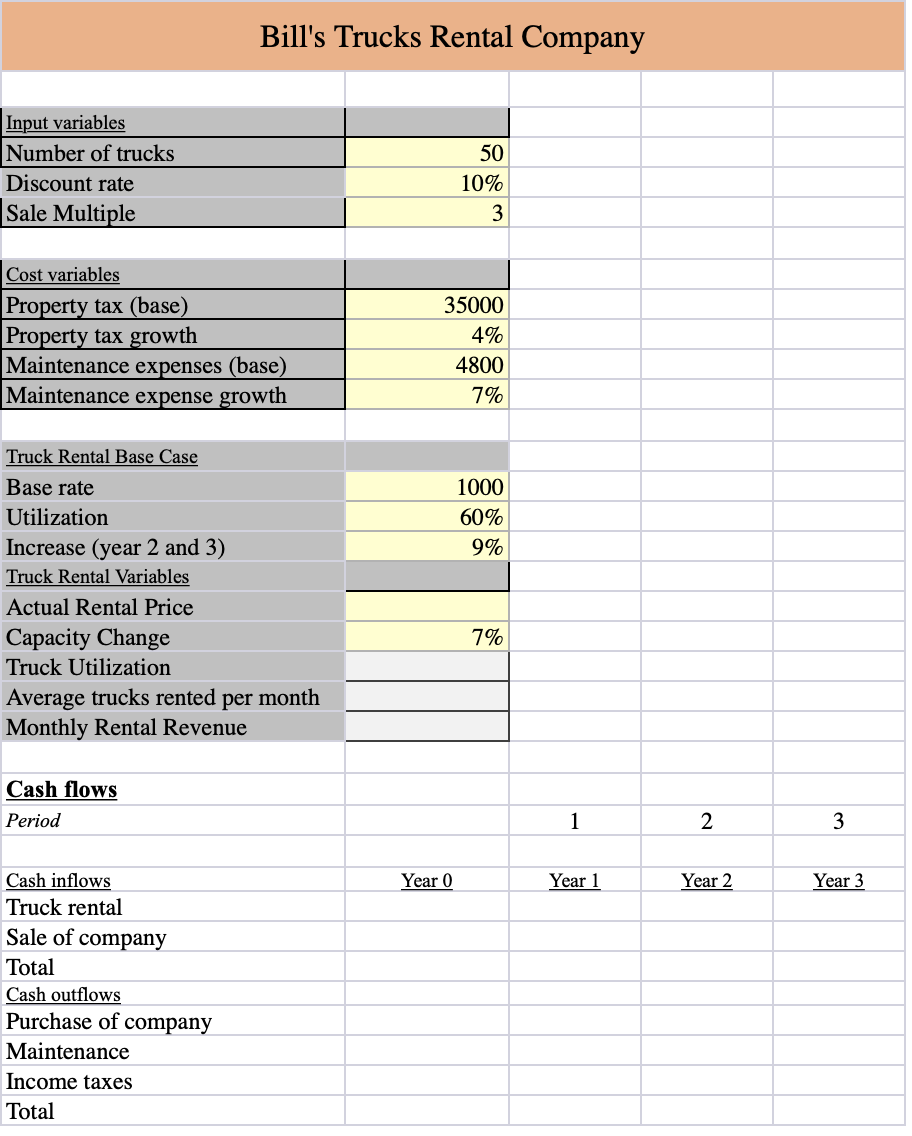

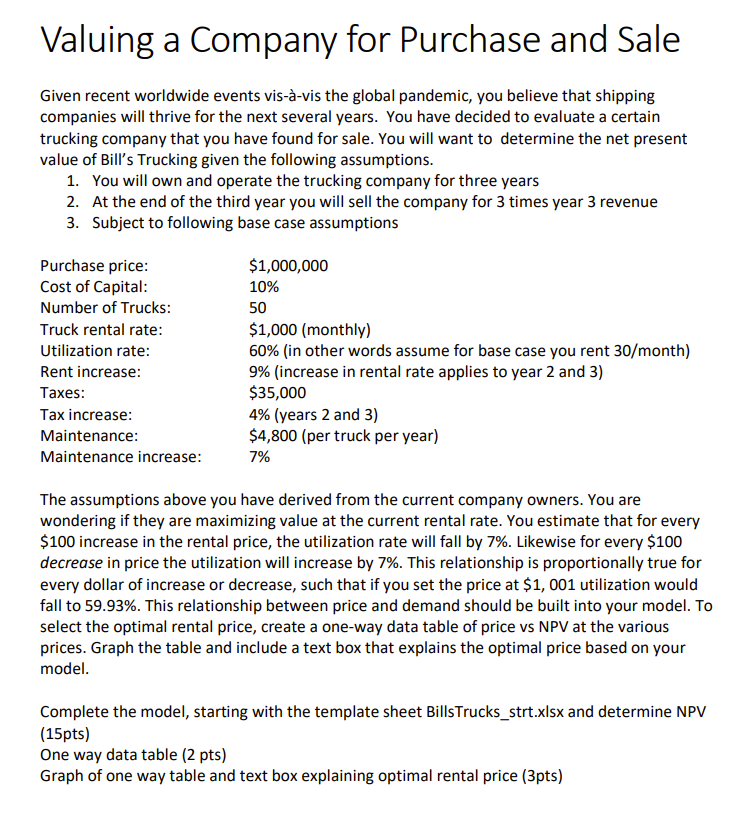

Bill's Trucks Rental Company Valuing a Company for Purchase and Sale Given recent worldwide events vis--vis the global pandemic, you believe that shipping companies will thrive for the next several years. You have decided to evaluate a certain trucking company that you have found for sale. You will want to determine the net present value of Bill's Trucking given the following assumptions. 1. You will own and operate the trucking company for three years 2. At the end of the third year you will sell the company for 3 times year 3 revenue 3. Subject to following base case assumptions The assumptions above you have derived from the current company owners. You are wondering if they are maximizing value at the current rental rate. You estimate that for every $100 increase in the rental price, the utilization rate will fall by 7%. Likewise for every $100 decrease in price the utilization will increase by 7%. This relationship is proportionally true for every dollar of increase or decrease, such that if you set the price at \$1, 001 utilization would fall to 59.93%. This relationship between price and demand should be built into your model. To select the optimal rental price, create a one-way data table of price vs NPV at the various prices. Graph the table and include a text box that explains the optimal price based on your model. Complete the model, starting with the template sheet BillsTrucks_strt.xlsx and determine NPV (15pts) One way data table ( 2 pts) Graph of one way table and text box explaining optimal rental price (3pts)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started